Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in

Question:

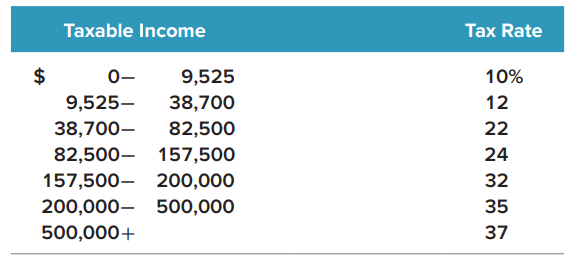

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.?

Transcribed Image Text:

Taxable Income Tax Rate 9,525 10% 9,525– 38,700 12 38,700- 82,500 22 82,500- 157,500 24 157,500- 200,000 32 200,000- 500,000 35 500,000+ 37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Using Table 23 we can see the marginal tax schedule The first 9525 of ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

In Problem 5 , what is the average tax rate? What is the marginal tax rate? Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her...

-

Tracy is single and had an adjusted gross income of $ 37,000 in 2012. Tracy also has the following items: Unreimbursed medical expenses...... $ 3,000 State income tax............. 1,850 Interest...

-

Terri Simmons is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes. What is the average tax rate? What is the marginal tax rate?...

-

Employee earnings records for Redding Company reveal the following gross earnings for four employees through the pay period of December 15. D. Edwards ........... $83,500 A. Seligman...

-

Distinguish between spontaneous and induced mutations. Which are more harmful? Which are avoidable?

-

On 31 December 2009, a company issued a 30,000 180-day note at 8 percent, using the cash received to pay for inventory, and issued 110,000 long-term debt at 11 percent annually, using the cash...

-

What amount should Pam report as cost of sales in its 2016 consolidated income statement? a $2,250 b $2,040 c $1,500 d $1,290 E 5-3 Downstream sales

-

The financial condition of White Co. Inc. is expressed in the following accounting equation: Required a. Are dividends paid to creditors or investors? Explain why. b. How much cash is in the Retained...

-

A. ASEEE 4! -Y-A. E=E. E. 3. AaB CcL AaBbC AaBbccI AaBbCd AaBbCD AaBbC AaBbc Emphasis Heading 1 1 Normal Strong Subtitle Title 1 No Sp Paragraph Styles QUESTION 9: (5 POINTS) What are the seven...

-

The file Danish Coffee contains a random sample of 144 Danish coffee drinkers and measures the annual coffee consumption in kilograms for each sampled coffee drinker. A marketing research firm wants...

-

Suppose the firm in Problem 2 paid out $68,000 in cash dividends. What is the addition to retained earnings? Problem 2 Sidewinder, Inc., has sales of $634,000, costs of $328,000, depreciation expense...

-

Benson, Inc., has sales of $38,530, costs of $12,750, depreciation expense of $2,550, and interest expense of $1,850. If the tax rate is 21 percent, what is the operating cash flow, or OCF?

-

What is learning, and how does it affect decision making?

-

Identify a public conflict (such as a recent Congressional debate or even a celebrity breakup) that has come to the forefront in the media (or public's attention) in the last thirty days. You have...

-

Performance Management Issues You have been asked to return to your alma mater and speak to current students about performance management issues. To make the most of this experience for yourself and...

-

Analysis of competitor organization of our selected organization Walmart and its competitor Safeway. 1. Complete analysis of competitor organization; addresses all relevant factors and typically uses...

-

Defining Program Objectives of Youth centers Clearly define the objectives of your program or center. What specific outcomes do you hope to achieve? Examples may include promoting physical fitness,...

-

Identify a local or regional organization and analyze how they demonstrate servant leadership in their operations. You will want to review their website, social media, news, and other resources to...

-

Variables x and y are connected by the equation y = 2x/x 2 + 3. Given that x increases at a rate of 2 units per second, find the rate of change of y when x = 1.

-

Describe a group you belong or have belonged discuss the stages of group development and suggest how to improve the group effectiveness by using the group development model.

-

Suppose you were the financial manager of a not-for-profit business (a not-for-profit hospital, perhaps). What kind of goals do you think would be appropriate?

-

Suppose you were the financial manager of a not-for-profit business (a not-for-profit hospital, perhaps). What kind of goals do you think would be appropriate?

-

Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits.

-

The following amounts were reported on the December 31, 2022, balance sheet: Cash $ 8,000 Land 20,000 Accounts payable 15,000 Bonds payable 120,000 Merchandise inventory 30,000 Retained earnings...

-

Sandhill Co. issued $ 600,000, 10-year, 8% bonds at 105. 1.Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when the...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

Study smarter with the SolutionInn App