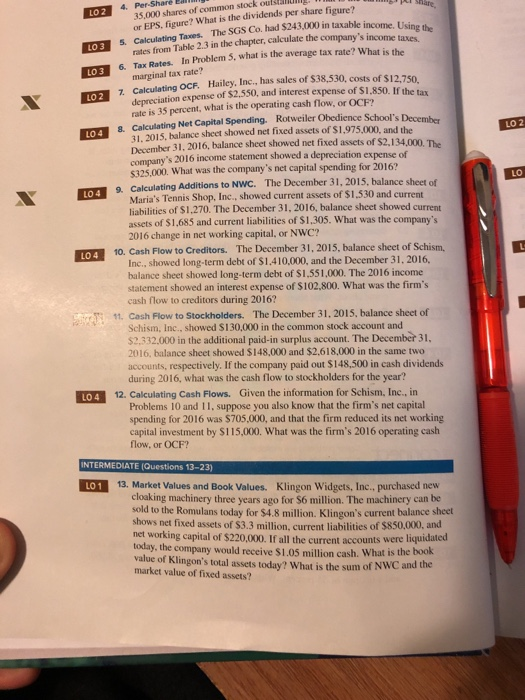

35,000 shares of common stock oung or EPS, figure? What is the dividends per share figure? L03 5 Calculating Taxes. The SGS Co. had $243,000 in taxable incon er, calculate the company's income taxes. rates from Table 2.3 in the chapt In Problem 5, what is the average tax rate? What is the 6 Tax Rates. marginal tax rate? 7. Calculating OCF. Hailey, Inc. has sales of $38,530, costs of $12,750 depreciation expense of $2.550, and interest expense of $1.850. If the tax rate is 35 percent, what is the operating cash flow, or OCF? 8. Calculating Net Capital Spending. Rotweiler Obedience School's December 31. 2015, balance sheet showed net fixed assets of $1,975,000, and the December 31, 2016, balance sheet showed net fixed assets of $2,134.000. company's 2016 income statement showed a depreciation expense of 5325,000. What was the company's net capital spending for 2016? LO 4 LO 2 LO YLO4 Calculating Additions to NWC. The December 31, 2015, balance sheet of Maria's Tennis Shop. Inc., showed current assets of $1,530 and current liabilities of S1.270. The December 31, 2016, balance sheet showed current assets of $1,685 and current liabilities of $1,305. What was the company's 2016 change in net working capital, or NWC? 10. Cash Flow to Creditors. The December 31, 2015, balance sheet of Schism, Inc., showed long-term debt of $1.410,000, and the December 31, 2016, balance sheet showed long-term debt of $1,551,000. The 2016 income statement showed an interest expense of $102.800. What was the firm's cash flow to creditors during 2016? 11. Cash Flow to Stockholders. The December 31, 2015, balance sheet of Schism, Inc., showed $130,000 in the common stock account and $2.332.000 in the additional paid-in surplus account. The December 31, 2016, balance sheet showed $148,000 and $2.618,000 in the same two accounts, respectively. If the company paid out $148,500 in cash dividends during 2016, what was the cash flow to stockholders for the year? LO 4 12. Calculating Cash Flows. Given the information for Schism, Inc., in Problems 10 and 11, suppose you also know that the firm's net capital spending for 2016 was $705,000, and that the firm reduced its net working capital investment by $115,000. What was the firm's 2016 operating cash flow, or OCF? INTERMEDIATE (Questions 13-2 LO1 13. Market Values and Book Values. Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $6 million. The machinery can be sold to the Romulans today for $4.8 million. Klingon's current balance sheet shows net fixed assets of $3.3 million, current liabilities of $850,000, and net working capital of $220,000. If all the current accounts today, the company would receive $1.05 million cash. What is value of Klingon's total assets today? What is the sum of NWC market value of fixed assets? and the