Winning against Competition:

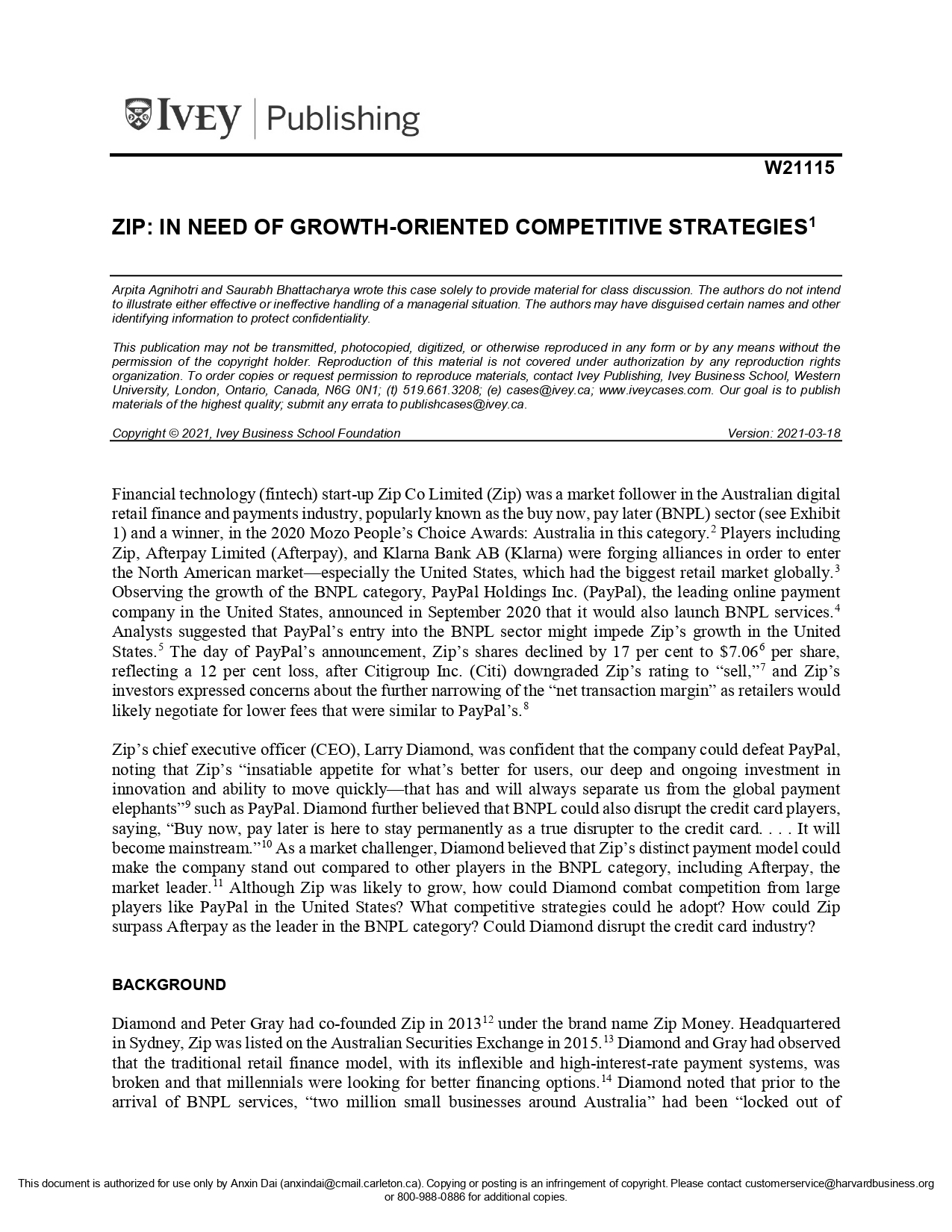

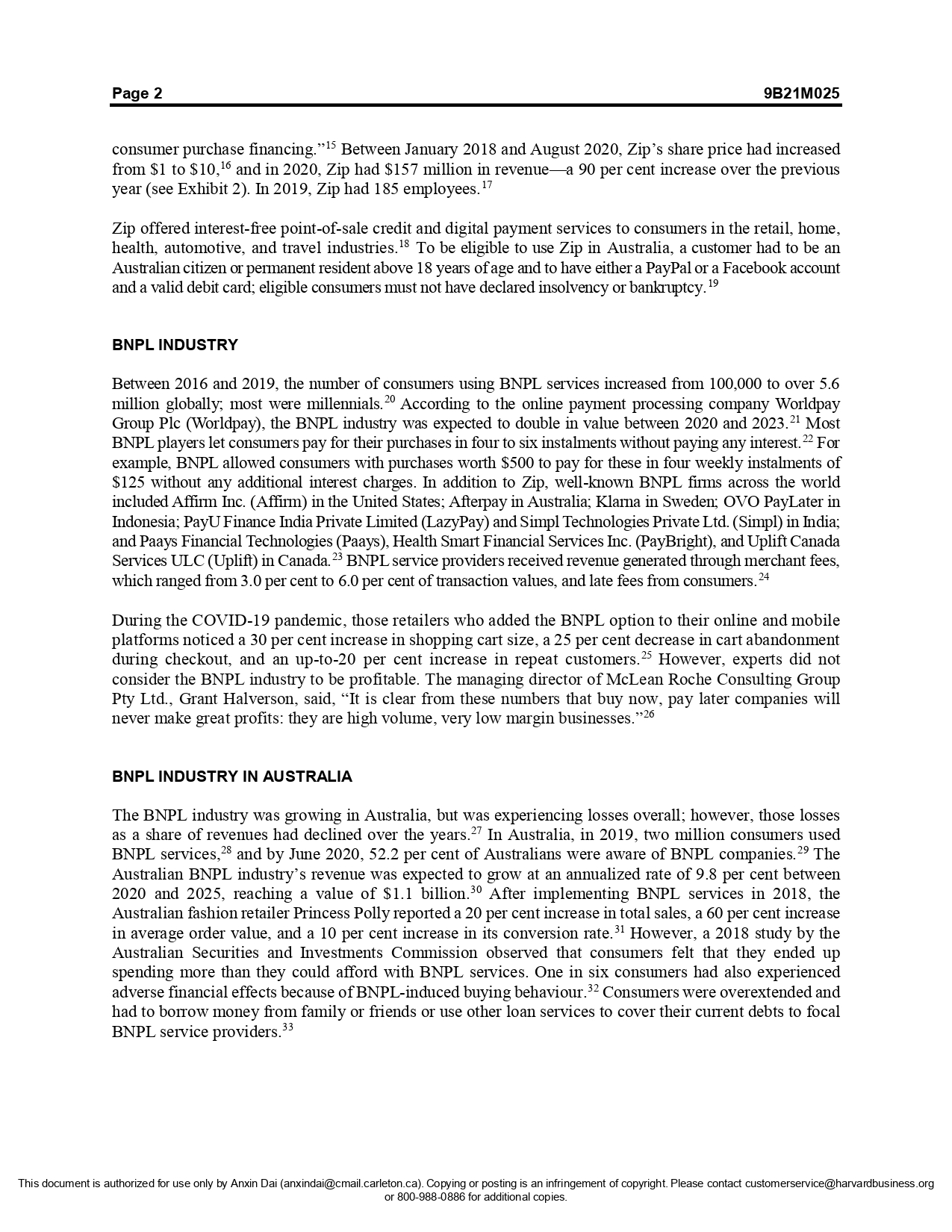

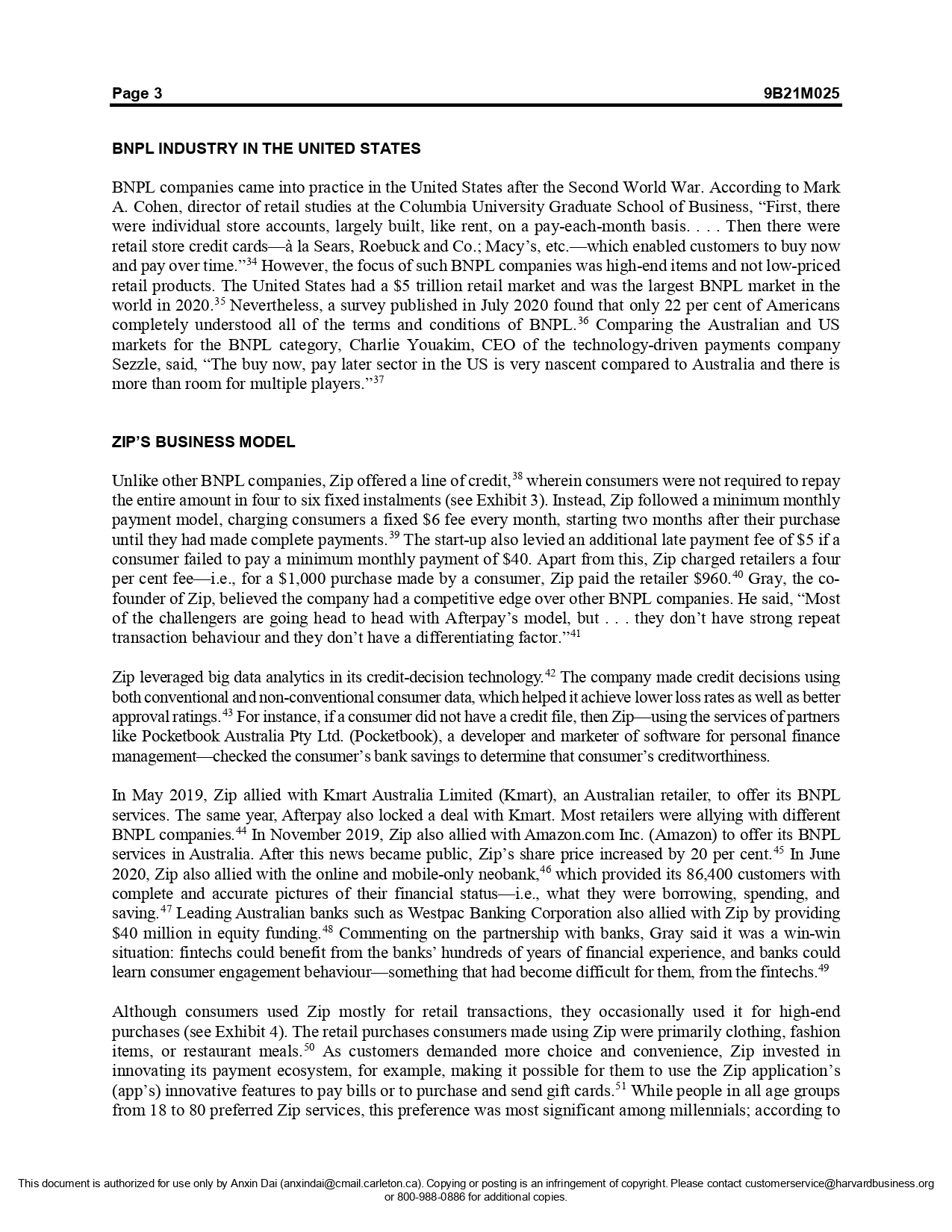

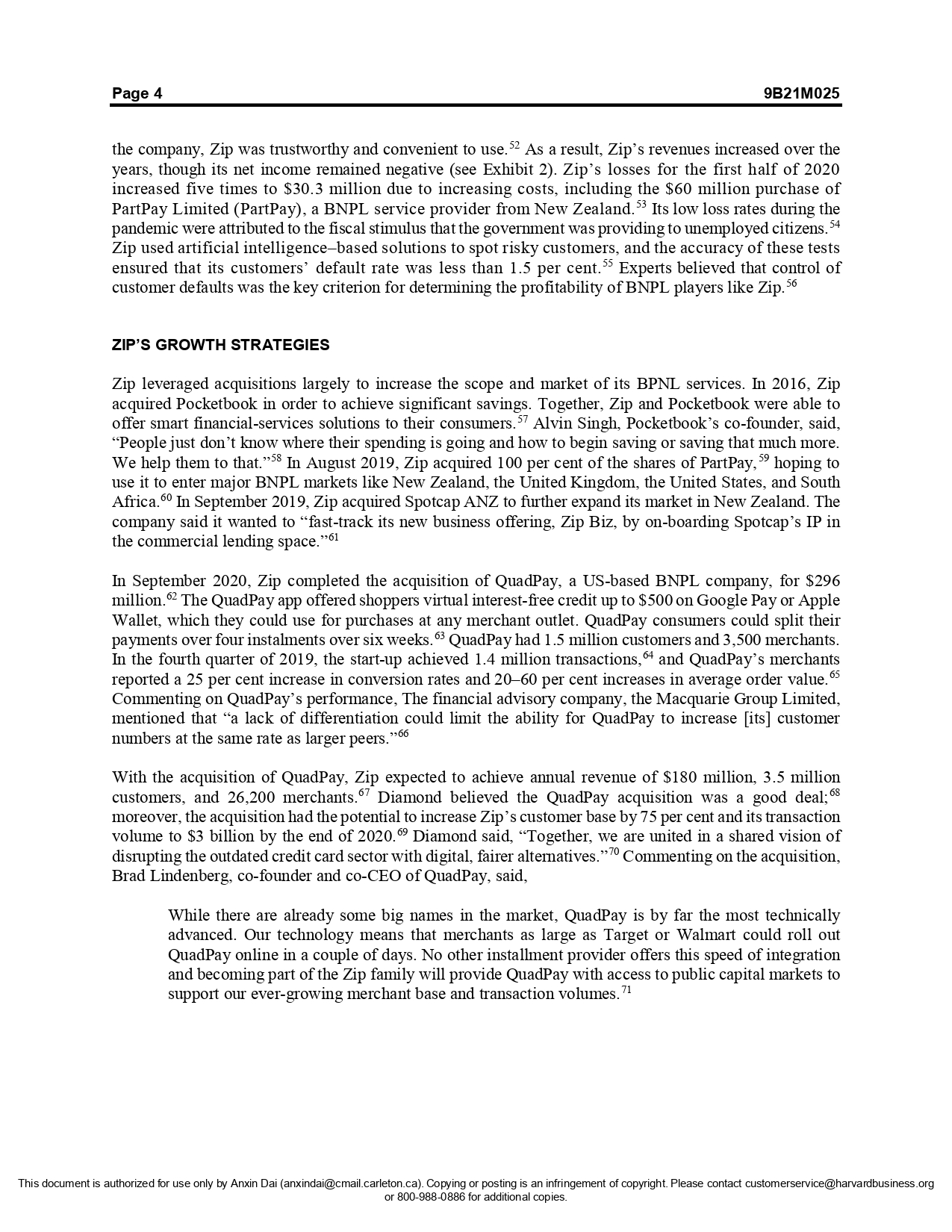

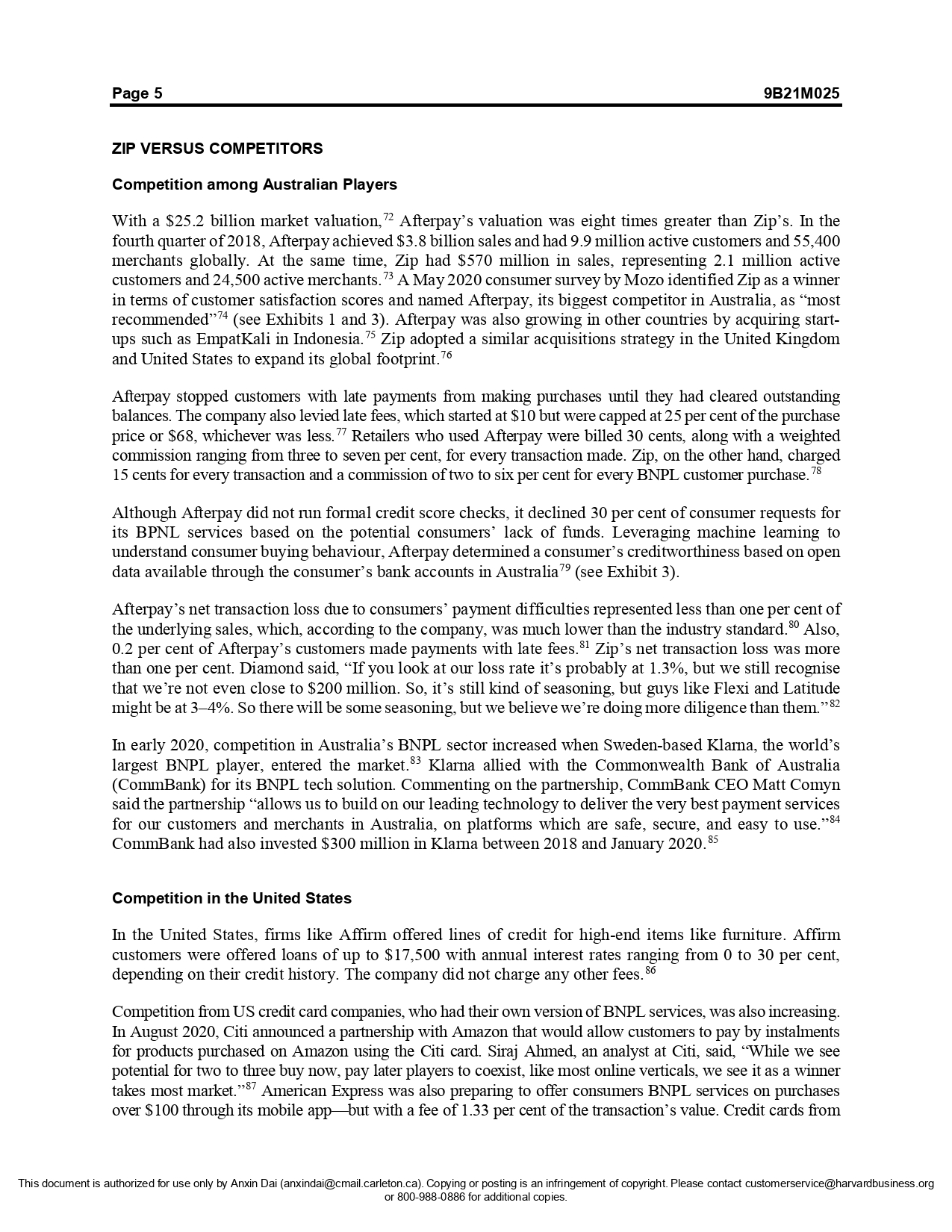

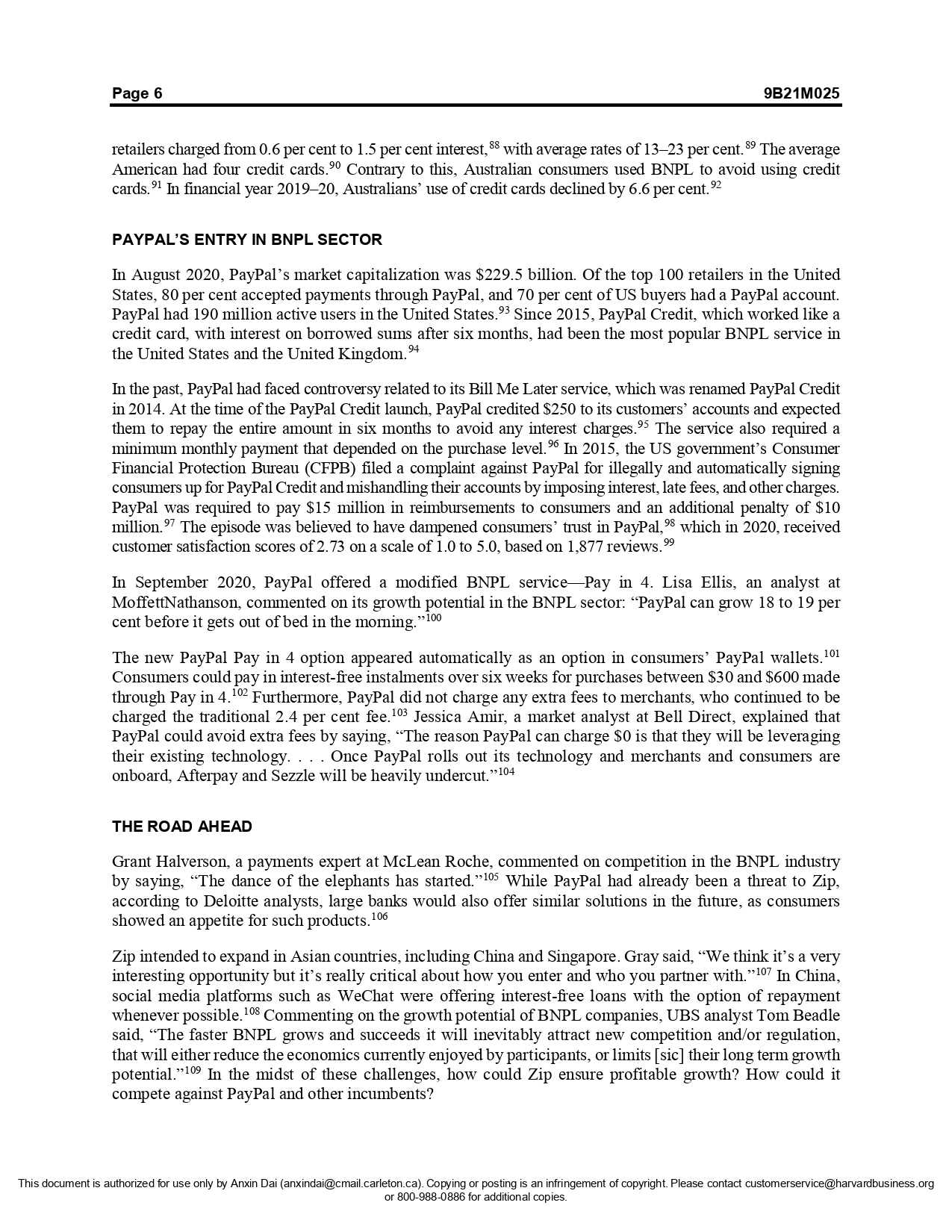

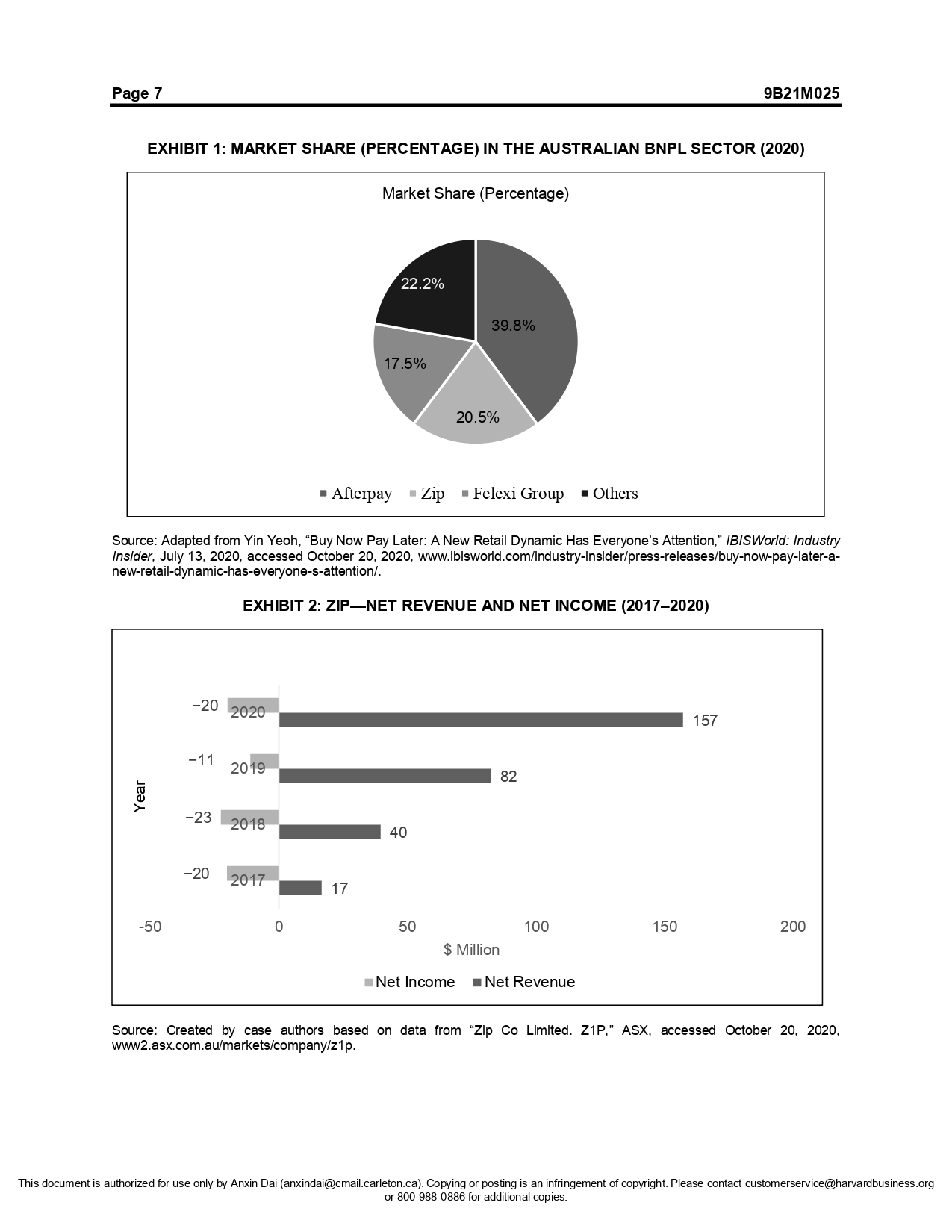

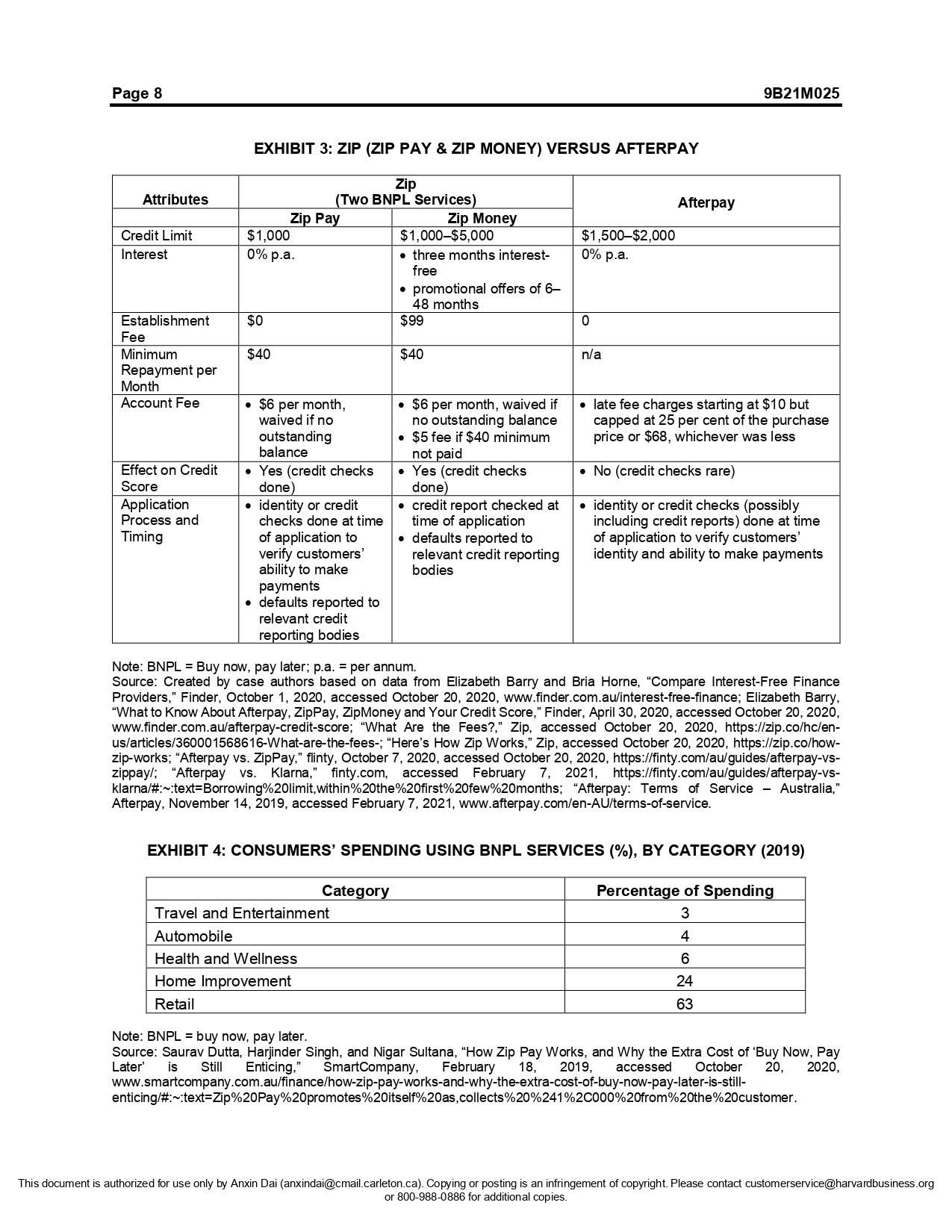

IVEy Publishing W21115 ZIP: IN NEED OF GROWTH-ORIENTED COMPETITIVE STRATEGIES1 Arpita Agnihotri and Saurabh Bhattacharya wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western Jniversity, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca, www.iveycases.com. Our goal is to publish materials of the highest quality, submit any errata to publishcases@ivey.ca. Copyright @ 2021, Ivey Business School Foundation Version: 2021-03-18 Financial technology (fintech) start-up Zip Co Limited (Zip) was a market follower in the Australian digital retail finance and payments industry, popularly known as the buy now, pay later (BNPL) sector (see Exhibit 1) and a winner, in the 2020 Mozo People's Choice Awards: Australia in this category. Players including Zip, Afterpay Limited (Afterpay), and Klarna Bank AB (Klarna) were forging alliances in order to enter the North American market-especially the United States, which had the biggest retail market globally.' Observing the growth of the BNPL category, PayPal Holdings Inc. (PayPal), the leading online payment company in the United States, announced in September 2020 that it would also launch BNPL services. Analysts suggested that PayPal's entry into the BNPL sector might impede Zip's growth in the United States. The day of PayPal's announcement, Zip's shares declined by 17 per cent to $7.06 per share, reflecting a 12 per cent loss, after Citigroup Inc. (Citi) downgraded Zip's rating to "sell," and Zip's investors expressed concerns about the further narrowing of the "net transaction margin" as retailers would likely negotiate for lower fees that were similar to PayPal's. Zip's chief executive officer (CEO), Larry Diamond, was confident that the company could defeat PayPal, noting that Zip's "insatiable appetite for what's better for users, our deep and ongoing investment in innovation and ability to move quickly-that has and will always separate us from the global payment elephants" such as PayPal. Diamond further believed that BNPL could also disrupt the credit card players, saying, "Buy now, pay later is here to stay permanently as a true disrupter to the credit card. . . . It will become mainstream."10 As a market challenger, Diamond believed that Zip's distinct payment model could make the company stand out compared to other players in the BNPL category, including Afterpay, the market leader. Although Zip was likely to grow, how could Diamond combat competition from large players like PayPal in the United States? What competitive strategies could he adopt? How could Zip surpass Afterpay as the leader in the BNPL category? Could Diamond disrupt the credit card industry? BACKGROUND Diamond and Peter Gray had co-founded Zip in 201312 under the brand name Zip Money. Headquartered in Sydney, Zip was listed on the Australian Securities Exchange in 2015.15 Diamond and Gray had observed that the traditional retail finance model, with its inflexible and high-interest-rate payment systems, was broken and that millennials were looking for better financing options. 4 Diamond noted that prior to the arrival of BNPL services, "two million small businesses around Australia" had been "locked out of This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.IVEy Publishing W21115 ZIP: IN NEED OF GROWTH-ORIENTED COMPETITIVE STRATEGIES1 Arpita Agnihotri and Saurabh Bhattacharya wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western Jniversity, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca, www.iveycases.com. Our goal is to publish materials of the highest quality, submit any errata to publishcases@ivey.ca. Copyright @ 2021, Ivey Business School Foundation Version: 2021-03-18 Financial technology (fintech) start-up Zip Co Limited (Zip) was a market follower in the Australian digital retail finance and payments industry, popularly known as the buy now, pay later (BNPL) sector (see Exhibit 1) and a winner, in the 2020 Mozo People's Choice Awards: Australia in this category. Players including Zip, Afterpay Limited (Afterpay), and Klarna Bank AB (Klarna) were forging alliances in order to enter the North American market-especially the United States, which had the biggest retail market globally.' Observing the growth of the BNPL category, PayPal Holdings Inc. (PayPal), the leading online payment company in the United States, announced in September 2020 that it would also launch BNPL services. Analysts suggested that PayPal's entry into the BNPL sector might impede Zip's growth in the United States. The day of PayPal's announcement, Zip's shares declined by 17 per cent to $7.06 per share, reflecting a 12 per cent loss, after Citigroup Inc. (Citi) downgraded Zip's rating to "sell," and Zip's investors expressed concerns about the further narrowing of the "net transaction margin" as retailers would likely negotiate for lower fees that were similar to PayPal's. Zip's chief executive officer (CEO), Larry Diamond, was confident that the company could defeat PayPal, noting that Zip's "insatiable appetite for what's better for users, our deep and ongoing investment in innovation and ability to move quickly-that has and will always separate us from the global payment elephants" such as PayPal. Diamond further believed that BNPL could also disrupt the credit card players, saying, "Buy now, pay later is here to stay permanently as a true disrupter to the credit card. . . . It will become mainstream."10 As a market challenger, Diamond believed that Zip's distinct payment model could make the company stand out compared to other players in the BNPL category, including Afterpay, the market leader. Although Zip was likely to grow, how could Diamond combat competition from large players like PayPal in the United States? What competitive strategies could he adopt? How could Zip surpass Afterpay as the leader in the BNPL category? Could Diamond disrupt the credit card industry? BACKGROUND Diamond and Peter Gray had co-founded Zip in 201312 under the brand name Zip Money. Headquartered in Sydney, Zip was listed on the Australian Securities Exchange in 2015.15 Diamond and Gray had observed that the traditional retail finance model, with its inflexible and high-interest-rate payment systems, was broken and that millennials were looking for better financing options. 4 Diamond noted that prior to the arrival of BNPL services, "two million small businesses around Australia" had been "locked out of This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 2 9B21M025 consumer purchase financing."15 Between January 2018 and August 2020, Zip's share price had increased from $1 to $ 10, and in 2020, Zip had $157 million in revenue-a 90 per cent increase over the previous year (see Exhibit 2). In 2019, Zip had 185 employees. 17 Zip offered interest-free point-of-sale credit and digital payment services to consumers in the retail, home, health, automotive, and travel industries. To be eligible to use Zip in Australia, a customer had to be an Australian citizen or permanent resident above 18 years of age and to have either a PayPal or a Facebook account and a valid debit card; eligible consumers must not have declared insolvency or bankruptcy. 19 BNPL INDUSTRY Between 2016 and 2019, the number of consumers using BNPL services increased from 100,000 to over 5.6 million globally; most were millennials. According to the online payment processing company Worldpay Group Plc (Worldpay), the BNPL industry was expected to double in value between 2020 and 2023.21 Most BNPL players let consumers pay for their purchases in four to six instalments without paying any interest. " For example, BNPL allowed consumers with purchases worth $500 to pay for these in four weekly instalments of $125 without any additional interest charges. In addition to Zip, well-known BNPL firms across the world included Affirm Inc. (Affirm) in the United States; Afterpay in Australia; Klara in Sweden; OVO PayLater in Indonesia; PayU Finance India Private Limited (LazyPay) and Simpl Technologies Private Lid. (Simpl) in India; and Paays Financial Technologies (Paays), Health Smart Financial Services Inc. (PayBright), and Uplift Canada Services ULC (Uplift) in Canada. 2 BNPL service providers received revenue generated through merchant fees, which ranged from 3.0 per cent to 6.0 per cent of transaction values, and late fees from consumers. 24 During the COVID-19 pandemic, those retailers who added the BNPL option to their online and mobile platforms noticed a 30 per cent increase in shopping cart size, a 25 per cent decrease in cart abandonment during checkout, and an up-to-20 per cent increase in repeat customers. However, experts did not consider the BNPL industry to be profitable. The managing director of Mclean Roche Consulting Group Pty Ltd., Grant Halverson, said, "It is clear from these numbers that buy now, pay later companies will never make great profits: they are high volume, very low margin businesses."26 BNPL INDUSTRY IN AUSTRALIA The BNPL industry was growing in Australia, but was experiencing losses overall; however, those losses as a share of revenues had declined over the years."In Australia, in 2019, two million consumers used BNPL services,2 and by June 2020, 52.2 per cent of Australians were aware of BNPL companies." The Australian BNPL industry's revenue was expected to grow at an annualized rate of 9.8 per cent between 2020 and 2025, reaching a value of $1.1 billion.3 After implementing BNPL services in 2018, the Australian fashion retailer Princess Polly reported a 20 per cent increase in total sales, a 60 per cent increase in average order value, and a 10 per cent increase in its conversion rate." However, a 2018 study by the Australian Securities and Investments Commission observed that consumers felt that they ended up spending more than they could afford with BNPL services. One in six consumers had also experienced adverse financial effects because of BNPL-induced buying behaviour.' Consumers were overextended and had to borrow money from family or friends or use other loan services to cover their current debts to focal BNPL service providers. 33 This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 2 9B21M025 consumer purchase financing."15 Between January 2018 and August 2020, Zip's share price had increased from $1 to $ 10, and in 2020, Zip had $157 million in revenue-a 90 per cent increase over the previous year (see Exhibit 2). In 2019, Zip had 185 employees. 17 Zip offered interest-free point-of-sale credit and digital payment services to consumers in the retail, home, health, automotive, and travel industries. To be eligible to use Zip in Australia, a customer had to be an Australian citizen or permanent resident above 18 years of age and to have either a PayPal or a Facebook account and a valid debit card; eligible consumers must not have declared insolvency or bankruptcy. 19 BNPL INDUSTRY Between 2016 and 2019, the number of consumers using BNPL services increased from 100,000 to over 5.6 million globally; most were millennials. According to the online payment processing company Worldpay Group Plc (Worldpay), the BNPL industry was expected to double in value between 2020 and 2023.21 Most BNPL players let consumers pay for their purchases in four to six instalments without paying any interest. " For example, BNPL allowed consumers with purchases worth $500 to pay for these in four weekly instalments of $125 without any additional interest charges. In addition to Zip, well-known BNPL firms across the world included Affirm Inc. (Affirm) in the United States; Afterpay in Australia; Klara in Sweden; OVO PayLater in Indonesia; PayU Finance India Private Limited (LazyPay) and Simpl Technologies Private Lid. (Simpl) in India; and Paays Financial Technologies (Paays), Health Smart Financial Services Inc. (PayBright), and Uplift Canada Services ULC (Uplift) in Canada. 2 BNPL service providers received revenue generated through merchant fees, which ranged from 3.0 per cent to 6.0 per cent of transaction values, and late fees from consumers. 24 During the COVID-19 pandemic, those retailers who added the BNPL option to their online and mobile platforms noticed a 30 per cent increase in shopping cart size, a 25 per cent decrease in cart abandonment during checkout, and an up-to-20 per cent increase in repeat customers. However, experts did not consider the BNPL industry to be profitable. The managing director of Mclean Roche Consulting Group Pty Ltd., Grant Halverson, said, "It is clear from these numbers that buy now, pay later companies will never make great profits: they are high volume, very low margin businesses."26 BNPL INDUSTRY IN AUSTRALIA The BNPL industry was growing in Australia, but was experiencing losses overall; however, those losses as a share of revenues had declined over the years."In Australia, in 2019, two million consumers used BNPL services,2 and by June 2020, 52.2 per cent of Australians were aware of BNPL companies." The Australian BNPL industry's revenue was expected to grow at an annualized rate of 9.8 per cent between 2020 and 2025, reaching a value of $1.1 billion.3 After implementing BNPL services in 2018, the Australian fashion retailer Princess Polly reported a 20 per cent increase in total sales, a 60 per cent increase in average order value, and a 10 per cent increase in its conversion rate." However, a 2018 study by the Australian Securities and Investments Commission observed that consumers felt that they ended up spending more than they could afford with BNPL services. One in six consumers had also experienced adverse financial effects because of BNPL-induced buying behaviour.' Consumers were overextended and had to borrow money from family or friends or use other loan services to cover their current debts to focal BNPL service providers. 33 This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 3 9B21M025 BNPL INDUSTRY IN THE UNITED STATES BNPL companies came into practice in the United States after the Second World War. According to Mark A. Cohen, director of retail studies at the Columbia University Graduate School of Business, "First, there were individual store accounts, largely built, like rent, on a pay-each-month basis. . . . Then there were retail store credit cards-a la Sears, Roebuck and Co.; Macy's, etc.-which enabled customers to buy now and pay over time."* However, the focus of such BNPL companies was high-end items and not low-priced retail products. The United States had a $5 trillion retail market and was the largest BNPL market in the world in 2020." Nevertheless, a survey published in July 2020 found that only 22 per cent of Americans completely understood all of the terms and conditions of BNPL. 5 Comparing the Australian and US markets for the BNPL category, Charlie Youakim, CEO of the technology-driven payments company Sezzle, said, "The buy now, pay later sector in the US is very nascent compared to Australia and there is more than room for multiple players."37 ZIP'S BUSINESS MODEL Unlike other BNPL companies, Zip offered a line of credit, " wherein consumers were not required to repay the entire amount in four to six fixed instalments (see Exhibit 3). Instead, Zip followed a minimum monthly payment model, charging consumers a fixed $6 fee every month, starting two months after their purchase until they had made complete payments. "The start-up also levied an additional late payment fee of $5 if a consumer failed to pay a minimum monthly payment of $40. Apart from this, Zip charged retailers a four per cent fee-i.e., for a $1,000 purchase made by a consumer, Zip paid the retailer $960. Gray, the co- founder of Zip, believed the company had a competitive edge over other BNPL companies. He said, "Most of the challengers are going head to head with Afterpay's model, but . . . they don't have strong repeat transaction behaviour and they don't have a differentiating factor."41 Zip leveraged big data analytics in its credit-decision technology.* The company made credit decisions using both conventional and non-conventional consumer data, which helped it achieve lower loss rates as well as better approval ratings. * For instance, if a consumer did not have a credit file, then Zip-using the services of partners like Pocketbook Australia Pty Lid. (Pocketbook), a developer and marketer of software for personal finance management-checked the consumer's bank savings to determine that consumer's creditworthiness. In May 2019, Zip allied with Kmart Australia Limited (Kmart), an Australian retailer, to offer its BNPL services. The same year, Afterpay also locked a deal with Kmart. Most retailers were allying with different BNPL companies. " In November 2019, Zip also allied with Amazon.com Inc. (Amazon) to offer its BNPL services in Australia. After this news became public, Zip's share price increased by 20 per cent. In June 2020, Zip also allied with the online and mobile-only neobank, * which provided its 86,400 customers with complete and accurate pictures of their financial status-i.e., what they were borrowing, spending, and saving. Leading Australian banks such as Westpac Banking Corporation also allied with Zip by providing $40 million in equity funding. Commenting on the partnership with banks, Gray said it was a win-win situation: fintechs could benefit from the banks' hundreds of years of financial experience, and banks could learn consumer engagement behaviour-something that had become difficult for them, from the fintechs. Although consumers used Zip mostly for retail transactions, they occasionally used it for high-end purchases (see Exhibit 4). The retail purchases consumers made using Zip were primarily clothing, fashion items, or restaurant meals." As customers demanded more choice and convenience, Zip invested in innovating its payment ecosystem, for example, making it possible for them to use the Zip application's (app's) innovative features to pay bills or to purchase and send gift cards." While people in all age groups from 18 to 80 preferred Zip services, this preference was most significant among millennials; according to This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 3 9B21M025 BNPL INDUSTRY IN THE UNITED STATES BNPL companies came into practice in the United States after the Second World War. According to Mark A. Cohen, director of retail studies at the Columbia University Graduate School of Business, "First, there were individual store accounts, largely built, like rent, on a pay-each-month basis. . . . Then there were retail store credit cards-a la Sears, Roebuck and Co.; Macy's, etc.-which enabled customers to buy now and pay over time."* However, the focus of such BNPL companies was high-end items and not low-priced retail products. The United States had a $5 trillion retail market and was the largest BNPL market in the world in 2020." Nevertheless, a survey published in July 2020 found that only 22 per cent of Americans completely understood all of the terms and conditions of BNPL. 5 Comparing the Australian and US markets for the BNPL category, Charlie Youakim, CEO of the technology-driven payments company Sezzle, said, "The buy now, pay later sector in the US is very nascent compared to Australia and there is more than room for multiple players."37 ZIP'S BUSINESS MODEL Unlike other BNPL companies, Zip offered a line of credit, " wherein consumers were not required to repay the entire amount in four to six fixed instalments (see Exhibit 3). Instead, Zip followed a minimum monthly payment model, charging consumers a fixed $6 fee every month, starting two months after their purchase until they had made complete payments. "The start-up also levied an additional late payment fee of $5 if a consumer failed to pay a minimum monthly payment of $40. Apart from this, Zip charged retailers a four per cent fee-i.e., for a $1,000 purchase made by a consumer, Zip paid the retailer $960. Gray, the co- founder of Zip, believed the company had a competitive edge over other BNPL companies. He said, "Most of the challengers are going head to head with Afterpay's model, but . . . they don't have strong repeat transaction behaviour and they don't have a differentiating factor."41 Zip leveraged big data analytics in its credit-decision technology.* The company made credit decisions using both conventional and non-conventional consumer data, which helped it achieve lower loss rates as well as better approval ratings. * For instance, if a consumer did not have a credit file, then Zip-using the services of partners like Pocketbook Australia Pty Lid. (Pocketbook), a developer and marketer of software for personal finance management-checked the consumer's bank savings to determine that consumer's creditworthiness. In May 2019, Zip allied with Kmart Australia Limited (Kmart), an Australian retailer, to offer its BNPL services. The same year, Afterpay also locked a deal with Kmart. Most retailers were allying with different BNPL companies. " In November 2019, Zip also allied with Amazon.com Inc. (Amazon) to offer its BNPL services in Australia. After this news became public, Zip's share price increased by 20 per cent. In June 2020, Zip also allied with the online and mobile-only neobank, * which provided its 86,400 customers with complete and accurate pictures of their financial status-i.e., what they were borrowing, spending, and saving. Leading Australian banks such as Westpac Banking Corporation also allied with Zip by providing $40 million in equity funding. Commenting on the partnership with banks, Gray said it was a win-win situation: fintechs could benefit from the banks' hundreds of years of financial experience, and banks could learn consumer engagement behaviour-something that had become difficult for them, from the fintechs. Although consumers used Zip mostly for retail transactions, they occasionally used it for high-end purchases (see Exhibit 4). The retail purchases consumers made using Zip were primarily clothing, fashion items, or restaurant meals." As customers demanded more choice and convenience, Zip invested in innovating its payment ecosystem, for example, making it possible for them to use the Zip application's (app's) innovative features to pay bills or to purchase and send gift cards." While people in all age groups from 18 to 80 preferred Zip services, this preference was most significant among millennials; according to This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 4 9B21M025 the company, Zip was trustworthy and convenient to use. " As a result, Zip's revenues increased over the years, though its net income remained negative (see Exhibit 2). Zip's losses for the first half of 2020 increased five times to $30.3 million due to increasing costs, including the $60 million purchase of PartPay Limited (PartPay), a BNPL service provider from New Zealand. Its low loss rates during the pandemic were attributed to the fiscal stimulus that the government was providing to unemployed citizens.4 Zip used artificial intelligence-based solutions to spot risky customers, and the accuracy of these tests ensured that its customers' default rate was less than 1.5 per cent. Experts believed that control of customer defaults was the key criterion for determining the profitability of BNPL players like Zip.S ZIP'S GROWTH STRATEGIES Zip leveraged acquisitions largely to increase the scope and market of its BPNL services. In 2016, Zip acquired Pocketbook in order to achieve significant savings. Together, Zip and Pocketbook were able to offer smart financial-services solutions to their consumers."Alvin Singh, Pocketbook's co-founder, said, "People just don't know where their spending is going and how to begin saving or saving that much more. We help them to that."> In August 2019, Zip acquired 100 per cent of the shares of PartPay," hoping to use it to enter major BNPL markets like New Zealand, the United Kingdom, the United States, and South Africa. In September 2019, Zip acquired Spotcap ANZ to further expand its market in New Zealand. The company said it wanted to "fast-track its new business offering, Zip Biz, by on-boarding Spotcap's IP in the commercial lending space."61 In September 2020, Zip completed the acquisition of QuadPay, a US-based BNPL company, for $296 million.The QuadPay app offered shoppers virtual interest-free credit up to $500 on Google Pay or Apple Wallet, which they could use for purchases at any merchant outlet. QuadPay consumers could split their payments over four instalments over six weeks. QuadPay had 1.5 million customers and 3,500 merchants. In the fourth quarter of 2019, the start-up achieved 1.4 million transactions, " and QuadPay's merchants reported a 25 per cent increase in conversion rates and 20-60 per cent increases in average order value. 65 Commenting on QuadPay's performance, The financial advisory company, the Macquarie Group Limited, mentioned that "a lack of differentiation could limit the ability for QuadPay to increase [its] customer numbers at the same rate as larger peers."60 With the acquisition of QuadPay, Zip expected to achieve annual revenue of $180 million, 3.5 million customers, and 26,200 merchants. Diamond believed the QuadPay acquisition was a good deal; moreover, the acquisition had the potential to increase Zip's customer base by 75 per cent and its transaction volume to $3 billion by the end of 2020. Diamond said, "Together, we are united in a shared vision of disrupting the outdated credit card sector with digital, fairer alternatives." Commenting on the acquisition, Brad Lindenberg, co-founder and co-CEO of QuadPay, said, While there are already some big names in the market, QuadPay is by far the most technically advanced. Our technology means that merchants as large as Target or Walmart could roll out QuadPay online in a couple of days. No other installment provider offers this speed of integration and becoming part of the Zip family will provide QuadPay with access to public capital markets to support our ever-growing merchant base and transaction volumes. 71 This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 4 9B21M025 the company, Zip was trustworthy and convenient to use. " As a result, Zip's revenues increased over the years, though its net income remained negative (see Exhibit 2). Zip's losses for the first half of 2020 increased five times to $30.3 million due to increasing costs, including the $60 million purchase of PartPay Limited (PartPay), a BNPL service provider from New Zealand. Its low loss rates during the pandemic were attributed to the fiscal stimulus that the government was providing to unemployed citizens.4 Zip used artificial intelligence-based solutions to spot risky customers, and the accuracy of these tests ensured that its customers' default rate was less than 1.5 per cent. Experts believed that control of customer defaults was the key criterion for determining the profitability of BNPL players like Zip.S ZIP'S GROWTH STRATEGIES Zip leveraged acquisitions largely to increase the scope and market of its BPNL services. In 2016, Zip acquired Pocketbook in order to achieve significant savings. Together, Zip and Pocketbook were able to offer smart financial-services solutions to their consumers."Alvin Singh, Pocketbook's co-founder, said, "People just don't know where their spending is going and how to begin saving or saving that much more. We help them to that."> In August 2019, Zip acquired 100 per cent of the shares of PartPay," hoping to use it to enter major BNPL markets like New Zealand, the United Kingdom, the United States, and South Africa. In September 2019, Zip acquired Spotcap ANZ to further expand its market in New Zealand. The company said it wanted to "fast-track its new business offering, Zip Biz, by on-boarding Spotcap's IP in the commercial lending space."61 In September 2020, Zip completed the acquisition of QuadPay, a US-based BNPL company, for $296 million.The QuadPay app offered shoppers virtual interest-free credit up to $500 on Google Pay or Apple Wallet, which they could use for purchases at any merchant outlet. QuadPay consumers could split their payments over four instalments over six weeks. QuadPay had 1.5 million customers and 3,500 merchants. In the fourth quarter of 2019, the start-up achieved 1.4 million transactions, " and QuadPay's merchants reported a 25 per cent increase in conversion rates and 20-60 per cent increases in average order value. 65 Commenting on QuadPay's performance, The financial advisory company, the Macquarie Group Limited, mentioned that "a lack of differentiation could limit the ability for QuadPay to increase [its] customer numbers at the same rate as larger peers."60 With the acquisition of QuadPay, Zip expected to achieve annual revenue of $180 million, 3.5 million customers, and 26,200 merchants. Diamond believed the QuadPay acquisition was a good deal; moreover, the acquisition had the potential to increase Zip's customer base by 75 per cent and its transaction volume to $3 billion by the end of 2020. Diamond said, "Together, we are united in a shared vision of disrupting the outdated credit card sector with digital, fairer alternatives." Commenting on the acquisition, Brad Lindenberg, co-founder and co-CEO of QuadPay, said, While there are already some big names in the market, QuadPay is by far the most technically advanced. Our technology means that merchants as large as Target or Walmart could roll out QuadPay online in a couple of days. No other installment provider offers this speed of integration and becoming part of the Zip family will provide QuadPay with access to public capital markets to support our ever-growing merchant base and transaction volumes. 71 This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 5 9B21M025 ZIP VERSUS COMPETITORS Competition among Australian Players With a $25.2 billion market valuation, "Afterpay's valuation was eight times greater than Zip's. In the fourth quarter of 2018, Afterpay achieved $3.8 billion sales and had 9.9 million active customers and 55,400 merchants globally. At the same time, Zip had $570 million in sales, representing 2.1 million active customers and 24,500 active merchants. "A May 2020 consumer survey by Mozo identified Zip as a winner in terms of customer satisfaction scores and named Afterpay, its biggest competitor in Australia, as "most recommended" (see Exhibits 1 and 3). Afterpay was also growing in other countries by acquiring start- ups such as EmpatKali in Indonesia. " Zip adopted a similar acquisitions strategy in the United Kingdom and United States to expand its global footprint. 76 Afterpay stopped customers with late payments from making purchases until they had cleared outstanding balances. The company also levied late fees, which started at $10 but were capped at 25 per cent of the purchase price or $68, whichever was less. "Retailers who used Afterpay were billed 30 cents, along with a weighted commission ranging from three to seven per cent, for every transaction made. Zip, on the other hand, charged 15 cents for every transaction and a commission of two to six per cent for every BNPL customer purchase. 78 Although Afterpay did not run formal credit score checks, it declined 30 per cent of consumer requests for its BPNL services based on the potential consumers' lack of funds. Leveraging machine learning to understand consumer buying behaviour, Afterpay determined a consumer's creditworthiness based on open data available through the consumer's bank accounts in Australia (see Exhibit 3). Afterpay's net transaction loss due to consumers' payment difficulties represented less than one per cent of the underlying sales, which, according to the company, was much lower than the industry standard. Also, 0.2 per cent of Afterpay's customers made payments with late fees. Zip's net transaction loss was more than one per cent. Diamond said, "If you look at our loss rate it's probably at 1.3%, but we still recognise that we're not even close to $200 million. So, it's still kind of seasoning, but guys like Flexi and Latitude might be at 3-4%. So there will be some seasoning, but we believe we're doing more diligence than them."82 In early 2020, competition in Australia's BNPL sector increased when Sweden-based Klara, the world's largest BNPL player, entered the market. Klarna allied with the Commonwealth Bank of Australia (CommBank) for its BNPL tech solution. Commenting on the partnership, CommBank CEO Matt Comyn said the partnership "allows us to build on our leading technology to deliver the very best payment services for our customers and merchants in Australia, on platforms which are safe, secure, and easy to use."84 CommBank had also invested $300 million in Klara between 2018 and January 2020. $5 Competition in the United States In the United States, firms like Affirm offered lines of credit for high-end items like furniture. Affirm customers were offered loans of up to $17,500 with annual interest rates ranging from 0 to 30 per cent, depending on their credit history. The company did not charge any other fees. Competition from US credit card companies, who had their own version of BNPL services, was also increasing. In August 2020, Citi announced a partnership with Amazon that would allow customers to pay by instalments for products purchased on Amazon using the Citi card. Siraj Ahmed, an analyst at Citi, said, "While we see potential for two to three buy now, pay later players to coexist, like most online verticals, we see it as a winner takes most market." American Express was also preparing to offer consumers BNPL services on purchases over $100 through its mobile app-but with a fee of 1.33 per cent of the transaction's value. Credit cards from This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 5 9B21M025 ZIP VERSUS COMPETITORS Competition among Australian Players With a $25.2 billion market valuation, "Afterpay's valuation was eight times greater than Zip's. In the fourth quarter of 2018, Afterpay achieved $3.8 billion sales and had 9.9 million active customers and 55,400 merchants globally. At the same time, Zip had $570 million in sales, representing 2.1 million active customers and 24,500 active merchants. "A May 2020 consumer survey by Mozo identified Zip as a winner in terms of customer satisfaction scores and named Afterpay, its biggest competitor in Australia, as "most recommended" (see Exhibits 1 and 3). Afterpay was also growing in other countries by acquiring start- ups such as EmpatKali in Indonesia. " Zip adopted a similar acquisitions strategy in the United Kingdom and United States to expand its global footprint. 76 Afterpay stopped customers with late payments from making purchases until they had cleared outstanding balances. The company also levied late fees, which started at $10 but were capped at 25 per cent of the purchase price or $68, whichever was less. "Retailers who used Afterpay were billed 30 cents, along with a weighted commission ranging from three to seven per cent, for every transaction made. Zip, on the other hand, charged 15 cents for every transaction and a commission of two to six per cent for every BNPL customer purchase. 78 Although Afterpay did not run formal credit score checks, it declined 30 per cent of consumer requests for its BPNL services based on the potential consumers' lack of funds. Leveraging machine learning to understand consumer buying behaviour, Afterpay determined a consumer's creditworthiness based on open data available through the consumer's bank accounts in Australia (see Exhibit 3). Afterpay's net transaction loss due to consumers' payment difficulties represented less than one per cent of the underlying sales, which, according to the company, was much lower than the industry standard. Also, 0.2 per cent of Afterpay's customers made payments with late fees. Zip's net transaction loss was more than one per cent. Diamond said, "If you look at our loss rate it's probably at 1.3%, but we still recognise that we're not even close to $200 million. So, it's still kind of seasoning, but guys like Flexi and Latitude might be at 3-4%. So there will be some seasoning, but we believe we're doing more diligence than them."82 In early 2020, competition in Australia's BNPL sector increased when Sweden-based Klara, the world's largest BNPL player, entered the market. Klarna allied with the Commonwealth Bank of Australia (CommBank) for its BNPL tech solution. Commenting on the partnership, CommBank CEO Matt Comyn said the partnership "allows us to build on our leading technology to deliver the very best payment services for our customers and merchants in Australia, on platforms which are safe, secure, and easy to use."84 CommBank had also invested $300 million in Klara between 2018 and January 2020. $5 Competition in the United States In the United States, firms like Affirm offered lines of credit for high-end items like furniture. Affirm customers were offered loans of up to $17,500 with annual interest rates ranging from 0 to 30 per cent, depending on their credit history. The company did not charge any other fees. Competition from US credit card companies, who had their own version of BNPL services, was also increasing. In August 2020, Citi announced a partnership with Amazon that would allow customers to pay by instalments for products purchased on Amazon using the Citi card. Siraj Ahmed, an analyst at Citi, said, "While we see potential for two to three buy now, pay later players to coexist, like most online verticals, we see it as a winner takes most market." American Express was also preparing to offer consumers BNPL services on purchases over $100 through its mobile app-but with a fee of 1.33 per cent of the transaction's value. Credit cards from This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 6 9B21M025 retailers charged from 0.6 per cent to 1.5 per cent interest, with average rates of 13-23 per cent. The average American had four credit cards." Contrary to this, Australian consumers used BNPL to avoid using credit cards. " In financial year 2019-20, Australians' use of credit cards declined by 6.6 per cent. 92 PAYPAL'S ENTRY IN BNPL SECTOR In August 2020, PayPal's market capitalization was $229.5 billion. Of the top 100 retailers in the United States, 80 per cent accepted payments through PayPal, and 70 per cent of US buyers had a PayPal account. PayPal had 190 million active users in the United States." Since 2015, PayPal Credit, which worked like a credit card, with interest on borrowed sums after six months, had been the most popular BNPL service in the United States and the United Kingdom. In the past, PayPal had faced controversy related to its Bill Me Later service, which was renamed PayPal Credit in 2014. At the time of the PayPal Credit launch, PayPal credited $250 to its customers' accounts and expected them to repay the entire amount in six months to avoid any interest charges." The service also required a minimum monthly payment that depended on the purchase level. " In 2015, the US government's Consumer Financial Protection Bureau (CFPB) filed a complaint against PayPal for illegally and automatically signing consumers up for PayPal Credit and mishandling their accounts by imposing interest, late fees, and other charges. PayPal was required to pay $15 million in reimbursements to consumers and an additional penalty of $10 million."The episode was believed to have dampened consumers' trust in PayPal," which in 2020, received customer satisfaction scores of 2.73 on a scale of 1.0 to 5.0, based on 1,877 reviews." In September 2020, PayPal offered a modified BNPL service-Pay in 4. Lisa Ellis, an analyst at MoffettNathanson, commented on its growth potential in the BNPL sector: "PayPal can grow 18 to 19 per cent before it gets out of bed in the morning."100 The new PayPal Pay in 4 option appeared automatically as an option in consumers' PayPal wallets. 101 Consumers could pay in interest-free instalments over six weeks for purchases between $30 and $600 made through Pay in 4. Furthermore, PayPal did not charge any extra fees to merchants, who continued to be charged the traditional 2.4 per cent fee. Jessica Amir, a market analyst at Bell Direct, explained that PayPal could avoid extra fees by saying, "The reason PayPal can charge $0 is that they will be leveraging their existing technology. . . . Once PayPal rolls out its technology and merchants and consumers are onboard, Afterpay and Sezzle will be heavily undercut."104 THE ROAD AHEAD Grant Halverson, a payments expert at Mclean Roche, commented on competition in the BNPL industry by saying, "The dance of the elephants has started."10 While PayPal had already been a threat to Zip, according to Deloitte analysts, large banks would also offer similar solutions in the future, as consumers showed an appetite for such products. 100 Zip intended to expand in Asian countries, including China and Singapore. Gray said, "We think it's a very interesting opportunity but it's really critical about how you enter and who you partner with." In China, social media platforms such as WeChat were offering interest-free loans with the option of repayment whenever possible. Commenting on the growth potential of BNPL companies, UBS analyst Tom Beadle said, "The faster BNPL grows and succeeds it will inevitably attract new competition and/or regulation, that will either reduce the economics currently enjoyed by participants, or limits [ sic] their long term growth potential."109 In the midst of these challenges, how could Zip ensure profitable growth? How could it compete against PayPal and other incumbents? This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 6 9B21M025 retailers charged from 0.6 per cent to 1.5 per cent interest, with average rates of 13-23 per cent. The average American had four credit cards." Contrary to this, Australian consumers used BNPL to avoid using credit cards. " In financial year 2019-20, Australians' use of credit cards declined by 6.6 per cent. 92 PAYPAL'S ENTRY IN BNPL SECTOR In August 2020, PayPal's market capitalization was $229.5 billion. Of the top 100 retailers in the United States, 80 per cent accepted payments through PayPal, and 70 per cent of US buyers had a PayPal account. PayPal had 190 million active users in the United States." Since 2015, PayPal Credit, which worked like a credit card, with interest on borrowed sums after six months, had been the most popular BNPL service in the United States and the United Kingdom. In the past, PayPal had faced controversy related to its Bill Me Later service, which was renamed PayPal Credit in 2014. At the time of the PayPal Credit launch, PayPal credited $250 to its customers' accounts and expected them to repay the entire amount in six months to avoid any interest charges." The service also required a minimum monthly payment that depended on the purchase level. " In 2015, the US government's Consumer Financial Protection Bureau (CFPB) filed a complaint against PayPal for illegally and automatically signing consumers up for PayPal Credit and mishandling their accounts by imposing interest, late fees, and other charges. PayPal was required to pay $15 million in reimbursements to consumers and an additional penalty of $10 million."The episode was believed to have dampened consumers' trust in PayPal," which in 2020, received customer satisfaction scores of 2.73 on a scale of 1.0 to 5.0, based on 1,877 reviews." In September 2020, PayPal offered a modified BNPL service-Pay in 4. Lisa Ellis, an analyst at MoffettNathanson, commented on its growth potential in the BNPL sector: "PayPal can grow 18 to 19 per cent before it gets out of bed in the morning."100 The new PayPal Pay in 4 option appeared automatically as an option in consumers' PayPal wallets. 101 Consumers could pay in interest-free instalments over six weeks for purchases between $30 and $600 made through Pay in 4. Furthermore, PayPal did not charge any extra fees to merchants, who continued to be charged the traditional 2.4 per cent fee. Jessica Amir, a market analyst at Bell Direct, explained that PayPal could avoid extra fees by saying, "The reason PayPal can charge $0 is that they will be leveraging their existing technology. . . . Once PayPal rolls out its technology and merchants and consumers are onboard, Afterpay and Sezzle will be heavily undercut."104 THE ROAD AHEAD Grant Halverson, a payments expert at Mclean Roche, commented on competition in the BNPL industry by saying, "The dance of the elephants has started."10 While PayPal had already been a threat to Zip, according to Deloitte analysts, large banks would also offer similar solutions in the future, as consumers showed an appetite for such products. 100 Zip intended to expand in Asian countries, including China and Singapore. Gray said, "We think it's a very interesting opportunity but it's really critical about how you enter and who you partner with." In China, social media platforms such as WeChat were offering interest-free loans with the option of repayment whenever possible. Commenting on the growth potential of BNPL companies, UBS analyst Tom Beadle said, "The faster BNPL grows and succeeds it will inevitably attract new competition and/or regulation, that will either reduce the economics currently enjoyed by participants, or limits [ sic] their long term growth potential."109 In the midst of these challenges, how could Zip ensure profitable growth? How could it compete against PayPal and other incumbents? This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 7 9B21M025 EXHIBIT 1: MARKET SHARE (PERCENTAGE) IN THE AUSTRALIAN BNPL SECTOR (2020) Market Share (Percentage) 22.2% 39.8% 17.5% 20.5% Afterpay Zip Felexi Group . Others Source: Adapted from Yin Yeoh, "Buy Now Pay Later: A New Retail Dynamic Has Everyone's Attention," IBISWorld: Industry Insider, July 13, 2020, accessed October 20, 2020, www.ibisworld.com/industry-insider/press-releases/buy-now-pay-later-a- new-retail-dynamic-has-everyone-s-attention/. EXHIBIT 2: ZIP-NET REVENUE AND NET INCOME (2017-2020) -20 2020 157 -11 2019 82 Year -23 2018 40 -20 2017 17 -50 0 50 100 150 200 $ Million Net Income Net Revenue Source: Created by case authors based on data from "Zip Co Limited. Z1P," ASX, accessed October 20, 2020, www2.asx.com.au/markets/company/z1p. This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies.Page 8 9B21M025 EXHIBIT 3: ZIP (ZIP PAY & ZIP MONEY) VERSUS AFTERPAY Zip Attributes (Two BNPL Services) Afterpay Zip Pay Zip Money Credit Limit $1,000 $1,000-$5,000 $1,500-$2,000 Interest 0% p.a. three months interest- 0% p.a. free . promotional offers of 6- 48 months Establishment $0 $99 0 Fee Minimum $40 $40 n/a Repayment per Month Account Fee . $6 per month, . $6 per month, waived if . late fee charges starting at $10 but waived if no no outstanding balance capped at 25 per cent of the purchase outstanding . $5 fee if $40 minimum price or $68, whichever was less balance not paid Effect on Credit Yes (credit checks . Yes (credit checks . No (credit checks rare) Score done) done Application . identity or credit . credit report checked at . identity or credit checks (possibly Process and checks done at time time of application ncluding credit reports) done at time Timing of application to defaults reported to of application to verify customers' verify customers' relevant credit reporting identity and ability to make payments ability to make bodies payment . defaults reported to relevant credit reporting bodies Note: BNPL = Buy now, pay later; p.a. = per annum. Source: Created by case authors based on data from Elizabeth Barry and Bria Horne, "Compare Interest-Free Finance Providers," Finder, October 1, 2020, accessed October 20, 2020, www.finder.com.au/interest-free-finance; Elizabeth Barry, "What to Know About Afterpay, ZipPay, ZipMoney and Your Credit Score," Finder, April 30, 2020, accessed October 20, 2020, www.finder.com.au/afterpay-credit-score; "What Are the Fees?," Zip, accessed October 20, 2020, https://zip.co/hc/en us/articles/360001568616-What-are-the-fees-; "Here's How Zip Works," Zip, accessed October 20, 2020, https://zip.co/how- zip-works; "Afterpay vs. ZipPay," flinty, October 7, 2020, accessed October 20, 2020, https://finty.com/au/guides/afterpay-vs- zippay/; "Afterpay vs. Klarna," finty.com, accessed February 7, 2021, https://finty.com/au/guides/afterpay-vs- klarna/#:~:text=Borrowing%20limit, within%20the%20first%20few%20months; "Afterpay: Terms of Service - Australia," Afterpay, November 14, 2019, accessed February 7, 2021, www.afterpay.com/en-AU/terms-of-service. EXHIBIT 4: CONSUMERS' SPENDING USING BNPL SERVICES (%), BY CATEGORY (2019) Category Percentage of Spending Travel and Entertainment 3 Automobile 4 Health and Wellness 6 Home Improvement 24 Retail 63 Note: BNPL = buy now, pay later. Source: Saurav Dutta, Harjinder Singh, and Nigar Sultana, "How Zip Pay Works, and Why the Extra Cost of 'Buy Now, Pay Later' is Still Enticing," SmartCompany, February 18, 2019, accessed October 20, 2020 www.smartcompany.com.au/finance/how-zip-pay-works-and-why-the-extra-cost-of-buy-now-pay-later-is-still- enticing/#:~:text=Zip%20Pay%20promotes%20itself%20as,collects%20%241%20000%20from%20the%20customer. This document is authorized for use only by Anxin Dai (anxindai@cmail.carleton.ca). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 800-988-0886 for additional copies