Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carla Vista Inc., a registered broker, enters into a finder's fee agreement with Wildhorse Homes Ltd. on June 15, 2023. Carla Vista will find

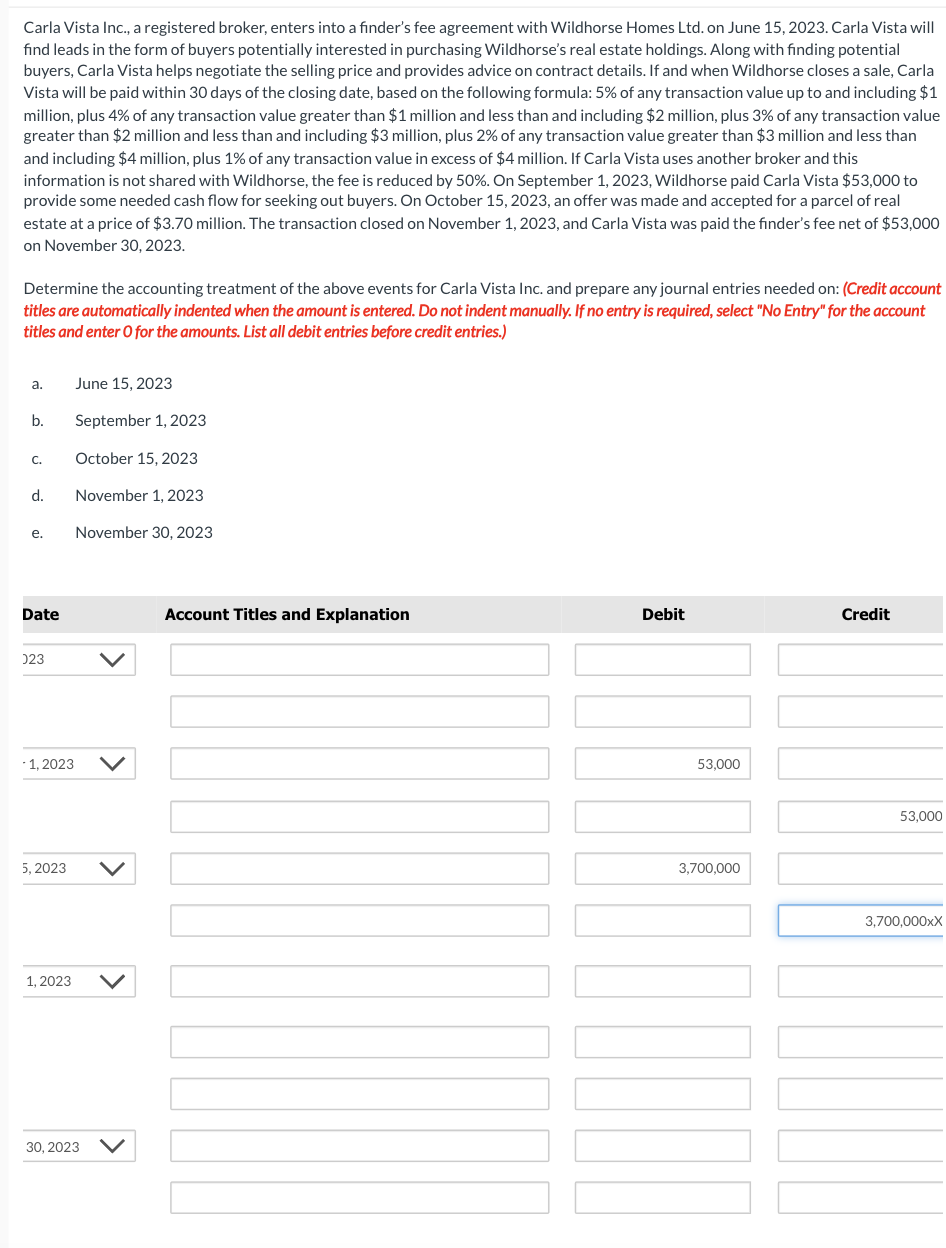

Carla Vista Inc., a registered broker, enters into a finder's fee agreement with Wildhorse Homes Ltd. on June 15, 2023. Carla Vista will find leads in the form of buyers potentially interested in purchasing Wildhorse's real estate holdings. Along with finding potential buyers, Carla Vista helps negotiate the selling price and provides advice on contract details. If and when Wildhorse closes a sale, Carla Vista will be paid within 30 days of the closing date, based on the following formula: 5% of any transaction value up to and including $1 million, plus 4% of any transaction value greater than $1 million and less than and including $2 million, plus 3% of any transaction value greater than $2 million and less than and including $3 million, plus 2% of any transaction value greater than $3 million and less than and including $4 million, plus 1% of any transaction value in excess of $4 million. If Carla Vista uses another broker and this information is not shared with Wildhorse, the fee is reduced by 50%. On September 1, 2023, Wildhorse paid Carla Vista $53,000 to provide some needed cash flow for seeking out buyers. On October 15, 2023, an offer was made and accepted for a parcel of real estate at a price of $3.70 million. The transaction closed on November 1, 2023, and Carla Vista was paid the finder's fee net of $53,000 on November 30, 2023. Determine the accounting treatment of the above events for Carla Vista Inc. and prepare any journal entries needed on: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) a. June 15, 2023 b. September 1, 2023 C. October 15, 2023 d. November 1, 2023 e. November 30, 2023 Date Account Titles and Explanation Debit Credit 023 -1,2023 5,2023 1,2023 < > 30, 2023 V 53,000 3,700,000 53,000 3,700,000xX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started