5. Consider the Facebook IPO in early 2012. Why do you think Zuckerberg decided to undertake an...

Question:

5. Consider the Facebook IPO in early 2012. Why do you think Zuckerberg decided to undertake an IPO at that time? In retrospect, do you think investors were receptive to it?

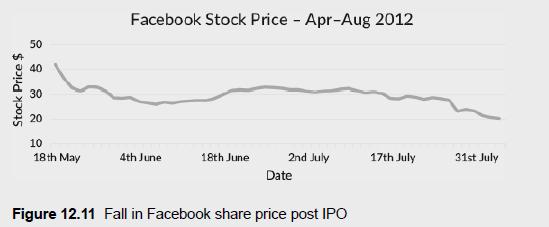

Facebook filed its application for an IPO with the Securities and Exchange Commission in early 2012 and began trading in May. Its initial valuation was estimated at $100 billion, four times that when Google went public in 2004, but the stock market was not immediately kind to the social networking company. The share price dropped steadily from the first-day price of $38, and by August it had fallen below $25 (Figure 12.11).

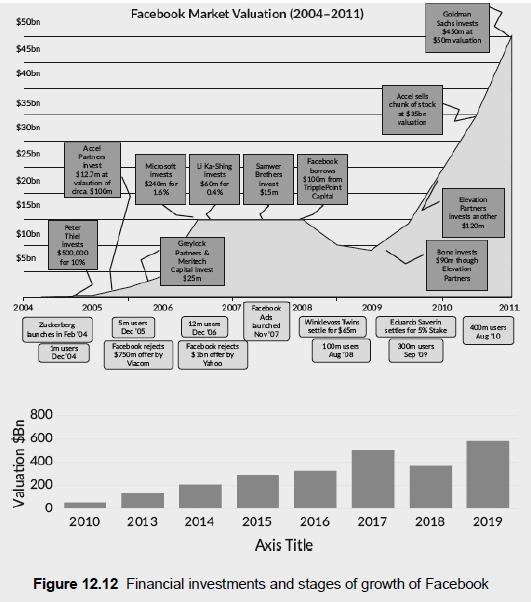

This, in part, was due to the increasing scepticism about how fast Facebook’s profits and revenues could grow. It needed to make money from its users, and it needed to find ways to do that from mobile devices where there was little space for ads. Yet on its current share price, Facebook is now valued at over $500 billion, which is staggering for a company only 16 years old. Between 2005 and 2011, its valuation grew from circa $100 million to $50 billion, but that was just the beginning. By 2013, its post-IPO valuation had hit $130 billion. With its net earnings consistently positive since then, Facebook’s valuation reached a staggering $500 billion in 2019, on the back of $20 billion free cashflow (Figure 12.12).

Step by Step Answer:

Technology Entrepreneurship Bringing Innovation To The Marketplace

ISBN: 9781352011173,9781350304864

2nd Edition

Authors: Natasha Evers , James Cunningham , Thomas Hoholm