Carlsberg is the smallest of the global brewers, but it is the dominant beer company in Russia.

Question:

Carlsberg is the smallest of the global brewers, but it is the dominant beer company in Russia. In 2011, Carlsberg’s subsidiary Baltika was the market leader in Russia with a 37% market share, followed by AB InBev with 16%, Heineken with 12%, Efes with 11%, and SAB Miller with 7%. The Russian market is considered a growth market because of its low per capita consumption of beer but high overall alcohol consumption.

In 2010, the Russian government, in its fight to curb alcohol consumption, tripled the excise duty on beer from RU B3 per liter to RU B9 and announced that excise duty will further increase by RU B1 per liter for each of the next two years.

In 2011, Baltika made significant efforts to strengthen the position of the more expensive brands in its portfolio. These efforts led to a 28% increase in selling costs. Similar to most consumer staple companies, Baltika experienced higher production costs.

Poor grain harvests put price pressure on buyers of almost all feedstocks, and rising oil prices resulted in higher packaging costs. In 2011, competing companies were much more cautious with advertising and promotional spending than Baltika.

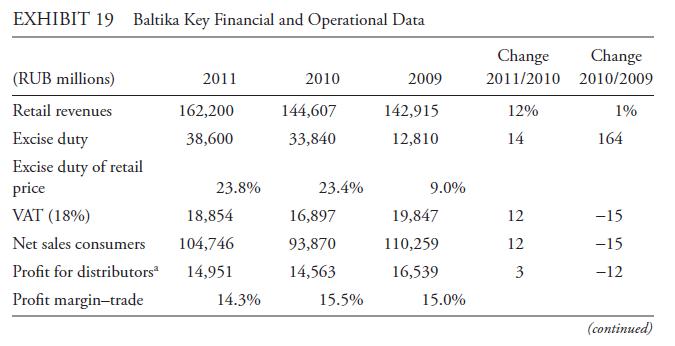

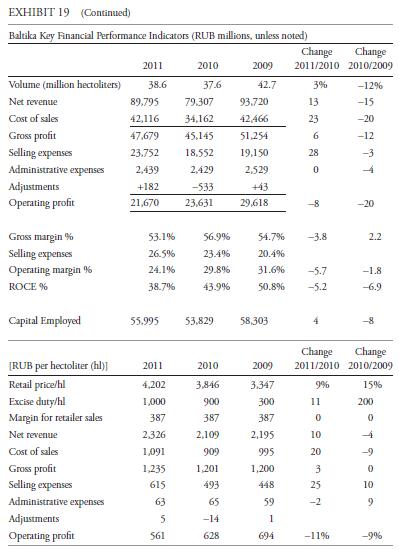

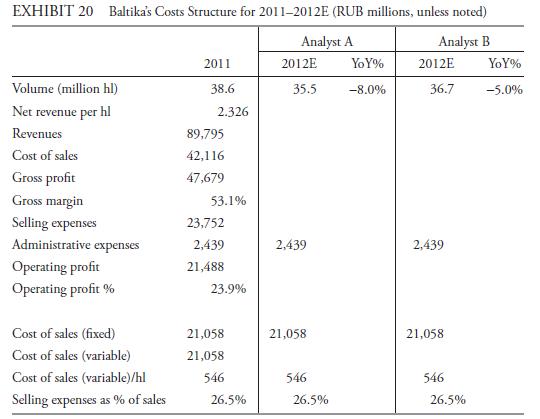

Two analysts research Baltika. In making their Baltika forecasts, both analysts use the separate published annual report from Baltika (see Exhibit 19). Based on the data on Baltika’s selling costs, Exhibit 19, and the assumption of no cost inflation, the two analysts have arrived at distinctly different conclusions. Analyst A thinks Baltika has a weak competitive position in Russia and should exit. But Analyst B is enthusiastic about Baltika’s prospects despite Baltika’s 8% lower operating profit in 2011.

i. Both analysts believe there will be an increase in the excise duty (special tax on beer)

in Russia; it should result in an approximate 10% increase in selling prices. Assume that half the cost of sales is fixed per hectoliter (hl) and half is variable based on volume, that selling expenses are a stable percentage of sales, and that administrative expenses are fixed. Also assume that Baltika will pass on the 10% excise duty increase to its customers without lowering its own net sales prices.

A. A nalyst A expects a price elasticity of 0.8, indicating that volume will fall by 8%

given the 10% retail price increase. Calculate the impact on operating profit and operating profit margin in 2012 using Exhibit 20.

B. A nalyst B expects a price elasticity of 0.5, indicating that volume will fall by 5%

given the 10% retail price increase. Calculate the impact on operating profit and operating profit margin in 2012 using Exhibit 20.

ii. Gross margin improved in 2010 (56.9%) but fell in 2011 (53.1%). Cost of sales was relatively high in 2011 because of high barley costs, an important input for brewing beer. Assume that in 2011 half of the cost of sales is fixed and half is based on volume. Of the variable part of the cost of sales, assume that half of the amount is related to the barley price in 2011. Barley prices increased 33% in 2011. For 2012, assume that revenues will remain stable and that barley prices will return to their previous 2010 level. Calculate Baltika’s estimated gross margin for 2012.

iii. Baltika’s selling expenses increased from 23.4% of sales in 2010 to 26.5% of sales in 2011. Which competitive forces most likely influenced Baltika’s significant increase in selling expenses?

iv. Retailers are the direct customers of brewers. They buy directly from the brewer and sell to the ultimate consumer. Analyst A expects that the increase in mass retailers in Russia will cause brewers’ margins to decline. He expects Baltika’s operating margin will decrease from 24.1% in 2011 to 15% in 2015 with stable sales (RU B89,795)

and an unchanged amount of invested capital (RU B55,995). Analyst B also sees the increasing importance of the larger food retailers but expects that Baltika can offset potential pricing pressure by offering more attractive trade credit (e.g., allowing the retailers longer payment terms). He thinks operating margin can remain stable at 24.1% with no sales growth. Capital employed (RU B 55,995), however, will double because of the extra investments in inventory and receivables. Describe the analysts’

expectations about the impact of large retailers on brewers in terms of Porter’s five forces and ROCE . Which of the two scenarios would be better for Baltika?

Step by Step Answer: