Question: In Problem 5 , what is the average tax rate? What is the marginal tax rate? Duela Dent is single and had $189,000 in taxable

In Problem 5, what is the average tax rate? What is the marginal tax rate?

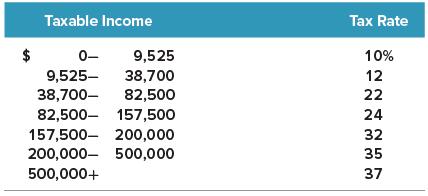

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.

Taxable Income Tax Rate 0- 9,525 10% 9,525- 38,700- 38,700 82,500 12 22 82,500- 157,500 24 157,500- 200,000 200,000- 500,000 32 35 500,000+ 37

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

The average tax rate is the total taxes paid divided by taxable income so Avera... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock