You are researching the valuation of Taiwan Semiconductor Manufacturing Company (NYSE: TSM, TAIEX : 2330), the worlds

Question:

You are researching the valuation of Taiwan Semiconductor Manufacturing Company

(NYSE: TSM, TAIEX : 2330), the world’s largest dedicated semiconductor foundry

(www.tsmc.com). Your research is for a US investor who is interested in the company’s ADRs rather than the company’s shares listed on the Taiwan Stock Exchange. On 5 July 2013, the closing price of TSM, the NYSE listed ADR, was \($18.21.\) The semiconductor industry is notably cyclical, so you decide to normalize earnings as part of your analysis.

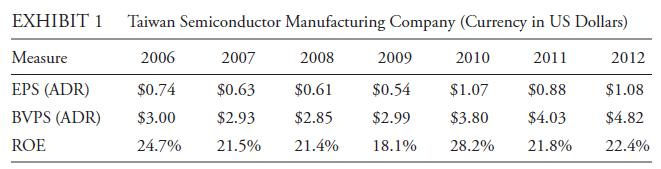

You believe that data from 2006 reasonably captures the beginning of the most recent business cycle, and you want to evaluate a normalized P/E. Exhibit 1 supplies data on EPS (based on Republic of China GAAP) for one TSM ADR, book value per share

(BVPS) for one ADR, and the company’s ROE .19

Using the data in Exhibit 1:

i. Calculate a normalized EPS for TSM by the method of historical average EPS and then calculate the P/E based on that estimate of normalized EPS.

ii. Calculate a normalized EPS for TSM by the method of average ROE and the P/E based on that estimate of normalized EPS.

iii. Explain the source of the differences in the normalized EPS calculated by the two methods, and contrast the impact on the estimate of a normalized P/E.

Step by Step Answer: