5. Mr. Yin owns Sugar Cane Farms, a small-sized farm. He would like to expand his farms...

Question:

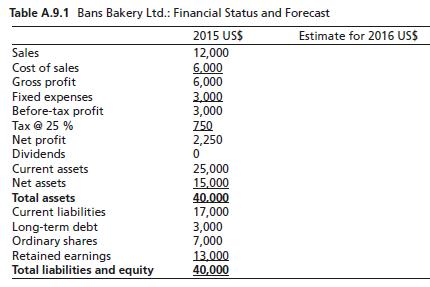

5. Mr. Yin owns Sugar Cane Farms’, a small-sized farm. He would like to expand his farms and buy a nearby land. Mr. Yin does not have the capital to undertake this project and would like to borrow the money from the local bank. He knows the banker will need projected income statement for his current farms when considering his loan application. Net sales for 2015 were US 80,000. Considering the previous growth rates in his business and the anticipated increase in tourism, projected net sales for 2016 is US 100, 000.

Cost of goods sold and selling and marketing expenses will remain the same value as 2015 at US 4,000. Mr. Yin uses the straight-line method of depreciation, so the previous year’s depreciation expense figure of US 1,000 can also be applied to 2016.

Answer the following questions based on the following assumptions.

(a) Cost of goods sold in 2015 was US 47,000. What is the forecasted value of Cost of goods sold for 2016?

(b) What is the forecasted gross profit for 2016?

(c) Selling and marketing expenses for 2015 were US 12,000. What is the forecasted value for 2016?

(d) Calculate the forecasted operating income for 2016.

(e) Assume the interest expense for 2015 is US 700 and the tax rate is 30%.

Calculate earnings before interest and tax (EBIT) and net income expected for 2016 to the nearest dollar.

(f ) If US 9,000 is distributed in dividends in 2016, what will be 2016’s addition to retained earnings?

Step by Step Answer:

Entrepreneurial Finance For MSMEs A Managerial Approach For Developing Markets

ISBN: 9783319340203

1st Edition

Authors: Joshua Yindenaba Abor