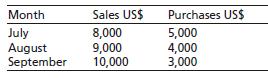

9. Grace Enterprise has estimated sales and purchase requirements for the last half of the coming year.

Question:

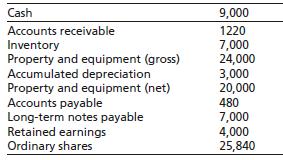

9. Grace Enterprise has estimated sales and purchase requirements for the last half of the coming year. Past experience indicates that it will collect 20 %

of its sales in the month of sale, 50 % of the remainder one month after the sale, and the balance in the second month following the sale. Grace Enterprise prefers to pay for half its purchases in the month of the purchase and the other half the following month. Labour expense for each month is expected to equal 5 % of that month’s sales, with cash payment being made in the month in which the expense is incurred. Depreciation expense is US$200 per month; miscellaneous cash expenses of US$2,500 per month are paid in the month incurred. General and administrative expenses of US$900 are recognised and paid monthly. A US$24,000 truck is to be purchased in August and is to be depreciated on a straight-line basis over ten years with no expected salvage value. Grace Enterprise also plans to pay a US$9,000 cash dividend to stockholders in July. The Enterprise feels that a minimum cash balance of US$12,000 should be maintained. Any borrowing will cost 12 % annually, with interest paid in the month following the month in which the funds are borrowed. Borrowing takes place at the beginning of the month in which the need for funds is made. For example, if during the month of July, the firm should need to borrow US$5000 to maintain its US$12,000 desired minimum balance, then US$5000 will be taken out on 1 July with the interest owed for the entire month of July.

Interest for the month of July would then be paid on 1 August. Sales and purchase estimates are shown in the following chart.

Prepare a cash budget for the months of July and August (cash on hand 30 June was US$12,000, whereas sales for May and June were US$4000 and purchases were US$1500 for each of these months).

Step by Step Answer:

Entrepreneurial Finance For MSMEs A Managerial Approach For Developing Markets

ISBN: 9783319340203

1st Edition

Authors: Joshua Yindenaba Abor