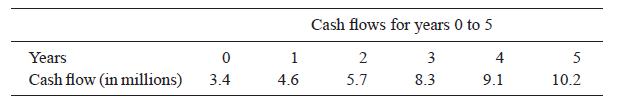

You have been given the following estimates of free cash flow from your company and have no

Question:

You have been given the following estimates of free cash flow from your company and have no reason to doubt them. The cash flows will not grow at this pace indefinitely and you are likely to be conservative in your estimates of future cash flows. A 2 percent growth is achievable. Current assets are equal to $10 million, current liabilities are equal to $15 million, long-term debt is equal to $6 million, and preferred shares are equal to

$2 million.

The T-bill offers a 3 percent rate of return and the S&P 60 returned 25 percent to investors last year. Your boss tells you that the investors in the fund expect an additional premium of 7 percent. You estimate that the company has average risk compared with others in the market.

Step by Step Answer:

Strategic Entrepreneurial Finance From Value Creation To Realization

ISBN: 9780415633567

1st Edition

Authors: Darek Klonowski