You are calculating a trailing P/E for AstraZeneca PLC (NYSE, LSE: AZN) as of 1 April 2013,

Question:

You are calculating a trailing P/E for AstraZeneca PLC (NYSE, LSE: AZN) as of 1 April 2013, when the share price closed at \($50.11\) in New York (£28.25 in London). In its first quarter of 2013, ended 31 March, AZN reported basic and diluted EPS according to IFRS of \($0.81\) which included \($0.34\) of restructuring costs and \($0.26\) of amortization of intangibles arising from acquisitions. Adjusting for all of these items, AZN reported “core EPS” of \($1.41\) for the first quarter of 2013, compared with core EPS of \($1.87\) for the first quarter of 2012. Because the core EPS differed from the EPS calculated under IFRS, the company provided a reconciliation of the two EPS figures.

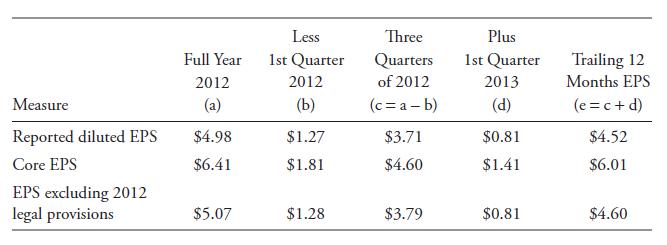

Other data for AZN as of 31 March 2013 are given below. The trailing 12 months diluted EPS for 31 March 2013 includes one quarter in 2013 and three quarters in 2012.

Based on the table and information about AZN, address the following:

i. Based on the company’s reported EPS, determine the trailing P/E of AZN as of 31 March 2013.

ii. Determine the trailing P/E of AZN as of 31 March 2013 using core earnings as determined by AZN.

Suppose you expect the amortization charges to continue for some years and note that, although AZN excluded restructuring charges from its core earnings calculation, AZN has reported restructuring charges in previous years. After reviewing all relevant data, you conclude that, in this instance, only the legal provision related to a previously disclosed legal matter should be viewed as clearly nonrecurring.

iii. Determine the trailing P/E based on your adjustment to EPS.

Step by Step Answer: