6. IYA Ltd is considering a project with an initial cash outlay of US$75,000 and a required...

Question:

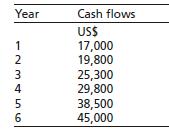

6. IYA Ltd is considering a project with an initial cash outlay of US$75,000 and a required rate of return of 11 %. The expected annual free cash flows from the project given as:

(a) Indicate whether this project is viable or not using the NPV and PI methods.

(b) Compute the MIRR for this project assuming the cash flows are reinvested.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Entrepreneurial Finance For MSMEs A Managerial Approach For Developing Markets

ISBN: 9783319340203

1st Edition

Authors: Joshua Yindenaba Abor

Question Posted: