Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inferring Transactions from Financial Statements (FSET) Wired.com Inc. is a large e-commerce company, with over $31 billion in revenues for the fiscal year ended

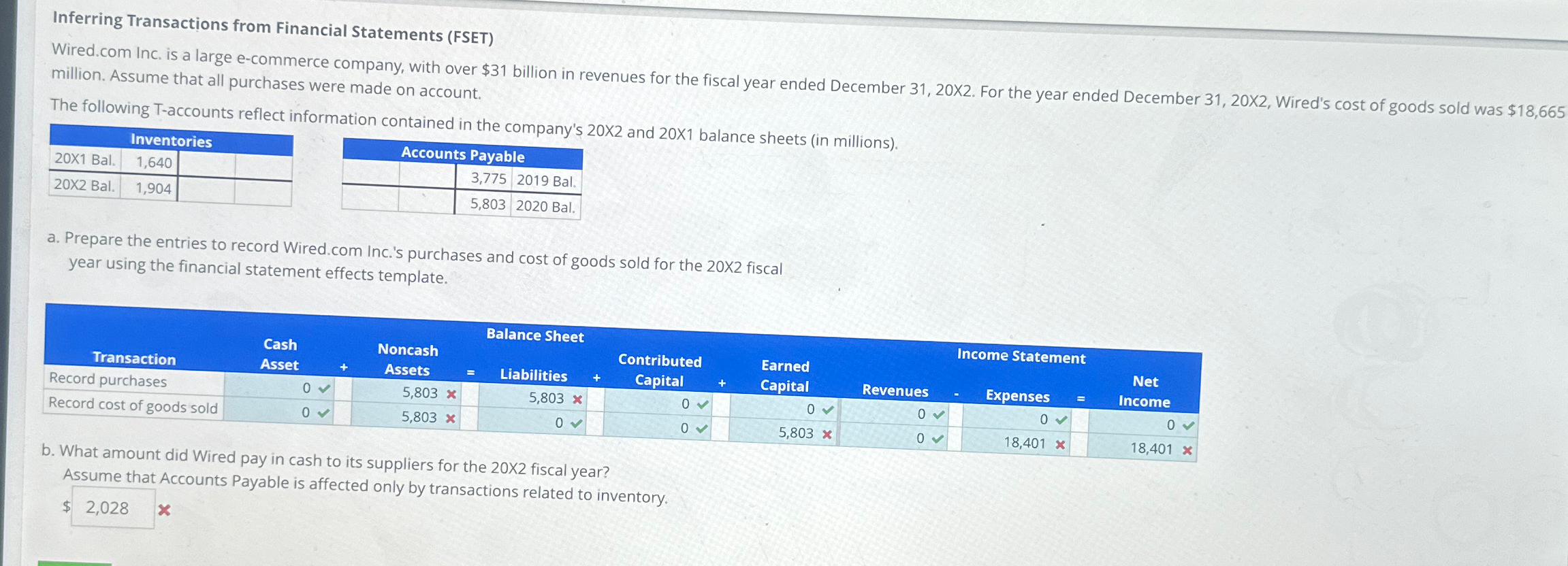

Inferring Transactions from Financial Statements (FSET) Wired.com Inc. is a large e-commerce company, with over $31 billion in revenues for the fiscal year ended December 31, 20X2. For the year ended December 31, 20X2, Wired's cost of goods sold was $18,665 million. Assume that all purchases were made on account. The following T-accounts reflect information contained in the company's 20X2 and 20X1 balance sheets (in millions). Inventories 20X1 Bal. 20X2 Bal. 1,640 1,904 Accounts Payable 3,775 2019 Bal. 5,803 2020 Bal. a. Prepare the entries to record Wired.com Inc.'s purchases and cost of goods sold for the 20X2 fiscal year using the financial statement effects template. Balance Sheet Income Statement Transaction Cash Asset + Noncash Assets = Record purchases Record cost of goods sold 0 0 5,803 x 5,803 x Liabilities + 5,803 x Contributed Capital + Earned Capital Revenues Expenses = Net Income 0 0 0 0 0 5,803 x 0 0 18,401 x 0 18,401 x b. What amount did Wired pay in cash to its suppliers for the 20X2 fiscal year? Assume that Accounts Payable is affected only by transactions related to inventory. $ 2,028 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the problem into steps Step 1 Preparing Entries to Record Purchases and Cost of Goods Sold a Record Purchases Increase in Inventory No...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started