I f Nkomos 2010 year-end estimate of Amersheen shares intrinsic value was accurate, then Amersheens shares were

Question:

I f Nkomo’s 2010 year-end estimate of Amersheen shares’ intrinsic value was accurate, then Amersheen’s shares were most likely:

A. overvalued.

B. undervalued.

C. fairly valued.

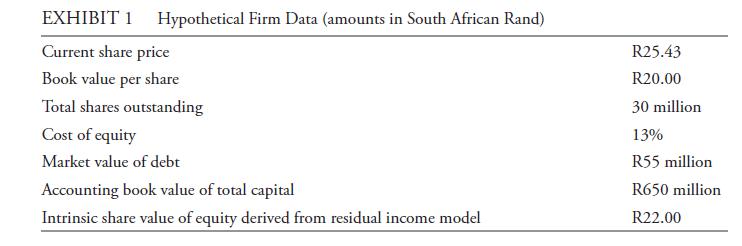

Mangoba Nkomo, CFA, a senior equity analyst with Robertson-Butler Investments, South Africa, has been assigned a recent graduate, Manga Mahlangu, to assist in valuations. Mahlangu is interested in pursuing a career in equity analysis. In their first meeting, Nkomo and Mahlangu discuss the concept of residual income and its commercial applications. Nkomo asks Mahlangu to determine the market value added for a hypothetical South African firm using the data provided in Exhibit 1.

Nkomo also shares his valuation report of the hypothetical firm with Mahlangu. Nkomo’s report concludes that the intrinsic value of the hypothetical firm, based on the residual income model, is R22.00 per share. To assess Mahlangu’s knowledge of residual income valuation, Nkomo asks Mahlangu two questions about the hypothetical firm:

Question 1: What conclusion can we make about future residual earnings, given the current book value per share and my estimate of intrinsic value per share?

Question 2: Suppose you estimated the intrinsic value of a firm’s shares using a constant growth residual income model, and you found that your estimate of intrinsic value equaled the book value per share. What would that finding imply about that firm’s return on equity?

Satisfied with Mahlangu’s response, Nkomo requests that Mahlangu use the single-stage residual income (RI) model to determine the intrinsic value of the equity of Jackson Breweries, a brewery and bottling company, using data provided in Exhibit 2.

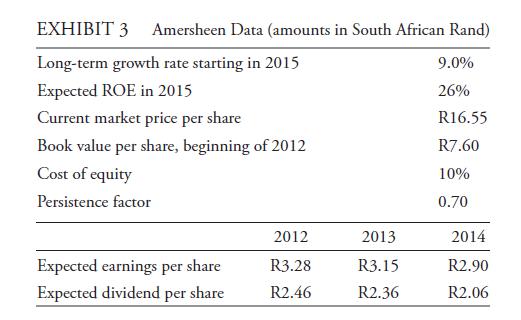

Nkomo also wants to update an earlier valuation of Amersheen, a food retailer. The valuation report, which was completed at the end of 2010, concluded an intrinsic value per share of R11.00 for Amersheen. The share price at that time was R8.25. Nkomo points out to Mahlangu that, in late 2010, Amersheen announced a significant restructuring charge, estimated at R2 million, that would be reported as part of operating earnings in Amersheen’s 2010 annual income statement. Nkomo asks Mahlangu the following question about the restructuring charge:

Question 3 What was the correct way to treat the estimated R2 million restructuring charge in my 2010 valuation report?

Satisfied with Mahlangu’s response, Nkomo mentions to Mahlangu that Amersheen recently (near the end of 2011) completed the acquisition of a chain of convenience stores.

Nkomo requests that Mahlangu complete, as of the beginning of 2012, an updated valuation of Amersheen under two scenarios:

Scenario 1 E stimate the value of Amersheen shares using a multistage residual income (RI) model with the data provided in Exhibit 3.

Under Scenario 1, expected ROE in 2015 is 26% but it is assumed that the firm’s ROE will slowly decline towards the cost of equity thereafter.

Scenario 2 E stimate the value of Amersheen shares using a multistage residual income

(RI) model with the data provided in Exhibit 3 but assume that, at the end of 2014, share price is expected to equal book value per share.

Step by Step Answer: