Answered step by step

Verified Expert Solution

Question

1 Approved Answer

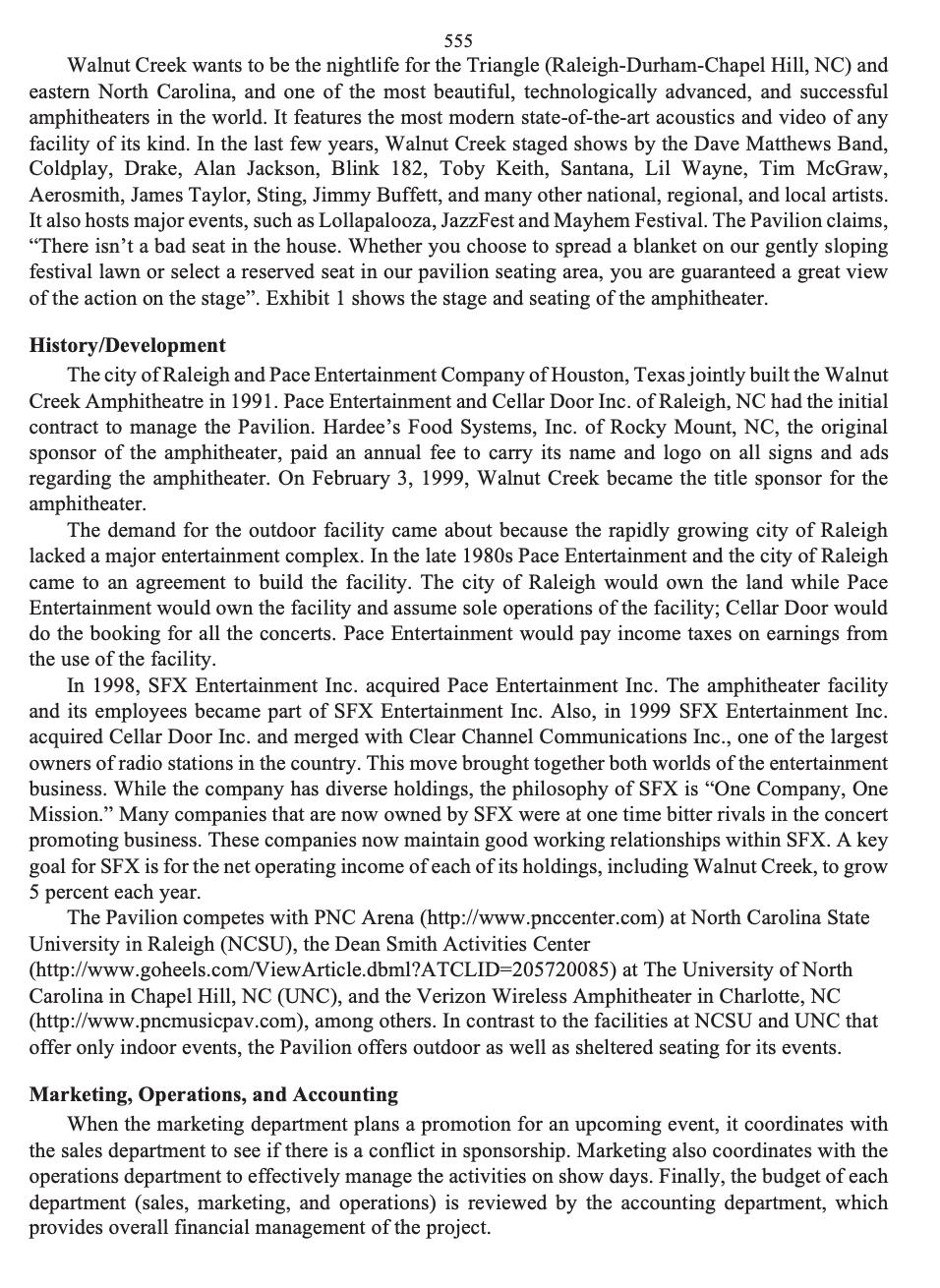

1. How would you describe the competitive strategy of Walnut Creek amphitheatre? Given the firm's strategy, what are the most important Key Performance Indicators