The international parity condition McFadden is referring to in Statement 1 is: A. purchasing power parity. B.

Question:

The international parity condition McFadden is referring to in Statement 1 is:

A. purchasing power parity.

B. covered interest rate parity.

C. uncovered interest rate parity.

Transcribed Image Text:

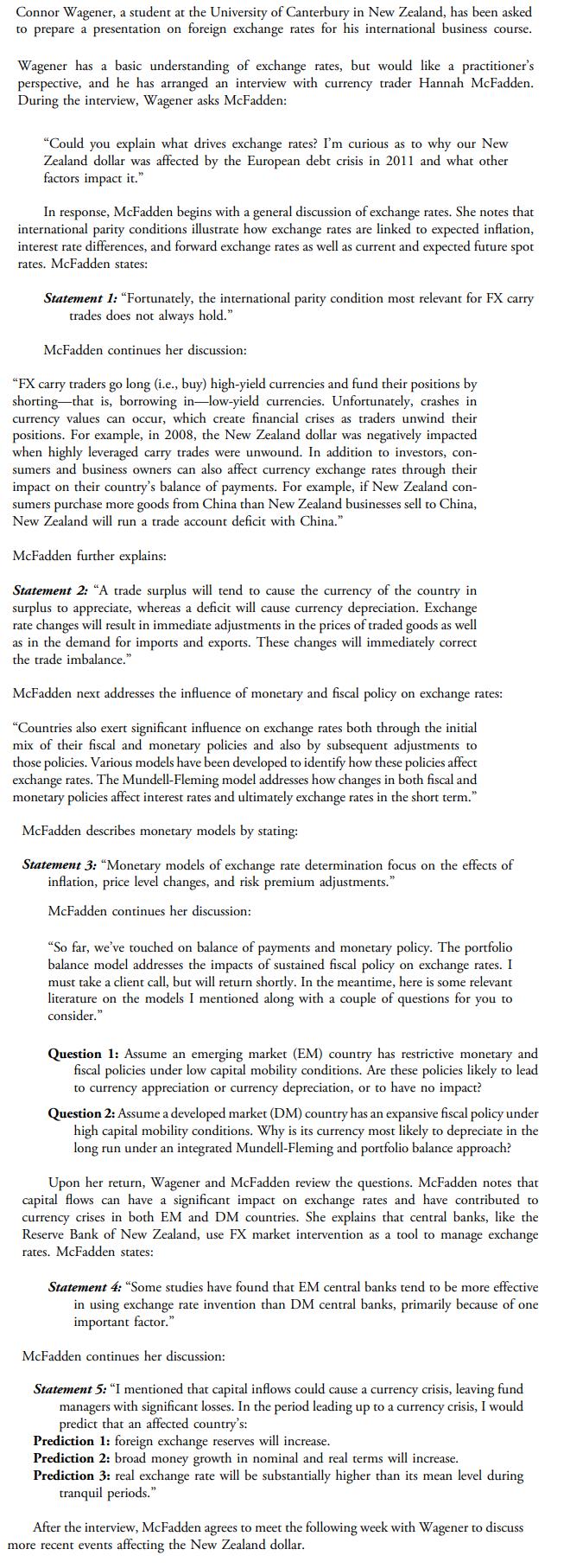

Connor Wagener, a student at the University of Canterbury in New Zealand, has been asked to prepare a presentation on foreign exchange rates for his international business course. Wagener has a basic understanding of exchange rates, but would like a practitioner's perspective, and he has arranged an interview with currency trader Hannah McFadden. During the interview, Wagener asks McFadden: "Could you explain what drives exchange rates? I'm curious as to why our New Zealand dollar was affected by the European debt crisis in 2011 and what other factors impact it." In response, McFadden begins with a general discussion of exchange rates. She notes that international parity conditions illustrate how exchange rates are linked to expected inflation, interest rate differences, and forward exchange rates as well as current and expected future spot rates. McFadden states: Statement 1: "Fortunately, the international parity condition most relevant for FX carry trades does not always hold." McFadden continues her discussion: "FX carry traders go long (i.e., buy) high-yield currencies and fund their positions by shorting that is, borrowing in-low-yield currencies. Unfortunately, crashes in currency values can occur, which create financial crises as traders unwind their positions. For example, in 2008, the New Zealand dollar was negatively impacted when highly leveraged carry trades were unwound. In addition to investors, con- sumers and business owners can also affect currency exchange rates through their impact on their country's balance of payments. For example, if New Zealand con- sumers purchase more goods from China than New Zealand businesses sell to China, New Zealand will run a trade account deficit with China." McFadden further explains: Statement 2: "A trade surplus will tend to cause the currency of the country in surplus to appreciate, whereas a deficit will cause currency depreciation. Exchange rate changes will result in immediate adjustments in the prices of traded goods as well as in the demand for imports and exports. These changes will immediately correct the trade imbalance." McFadden next addresses the influence of monetary and fiscal policy on exchange rates: "Countries also exert significant influence on exchange rates both through the initial mix of their fiscal and monetary policies and also by subsequent adjustments to those policies. Various models have been developed to identify how these policies affect exchange rates. The Mundell-Fleming model addresses how changes in both fiscal and monetary policies affect interest rates and ultimately exchange rates in the short term." McFadden describes monetary models by stating: Statement 3: "Monetary models of exchange rate determination focus on the effects of inflation, price level changes, and risk premium adjustments." McFadden continues her discussion: "So far, we've touched on balance of payments and monetary policy. The portfolio balance model addresses the impacts of sustained fiscal policy on exchange rates. I must take a client call, but will return shortly. In the meantime, here is some relevant literature on the models I mentioned along with a couple of questions for you to consider." Question 1: Assume an emerging market (EM) country has restrictive monetary and fiscal policies under low capital mobility conditions. Are these policies likely to lead to currency appreciation or currency depreciation, or to have no impact? Question 2: Assume a developed market (DM) country has an expansive fiscal policy under high capital mobility conditions. Why is its currency most likely to depreciate in the long run under an integrated Mundell-Fleming and portfolio balance approach? Upon her return, Wagener and McFadden review the questions. McFadden notes that capital flows can have a significant impact on exchange rates and have contributed to currency crises in both EM and DM countries. She explains that central banks, like the Reserve Bank of New Zealand, use FX market intervention as a tool to manage exchange rates. McFadden states: Statement 4: "Some studies have found that EM central banks tend to be more effective in using exchange rate invention than DM central banks, primarily because of one important factor." McFadden continues her discussion: Statement 5: "I mentioned that capital inflows could cause a currency crisis, leaving fund managers with significant losses. In the period leading up to a currency crisis, I would predict that an affected country's: Prediction 1: foreign exchange reserves will increase. Prediction 2: broad money growth in nominal and real terms will increase. Prediction 3: real exchange rate will be substantially higher than its mean level during tranquil periods." After the interview, McFadden agrees to meet the following week with Wagener to discuss more recent events affecting the New Zealand dollar.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Benard Ndini Mwendwa

I am a graduate from Kenya. I managed to score one of the highest levels in my BS. I have experience in academic writing since I have been working as a freelancer in most of my time. I am willing to help other students attain better grades in their academic portfolio. Thank you.

4.90+

107+ Reviews

240+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

The factor that McFadden is most likely referring to in Statement 4 is: A. FX reserve levels. B. domestic demand. C. the level of capital flows. Connor Wagener, a student at the University of...

-

Which of McFadden's predictions in Statement 5 is least correct? A. Prediction 1 B. Prediction 2 C. Prediction 3 Connor Wagener, a student at the University of Canterbury in New Zealand, has been...

-

The best response to Question 1 is that the policies will: A. have no impact. B. lead to currency appreciation. C. lead to currency depreciation. Connor Wagener, a student at the University of...

-

One item is omitted in each of the following summaries of balance sheet and income statement data for the following four different corporations: Determine the missing amounts, identifying them...

-

The total annual energy consumption in the United States is about 1 1020 J. How much mass would have to be converted to energy to fuel this need?

-

A group of new internal auditors from different organizations met at a seminar held in a large city in New England. One of the topics of discussion was the relevance of a single set of standards for...

-

Tests of product quality using human inspectors can lead to serious inspection error problems (Journal of Quality Technology, Apr. 1986). To evaluate the performance of inspectors in a new company, a...

-

John's Specialty Store uses a perpetual inventory system. The following are some inventory transactions for the month of May 2011: 1. John's purchased merchandise on account for $5,000. Freight...

-

Daniels Consulting invests its temporary excess cash in a brokerage account. On November 3, 2017, Daniels purchased 300 shares of Mauve Co. common stock for $15 per share. On December 31, 2017,...

-

In Statement 2, McFadden is most likely failing to consider: A. the initial gap between the country's imports and exports. B. the price elasticity of export demand versus import demand. C. the lag in...

-

Which of the following statements given by trainee Jones in describing the approaches used by CGER is most accurate? A. Statement 1 B. Statement 2 C. Statement 3 Ed Smith is a new trainee in the...

-

The repo margin is: A. Negotiated between counterparties. B. Established independently of market-related conditions. C. Structured on an agreement assuming equal credit risks to all counterparties.

-

firm c has net income of 45,360 , asset turnover of 1.4 and roi 12.6% calculate firms margin,sales and average total assets

-

A poll of 1065 Americans showed that 47.2% of the respondents prefer to watch the news rather than read or listen to it. Use those results with a 0.10 significance level to test the claim that fewer...

-

Garcia Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one unit: Standard Quantity X Standard...

-

Express the confidence interval 0.255 0.046 in the form of p-E

-

5 28 its Jay Oullette, CEO of Bumper to Bumper Incorporated, anticipates that his company's year-end balance sheet will show current assets of $12,801 and current liabilities of $7,540. Oullette has...

-

1. U.S. courts sometimes appoint advisors (often called Special Masters) to help them decide cases that involve complex business or technical issues. Assume you are a business advisor to a court that...

-

Using (1) or (2), find L(f) if f(t) if equals: t cos 4t

-

What are the effects of farm subsidies such as those of the United States and the European Union On? (a) Domestic agricultural prices, (b) World agricultural prices, (c) The international allocation...

-

How do government statisticians determine the poverty rate? How could the poverty rate fall while the number of people in poverty rises? Which group in each of the following pairs has the higher...

-

The labor demand and supply data in the following table relate to a single occupation. Use them to answer the questions that follow. Base your answers on the taste-for-discrimination model. a. Plot...

-

Regarding Enron, this was a company that resulted in the creation of the Sarbanes-Oxley Act and many reforms to the accounting profession. Research the company and answer the following...

-

Clayton received a $140,000 distribution from his 401(k) account this year. Assuming Clayton's marginal tax rate is 25 percent, what is the total amount of tax and penalty Shauna will be required to...

-

Mass LLp developed software that helps farmers to plow their fiels in a mannyue sthat precvents erosion and maimizes the effoctiveness of irrigation. Suny dale paid a licesnsing fee of $23000 for a...

Study smarter with the SolutionInn App