In the previous problem, suppose the firm was operating at only 80 percent capacity in 2019. What

Question:

In the previous problem, suppose the firm was operating at only 80 percent capacity in 2019. What is EFN now?

Data from previous problem

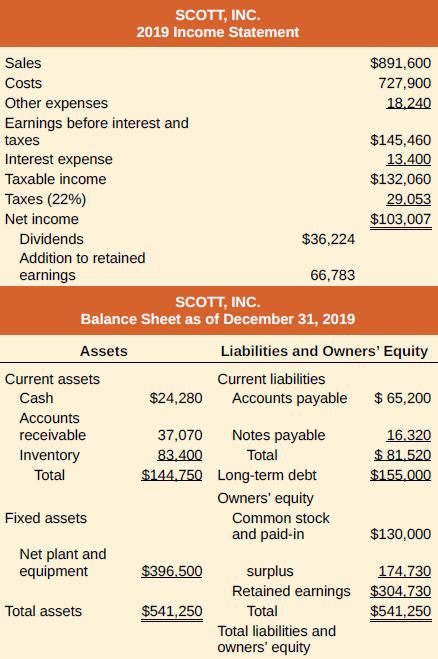

The most recent financial statements for Scott, Inc., appear below. Sales for 2020 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan