The best response to Question 1 is that the policies will: A. have no impact. B. lead

Question:

The best response to Question 1 is that the policies will:

A. have no impact.

B. lead to currency appreciation.

C. lead to currency depreciation.

Transcribed Image Text:

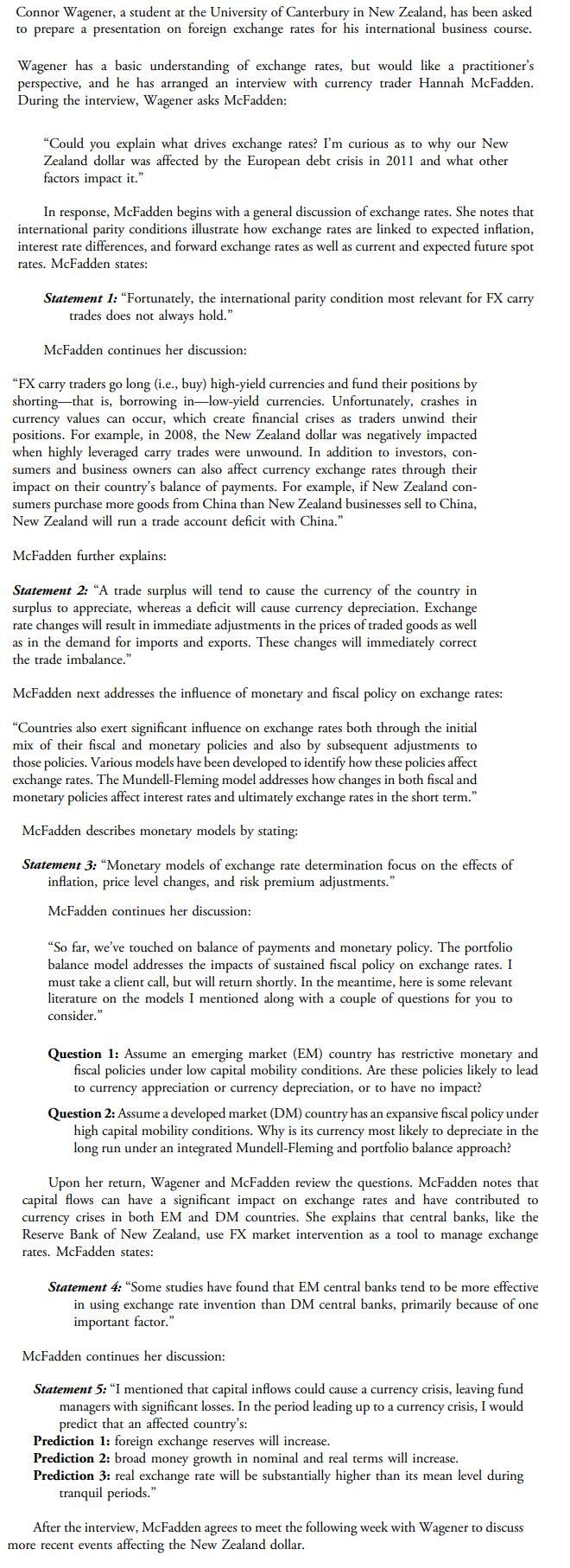

Connor Wagener, a student at the University of Canterbury in New Zealand, has been asked to prepare a presentation on foreign exchange rates for his international business course. Wagener has a basic understanding of exchange rates, but would like a practitioner's perspective, and he has arranged an interview with currency trader Hannah McFadden. During the interview, Wagener asks McFadden: "Could you explain what drives exchange rates? I'm curious as to why our New Zealand dollar was affected by the European debt crisis in 2011 and what other factors impact it." In response, McFadden begins with a general discussion of exchange rates. She notes that international parity conditions illustrate how exchange rates are linked to expected inflation, interest rate differences, and forward exchange rates as well as current and expected future spot rates. McFadden states: Statement 1: "Fortunately, the international parity condition most relevant for FX carry trades does not always hold." McFadden continues her discussion: "FX carry traders go long (i.e., buy) high-yield currencies and fund their positions by shorting that is, borrowing in-low-yield currencies. Unfortunately, crashes in currency values can occur, which create financial crises as traders unwind their positions. For example, in 2008, the New Zealand dollar was negatively impacted when highly leveraged carry trades were unwound. In addition to investors, con- sumers and business owners can also affect currency exchange rates through their impact on their country's balance of payments. For example, if New Zealand con- sumers purchase more goods from China than New Zealand businesses sell to China, New Zealand will run a trade account deficit with China." McFadden further explains: Statement 2: "A trade surplus will tend to cause the currency of the country in surplus to appreciate, whereas a deficit will cause currency depreciation. Exchange rate changes will result in immediate adjustments in the prices of traded goods as well as in the demand for imports and exports. These changes will immediately correct the trade imbalance." McFadden next addresses the influence of monetary and fiscal policy on exchange rates: "Countries also exert significant influence on exchange rates both through the initial mix of their fiscal and monetary policies and also by subsequent adjustments to those policies. Various models have been developed to identify how these policies affect exchange rates. The Mundell-Fleming model addresses how changes in both fiscal and monetary policies affect interest rates and ultimately exchange rates in the short term." McFadden describes monetary models by stating: Statement 3: "Monetary models of exchange rate determination focus on the effects of inflation, price level changes, and risk premium adjustments." McFadden continues her discussion: "So far, we've touched on balance of payments and monetary policy. The portfolio balance model addresses the impacts of sustained fiscal policy on exchange rates. I must take a client call, but will return shortly. In the meantime, here is some relevant literature on the models I mentioned along with a couple of questions for you to consider." Question 1: Assume an emerging market (EM) country has restrictive monetary and fiscal policies under low capital mobility conditions. Are these policies likely to lead to currency appreciation or currency depreciation, or to have no impact? Question 2: Assume a developed market (DM) country has an expansive fiscal policy under high capital mobility conditions. Why is its currency most likely to depreciate in the long run under an integrated Mundell-Fleming and portfolio balance approach? Upon her return, Wagener and McFadden review the questions. McFadden notes that capital flows can have a significant impact on exchange rates and have contributed to currency crises in both EM and DM countries. She explains that central banks, like the Reserve Bank of New Zealand, use FX market intervention as a tool to manage exchange rates. McFadden states: Statement 4: "Some studies have found that EM central banks tend to be more effective in using exchange rate invention than DM central banks, primarily because of one important factor." McFadden continues her discussion: Statement 5: "I mentioned that capital inflows could cause a currency crisis, leaving fund managers with significant losses. In the period leading up to a currency crisis, I would predict that an affected country's: Prediction 1: foreign exchange reserves will increase. Prediction 2: broad money growth in nominal and real terms will increase. Prediction 3: real exchange rate will be substantially higher than its mean level during tranquil periods." After the interview, McFadden agrees to meet the following week with Wagener to discuss more recent events affecting the New Zealand dollar.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

The most likely response to Question 2 is a(n): A. increase in the price level. B. decrease in risk premiums. C. increase in government debt. Connor Wagener, a student at the University of Canterbury...

-

In Statement 2, McFadden is most likely failing to consider: A. the initial gap between the country's imports and exports. B. the price elasticity of export demand versus import demand. C. the lag in...

-

Natalie Warren is a single woman in her late 20s. She is renting an apartment in the fashionable part of town for $1,300 a month. After much thought, she's seriously considering buying a condominium...

-

What is the momentum of a 950-MeV proton (that is, its kinetic energy is 950 MeV)?

-

Why might it be particularly difficult to program a computer to successfully play card games like bridge or poker? What sort of algorithms might you use to play these games?

-

The American Educational Research Journal (Fall, 1998) published a study to compare the mathematics achievement test scores of male and female students. a. The researchers hypothesized that the...

-

Marcellus Jackson, the CFO of Mac, Inc., notices that the tax liability reported on Macs tax return is less than the tax expense reported on Macs financial statements. Provide a letter to Jackson...

-

1.The standard rate of pay is $20 per direct labor hour. If the actual direct labor payroll was $117,600 for 5,670 direct labor hours worked, the direct labor price (rate) variance is A-$1,500...

-

The factor that McFadden is most likely referring to in Statement 4 is: A. FX reserve levels. B. domestic demand. C. the level of capital flows. Connor Wagener, a student at the University of...

-

The least appropriate factor used to describe the type of models mentioned in Statement 3 is: A. inflation. B. price level changes. C. risk premium adjustments. Connor Wagener, a student at the...

-

1. What motivates companies like Starbucks to expand into international markets with little perceived interest for their product? 2. How has Starbucks adapted to Chinese culture? 3. China has a...

-

Maria A Solo (SSN 318-01-6921) lives at 190 Glenn drive, grand rapids, Michigan 49527-2005. Maria (age 45 and single) claims her aunt, Selda Ray (ssn 282-61-4011), as a dependent. Selda lives with...

-

A clinical trial was conducted to test the effectiveness of a drug used for treating insomnia in older subjects. After treatment with the drug, 11 subjects had a mean wake time of 95.1 min and a...

-

PROBLEM 13-3 Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a US-based...

-

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary...

-

Claim: Fewer than 8.2% of homes have only a landline telephone and no wireless phone. Sample data: A survey by the National Center for Health Statistics showed that among 13,215 homes 5.78% had...

-

Beginning with the links provided in the Online Companion, locate more information about two of the three Web servers discussed in the chapter: Apache, Microsoft IIS, and Sun JSWS. Write...

-

A red card is illuminated by red light. What color will the card appear? What if its illuminated by blue light?

-

The social desirability of any particular firm should be judged not on the basis of its market share but on the basis of its conduct and performance. Make a counterargument, referring to the monopoly...

-

In view of the problems involved in regulating natural monopolies, compare socially optimal (marginal-cost) pricing and fair-return pricing by referring again to Figure. Regulated monopoly Assuming...

-

How does social regulation differ from industrial regulation? What types of benefits and costs are associated with social regulation?

-

Kenneth lived in his home for the entire year except for when he rented his home (near a very nice ski resort) to a married couple for 14 days in December. The couple paid Kenneth $14,000 in rent for...

-

On December 31, 2021, Shack Store Inc had 143 million shares outstanding, which traded for $643.29 per share. On January 02, 2022, the CEO announced a 20-for-1 stock split. Every shareholder would...

-

o1s= secom o1s= secom

Study smarter with the SolutionInn App