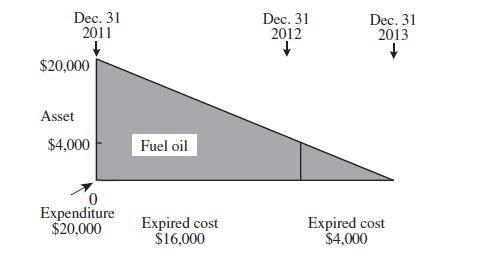

Sherbrooke Company purchased $20,000 of fuel oil in 2011, consumed $16,000 of it in 2012, and consumed

Question:

Sherbrooke Company purchased $20,000 of fuel oil in 2011, consumed $16,000 of it in 2012, and consumed $4,000 of it in 2013. At the end of 2011, the total expenditure of $20,000 was an [asset / expense]

because none of the cost had expired. In 2012, $16,000 of the cost expired, and $16,000 was therefore an [asset / expense] in 2012. At the end of 2012, $4,000 was an unexpired cost and therefore an [asset / expense].

The remaining $4,000 expired in 2013, so it was an [asset / expense]

in 2013.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: