John Jones, CFA, is head of the research department of Peninsular Research. One of the companies he

Question:

John Jones, CFA, is head of the research department of Peninsular Research. One of the companies he is researching, Mackinac Inc., is a US-based manufacturing company.

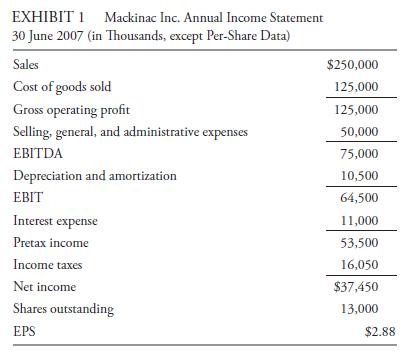

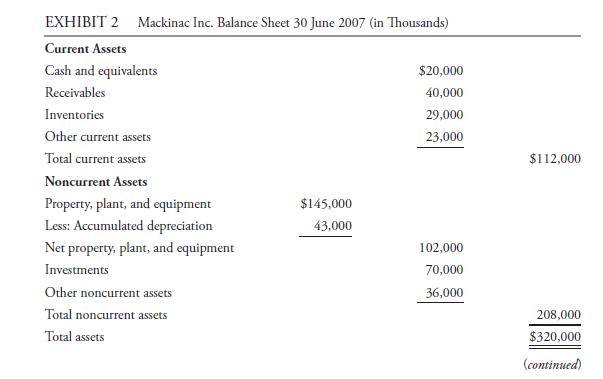

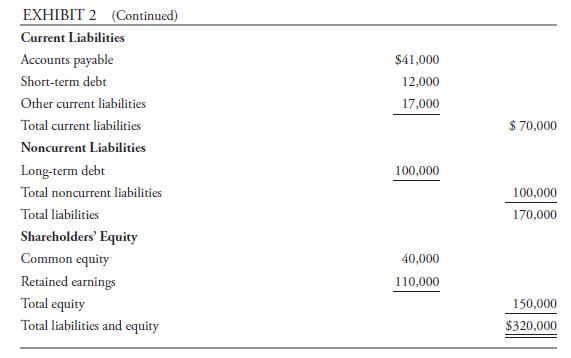

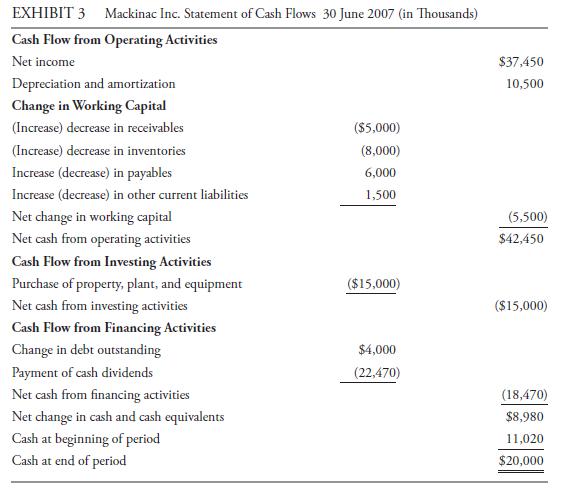

Mackinac has released the June 2007 financial statements shown in Exhibits 1, 2, and 3.

Mackinac has announced that it has finalized an agreement to handle North American production of a successful product currently marketed by a company headquartered outside North America. Jones decides to value Mackinac by using the DDM and FCFE models. After reviewing Mackinac’s financial statements and forecasts related to the new production agreement, Jones concludes the following:

• Mackinac’s earnings and FCFE are expected to grow 17 percent a year over the next three years before stabilizing at an annual growth rate of 9 percent.

• Mackinac will maintain the current payout ratio.

• Mackinac’s beta is 1.25.

• The government bond yield is 6 percent, and the market equity risk premium is 5 percent.

A. Calculate the value of a share of Mackinac’s common stock by using the two-stage DDM.

B. Calculate the value of a share of Mackinac’s common stock by using the two-stage FCFE model.

C. Jones is discussing with a corporate client the possibility of that client acquiring a 70 percent interest in Mackinac. Discuss whether the DDM or FCFE model is more appropriate for this client’s valuation purposes.

Step by Step Answer: