Syngenta AG (SWX: SYNN), a company domiciled and incorporated in Switzerland, is a world-leading agribusiness operating in

Question:

Syngenta AG (SWX: SYNN), a company domiciled and incorporated in Switzerland, is a world-leading agribusiness operating in the Crop Protection, Seeds and Lawn and Garden markets. Crop Protection chemicals include herbicides, insecticides, fungicides, and seed treatments to control weeds, insects and diseases in crops and are essential inputs enabling growers around the world to improve agricultural productivity and food quality.

In Seeds, Syngenta operates in the high value commercial sectors of field crops (including corn, oilseeds, cereals, and sugar beet) and vegetables. The Lawn and Garden business provides professional growers and consumers with flowers, turf, and landscape products.

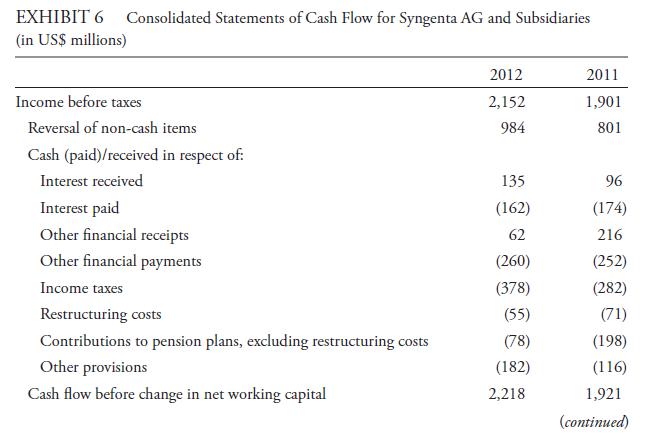

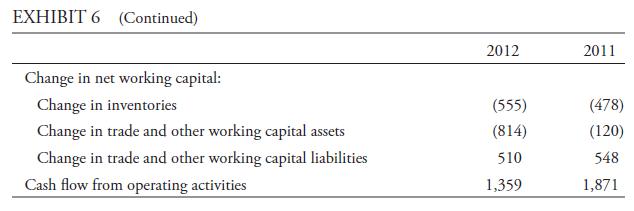

Syngenta’s financial statements are presented in United States dollars as it is the major currency in which revenues are denominated. Jane Everett wants to value Syngenta by using the FCFF method. She collects information from the company’s 10-K for the fiscal year ended 31 December 2012. The 2011 and 2012 cash flow from operating activities section from the consolidated statements of cash flow appear in Exhibit 6.

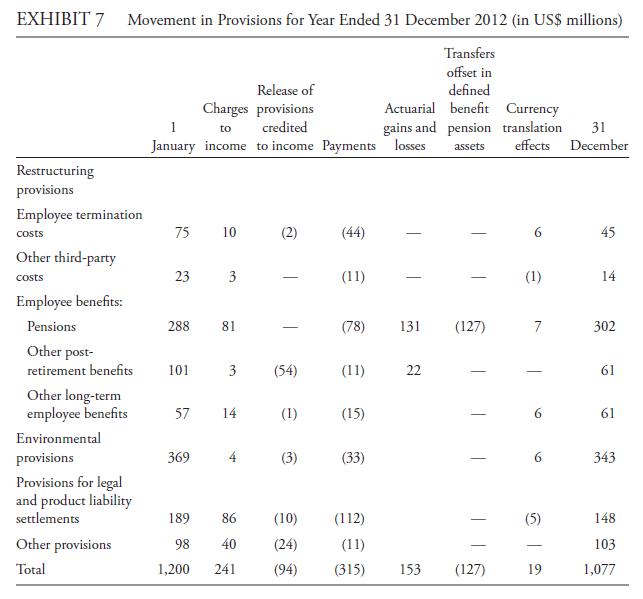

Everett notices that the reconciliation amount in the 2012 cash flow statement for restructuring costs of \($55\) differs significantly from the \($241\) restructuring expense that was reflected in the income statement. She finds the following discussion of provisions in Note 19 of the financial statements (Exhibit 7).

Using the provided information, answer the following questions:

i. Why is there a difference in the amount shown for restructuring expenses in the income statement and the amount shown for restructuring costs in the cash flow statement?

ii. How should the restructuring costs be treated when forecasting future cash flows?

Step by Step Answer: