International Business Machines (NYSE: IBM), which currently pays a dividend of ($3.40) per share, has been the

Question:

International Business Machines (NYSE: IBM), which currently pays a dividend of \($3.40\) per share, has been the subject of two other examples in this reading. In one example, an analyst estimated IBM’s mature phase growth rate at 6.75 percent, based on its mature phase ROE exactly equaling its estimated required return on equity of 9 percent. Another estimate can be made using the DuPont decomposition of ROE .

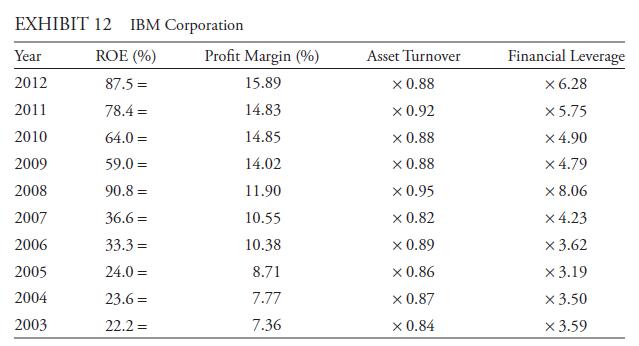

An analysis of IBM’s ROE for the past ten years is shown in Exhibit 12. During the period shown, EPS grew at a compound annual rate of about 16 percent. IBM’s retention ratio has declined from 83.5 percent in 2003 to 77.3 percent in 2012. Annual nominal investment in property, plant, and equipment has also declined from \($4.4\) billion in 2003 to \($4.1\) billion in 2012.

IBM’s ROE has been much higher the last five years than it was in the preceding five year period. This change can largely be attributed to improved profit margins and a significant increase in leverage. However, it is unrealistic to assume that sustainable earnings growth (growth in perpetuity) will be equal to a recent average ROE (75.9 percent over the last five years) times a plausible assumption for the future retention rate (most recently 77.3 percent) given that world-wide economic growth is typically in the mid-single digits. That sort of estimate is also totally inconsistent with the noted historical EPS growth rate of 16.0 percent.

Profit margins are strongly mean-reverting. Suppose the analyst believes that IBM’s recent superiority in profit margin in comparison to peers will be much reduced in the mature phase. The analyst forecasts a peer mean pretax profit margin of 5 percent during IBM’s mature phase. With its strategy of searching for high-margined growth and its strong ability to compete in integrated hardware–software solutions for businesses, the analyst forecasts a long-run pretax profit margin of 6 percent for IBM, equal to a profit margin (after tax) of about 4.2 percent based on an effective tax rate of about 30 percent.

The analyst also believes that capital investment will continue to decline as IBM matures, and cash flow that was previously used for investment will be used to retire debt and pay dividends. The analyst forecasts a financial leverage ratio of 3.5, consistent with 2003–2007 values, but well below the ratio of 6.28 in 2012. The analyst also sees the dividend payout ratio continuing its recent rise and ultimately reaching a level of 40 percent.

Based on an asset turnover ratio of 0.88 (the mean value in Exhibit 12), but using a profit margin estimate of 4.2, a forecast of ROE in the maturity phase is (4.2 percent)

(0.88)(3.5) = 12.9 percent. Therefore, based on this analysis, the estimate of the sustainable growth rate for IBM would be g = (0.60)(12.9 percent) = 7.7 percent.

Step by Step Answer: