ABC, a hypothetical company, operates in Countries A and B. The tax rate in Country A is

Question:

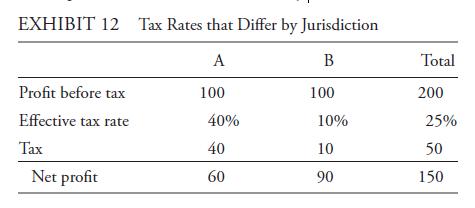

ABC, a hypothetical company, operates in Countries A and B. The tax rate in Country A is 40%, and the tax rate in Country B is 10%. In the first year, the company generates an equal amount of profit before tax in each country.

i. What will happen to the effective tax rate for the next three years if the profit in Country A is stable but the profit in Country B grows 15% annually?

ii. Evaluate the cash tax and effective tax rates for the next three years if the tax authorities in Country A allow some costs (e.g., accelerated depreciation) to be taken sooner for tax purposes. For Country A, the result will be a 50% reduction in taxes paid in the current year but an increase in taxes paid by the same amount in the following year (this happens each year). Assume stable profit before tax in Country A and 15% annual before-tax-profit growth in Country B.

iii. Repeat the exercise of Problem 2, but now assume that it is Country B not Country A that allows some costs to be taken sooner for tax purposes and that the tax effect described applies to Country B. Continue to assume stable profit before tax at Country A and 15% annual profit growth in Country B.

Step by Step Answer: