In Statement 2, McFadden is most likely failing to consider: A. the initial gap between the country's

Question:

In Statement 2, McFadden is most likely failing to consider:

A. the initial gap between the country's imports and exports.

B. the price elasticity of export demand versus import demand.

C. the lag in the response of import and export demand to price changes.

Transcribed Image Text:

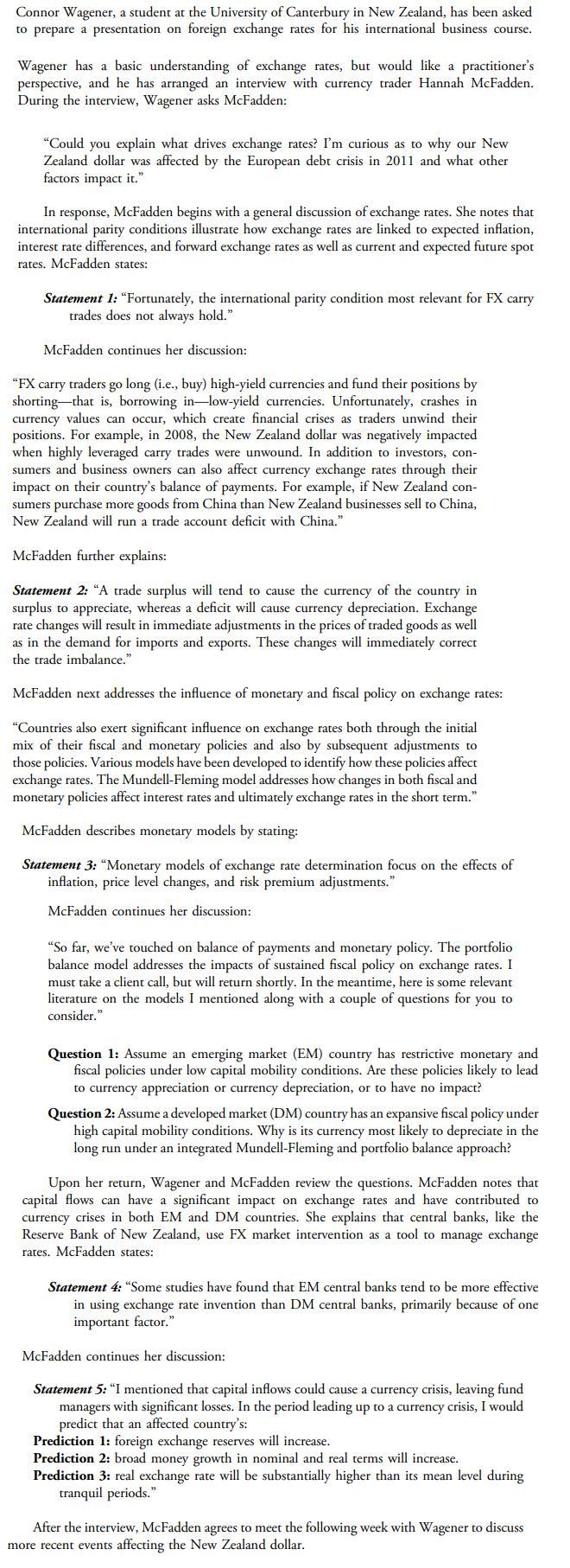

Connor Wagener, a student at the University of Canterbury in New Zealand, has been asked to prepare a presentation on foreign exchange rates for his international business course. Wagener has a basic understanding of exchange rates, but would like a practitioner's perspective, and he has arranged an interview with currency trader Hannah McFadden. During the interview, Wagener asks McFadden: "Could you explain what drives exchange rates? I'm curious as to why our New Zealand dollar was affected by the European debt crisis in 2011 and what other factors impact it." In response, McFadden begins with a general discussion of exchange rates. She notes that international parity conditions illustrate how exchange rates are linked to expected inflation, interest rate differences, and forward exchange rates as well as current and expected future spot rates. McFadden states: Statement 1: "Fortunately, the international parity condition most relevant for FX carry trades does not always hold." McFadden continues her discussion: "FX carry traders go long (i.e., buy) high-yield currencies and fund their positions by shorting that is, borrowing in-low-yield currencies. Unfortunately, crashes in currency values can occur, which create financial crises as traders unwind their positions. For example, in 2008, the New Zealand dollar was negatively impacted when highly leveraged carry trades were unwound. In addition to investors, con- sumers and business owners can also affect currency exchange rates through their impact on their country's balance of payments. For example, if New Zealand con- sumers purchase more goods from China than New Zealand businesses sell to China, New Zealand will run a trade account deficit with China." McFadden further explains: Statement 2: "A trade surplus will tend to cause the currency of the country in surplus to appreciate, whereas a deficit will cause currency depreciation. Exchange rate changes will result in immediate adjustments in the prices of traded goods as well as in the demand for imports and exports. These changes will immediately correct the trade imbalance." McFadden next addresses the influence of monetary and fiscal policy on exchange rates: "Countries also exert significant influence on exchange rates both through the initial mix of their fiscal and monetary policies and also by subsequent adjustments to those policies. Various models have been developed to identify how these policies affect exchange rates. The Mundell-Fleming model addresses how changes in both fiscal and monetary policies affect interest rates and ultimately exchange rates in the short term." McFadden describes monetary models by stating: Statement 3: "Monetary models of exchange rate determination focus on the effects of inflation, price level changes, and risk premium adjustments." McFadden continues her discussion: "So far, we've touched on balance of payments and monetary policy. The portfolio balance model addresses the impacts of sustained fiscal policy on exchange rates. I must take a client call, but will return shortly. In the meantime, here is some relevant literature on the models I mentioned along with a couple of questions for you to consider." Question 1: Assume an emerging market (EM) country has restrictive monetary and fiscal policies under low capital mobility conditions. Are these policies likely to lead to currency appreciation or currency depreciation, or to have no impact? Question 2: Assume a developed market (DM) country has an expansive fiscal policy under high capital mobility conditions. Why is its currency most likely to depreciate in the long run under an integrated Mundell-Fleming and portfolio balance approach? Upon her return, Wagener and McFadden review the questions. McFadden notes that capital flows can have a significant impact on exchange rates and have contributed to currency crises in both EM and DM countries. She explains that central banks, like the Reserve Bank of New Zealand, use FX market intervention as a tool to manage exchange rates. McFadden states: Statement 4: "Some studies have found that EM central banks tend to be more effective in using exchange rate invention than DM central banks, primarily because of one important factor." McFadden continues her discussion: Statement 5: "I mentioned that capital inflows could cause a currency crisis, leaving fund managers with significant losses. In the period leading up to a currency crisis, I would predict that an affected country's: Prediction 1: foreign exchange reserves will increase. Prediction 2: broad money growth in nominal and real terms will increase. Prediction 3: real exchange rate will be substantially higher than its mean level during tranquil periods." After the interview, McFadden agrees to meet the following week with Wagener to discuss more recent events affecting the New Zealand dollar.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (7 reviews)

Answered By

Benard Ndini Mwendwa

I am a graduate from Kenya. I managed to score one of the highest levels in my BS. I have experience in academic writing since I have been working as a freelancer in most of my time. I am willing to help other students attain better grades in their academic portfolio. Thank you.

4.90+

107+ Reviews

240+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

The factor that McFadden is most likely referring to in Statement 4 is: A. FX reserve levels. B. domestic demand. C. the level of capital flows. Connor Wagener, a student at the University of...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

A chemical processing plant has a network of pipes that are used to transfer liquid chemical products from one part of the plant to another. The following pipe network has pipe flow capacities in...

-

Calculate the mass of a proton (1.67 10-27 kg) in MeV/c2.

-

Following are five statements regarding the internal auditing function within organizations: 1. Internal auditors should report any situations in which a conflict of interest or bias is present or...

-

Refer to the International Journal of Environmental Health Research (Vol. 4, 1994) study, Exercise 7.15 (p. 360) in which the mean solid-waste generation rates for middle-income and industrialized...

-

The Shrives Corporation has $10,000 that it plans to invest in marketable securities. It is choosing among AT&T bonds, which yield 7.5 percent, state of Florida mu ni bonds, which yield 5 percent,...

-

Identify the equilibrium level of income given Y=1000; C=850; I=100 AE=? solve for the AE? Question 1 Identify the equilibrium level of income given Y=1000; C=850; 1=100 AE=? solve for the AE

-

The least appropriate factor used to describe the type of models mentioned in Statement 3 is: A. inflation. B. price level changes. C. risk premium adjustments. Connor Wagener, a student at the...

-

The international parity condition McFadden is referring to in Statement 1 is: A. purchasing power parity. B. covered interest rate parity. C. uncovered interest rate parity. Connor Wagener, a...

-

A research center claims that at most 35% of U.S. adults seek to buy naturally raised and fed meat and poultry. In a random sample of 1000 U.S. adults, 38% say they seek to buy naturally raised and...

-

Your friend Amber has approached you seeking advice concerning two investment opportunities that she is presently considering. Her classmate Simone has asked her for a loan of $5,000 to help...

-

Please read the following carefully. For each question on the exam, you should assume that: 1. unless expressly stated to the contrary, all events occurred in ?the current taxable year;? 2. all...

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

Can I get clear explanation how to work these. Thanking you in advance. 1. A rod 12.0 cm long is uniformly charged and has a total charge of -23.0 uC. Determine the magnitude and direction of the...

-

Poll Results in the Media USA Today provided results from a survey of 1144 Americans who were asked if they approve of Brett Kavanaugh as the choice for Supreme Court justice. 51% of the respondents...

-

1. Ellen will use some copyrighted illustrations from her books on the Web site. She will also include themes from the story lines of her books in some of the games that will be available (free) on...

-

Design an experiment to demonstrate that RNA transcripts are synthesized in the nucleus of eukaryotes and are subsequently transported to the cytoplasm.

-

Because consumers as a group must ultimately pay the total income received by farmers, it makes no real difference whether the income is paid through free farm markets or through price supports...

-

Use supply and demand curves to depict equilibrium price and output in a competitive market for some farm product. Then show how an above-equilibrium price floor (price support) would cause a surplus...

-

Do you agree with each of the following statements? Explain why or why not. a. The problem with U.S. agriculture is that there are too many farmers. That is not the fault of farmers but the fault of...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App