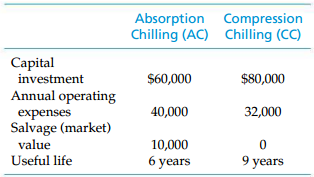

Two mutually exclusive alternatives for office building refrigeration and air conditioning are being investigated. Their relevant costs

Question:

If the hurdle rate (MARR) is 15% per year and the study period is 18 years, which chilling system should be recommended?

Transcribed Image Text:

Absorption Compression Chilling (AC) Chilling (CC) Capital investment $80,000 $60,000 Annual operating 40,000 32,000 expenses Salvage (market) value 10,000 9 years Useful life 6 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Assume repeatability over an 18year study period and compare equivalent uniform annual costs EUAC ...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted:

Students also viewed these Business questions

-

Work Problem 6-38 by using the internal rate of return (IRR) method. The MARR is 15% per year. Remember to think incrementally! Data from Problem 6-38: Two mutually exclusive alternatives for office...

-

Two mutually exclusive alternatives have the estimates shown below. Use annual worth analysis to determine which should be selected at an interest rate of 10% per year. First cost, $ -42,000 -80,000...

-

Consider the two mutually exclusive alternatives given in Table P7.40. Table P7.40 (a) Determine the IRR on the incremental investment in the amount of $2,000. (b) If the firm's MARR is 10%, which...

-

The following are the Ledger Balance (in thousands) extracted from the books of Vaishnavi Bank Ltd as on March 31, 2016. The bank's Profit and Loss Account for the year ended and Balance Sheet as at...

-

The report "Addiction Medicine: Closing the Gap between Science and Practice" from the National Center on Addiction and Substance Abuse at Columbia University reveals that addiction treatment is...

-

Blue Blaze adds direct materials at the beginning of its production process and adds conversion costs uniformly throughout the process. Given the following information from Blue Blazes records for...

-

Integrate the design class diagram solutions that you developed for problems 8, 10, and 12 into a single design class diagram. Dental Clinic System A clinic with three dentists and several dental...

-

Run America, Inc., manufactures running shoes. Its shoe is consistently rated poorly by Run Run Run magazine in its annual shoe review. The number one shoe in Run Run Runs review is the Cheetah a...

-

Suppose that a bank has agreed to the following terms of an interest rate swap: - The notional principal is CAD 300 million and the remaining life of the swap is 11 months. - The bank pays 8% per...

-

A close-coiled helical spring has its free length as 120 mm. It absorbs 40 N-m of energy when fully compressed and the coils are in contact. The mean coil diameter is 80 mm. Find the diameter of the...

-

Use the CW method to determine which mutually exclusive bridge design (LorH) to recommend, based on the data provided in the accompanying table. The MARR is 15% per year. Bridge Design L Bridge...

-

A city water and waste-water department has a four-year-old sludge pump that was initially purchased for $65,000. This pump can be kept in service for an additional four years, or it can be sold for...

-

Consider an employee who does not receive employer-based health insurance and must divide her $700 per week in after-tax income between health insurance and other goods. Draw this workers opportunity...

-

the assessment include developing gantt chart, work breakdown structure and and all task 3 are related to its respective task 2. all the instructions are given in the assignment itself. Assessment...

-

Mens heights are normally distributed with mean 68.6in. and standard deviation 2.8in. Air Force Pilots The U.S. Air Force required that pilots have heights between 64 in. and 77 in. Find the...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

ACC1810 - PRINCIPLES OF FINANCIAL ACCOUNTING Project 11: Chapter 11 - Stockholders' Equity Part B: Financial Statements The accounts of Rehearsal Corporation are listed along with their adjusted...

-

Match the term to the description. Outcome evaluation Focuses on the accomplishments and impact of a service, program, or policy and its effectiveness in attaining its outcomes set prior to...

-

What is a patent?

-

The MIT Sloan School of Management is one of the leading business schools in the U.S. The following table contains the tuition data for the masters program in the Sloan School of Management. a. Use...

-

What is the difference between disbenefits and costs?

-

Identify the following as primarily public or private sector undertakings: eBay, farmer's market, state police department, car racing facility, social security, EMS, ATM, travel agency, amusement...

-

State whether the following characteristics are primarily associated with public or private sector projects: large initial investment, park user fees, short-life projects, profit, disbenefits,...

-

.Is bankruptcy on the part of the borrower a common risk that frequently interferes with a lenders efforts to work out a defaulted loan through either nonforeclosure means or foreclosure? Discuss.

-

For each of the following, compute the future value: Present Value Years Interest Rate $ 1 , 2 5 0 1 9 1 2 % $ 9 8 , 7 2 7 1 5 1 3 % $ 6 2 5 6 1 2 % $ 1 1 7 , 6 2 2 7 1 6 % 2 . For each of the...

-

Only need help on 4B and 5. Exercise 9-21 Breakeven Planning; Profit Planning (LO 9-2, 9-3] Connelly Inc., a manufacturer of quality electric ice cream makers, has experienced a steady growth in...

Study smarter with the SolutionInn App