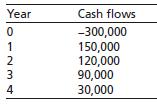

4. Glax Limited is considering embarking on a bottling water project with the following cash flows. The

Question:

4. Glax Limited is considering embarking on a bottling water project with the following cash flows. The opportunity cost of capital of the project is 10 %.

(a) Assuming the payback period of Glax Limited is three years. Should the project be accepted based on the payback rule?

(b) If the discounted payback period of Glax Limited is 3.5 years, should the project be accepted based on the discounted payback period rule?

(c) Based on the NPV rule, should the project be accepted?

(d) Based on the IRR rule, should the project be accepted?

(e) Based on the Modified IRR rule, should the project be accepted?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Entrepreneurial Finance For MSMEs A Managerial Approach For Developing Markets

ISBN: 9783319340203

1st Edition

Authors: Joshua Yindenaba Abor

Question Posted: