Locate the Treasury bond in Figure 8.4 maturing in November 2028. What is its coupon rate? What

Question:

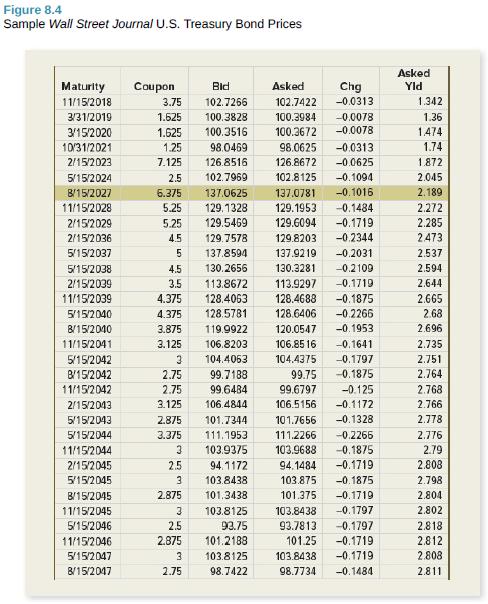

Locate the Treasury bond in Figure 8.4 maturing in November 2028. What is its coupon rate? What is its bid price? What was the previous day’s asked price? Assume a par value of $10,000.

Figure 8.4

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Figure 8.4 Sample Wall Street Journal U.S. Treasury Bond Prices Asked Maturity Coupon Bid Asked Chg Yld 11/15/2018 3.75 102.7266 102.7422 -0.0313 1.342 3/31/2019 1.625 100.3828 100.3984 -0.0078 1.36 3/15/2020 1.625 100.3516 100.3672 -0.0078 1.474 10/31/2021 1.25 98.0469 98.0625 -0.0313 1.74 2/15/2023 7.125 126.8516 126.8672 -0.0625 1.872 5/15/2024 2.5 102.7969 102.8125 -0.1094 2.045 B/15/2027 6.375 137.0625 137.0781 -0.1016 2.189 11/15/2028 5.25 129,1328 129.1953 -0.1484 2.272 2/15/2029 5.25 129.5469 129.6094 -0.1719 2.285 2/15/2036 4.5 129.7578 129.8203 -0.2344 2.473 5/15/2037 5 137.8594 137.9219 --0.2031 2.537 5/15/2038 4.5 130.2656 130.3281 -0.2109 2.594 2/15/2039 3.5 113.8672 113.9297 -0.1719 2.644 11/15/2039 4.375 128.4063 128.4688 -0.1875 2.665 5/15/2040 4.375 128.5781 128.6406 -0.2266 2.68 B/15/2040 3.875 119.9922 120.0547 -0.1953 2.696 11/15/2041 3.125 106.8203 106.85 16 -0.1641 2.735 5/15/2042 104.4063 104.4375 -0.1797 2.751 B/15/2042 2.75 99.7188 99.75 -0.1875 2.764 11/15/2042 2.75 99.6484 99.6797 -0.125 2.768 2/15/2043 3.125 106.4844 106.5156 -0.1172 2.766 5/15/2043 2.875 101.7344 101.7656 -0.1328 2.778 5/15/2044 3.375 111.1953 111.2266 -0.2266 2.776 11/15/2044 103.9375 103.9688 -0.1875 2.79 2/15/2045 2.5 94.1172 94.1484 -0.1719 2.808 5/15/2045 3 103.8438 103.875 -0.1875 2.798 B/15/2045 2.875 101.3438 101.375 -0.1719 2.804 11/15/2045 3 103.8125 103.8438 -0.1797 2.802 5/15/2046 2.5 93.75 93.7813 -0.1797 2.818 11/15/2046 2.875 101.2188 101.25 -0.1719 2.812 5/15/2047 3 103.8125 103.8438 -0.1719 2.808 8/15/2047 2.75 98.7422 98.7734 -0.1484 2.811

Step by Step Answer:

The coupon rate located in the second column of the quote is 5250 percent The bid price i...View the full answer

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Locate the Treasury bond in Figure 8.4 maturing in November 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in...

-

Locate the Treasury bond in Figure 5.4 maturing in February 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread? d 2. 2 3...

-

Locate the Treasury bond in Figure 7.4 maturing in November 2024. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread? Figure...

-

Hussein Hage has just approached a venture capitalist for financing for his new restaurant, Bistro Sally. The lender is willing to loan Bistro Sally Inc. $240,000 at a high-risk interest rate of 9%....

-

Based on energy considerations, which of the following reactions will occur more readily? (a) Cl(g) + CH4(g) CH3Cl(g) + H(g) (b) Cl(g) + CH4(g) CH3(g) + HCl(g)

-

Develop the appropriate primary research question to be associated with this design. Develop a hypothetical research scenario that would necessitate the use of a Longitudinal Design. The research...

-

Discuss the assumption that the odds ratio is constant across the range of the predictor, with respect to various types of relationships between the predictor and the response. Provide modeling...

-

The administrators of Tiny College are so pleased with your design and implementation of their student registration/tracking system that they want you to expand the design to include the database for...

-

Applying Tableau Analytics 1 4 - 0 1 ( Static ) Net Present Value Analysis [ LO 1 4 - 2 ] Skip to question To complete this exercise, you will need to download and install Tableau on your computer....

-

Mr B aged 52 years, has earned rupees 75,00,000 out of his business. His ex-wife gifted him a car worth rupees 8 lakh. He spent a total of rupees 20 lakh during a family trip. He won a lottery of 16...

-

You buy a zero coupon bond at the beginning of the year that has a face value of $1,000, a YTM of 5.7 percent, and 20 years to maturity. If you hold the bond for the entire year, how much in interest...

-

Suppose the real rate is 2.25 percent and the inflation rate is 3.2 percent. What rate would you expect to see on a Treasury bill?

-

Omega Sales and Distribution Co. needs $600,000 for the 6-month period ending September 30, 2019. The firm has explored three possible sources of credit. a. A loan from a microfinance organization...

-

Melannie Inc. sold $8,200 worth of merchandise on June 1, 2015 on credit. After inspecting the inventory, the customer determined that 10% of the items were defective and returned them to Melannie...

-

2. (20 marks) A firm wishes to produce a single product at one or more locations so that the total monthly cost is minimized subject to demand being satisfied. At each location there is a fixed...

-

Evaluate your own negotiation way. Do you have one? how you consider having an excellent negotiaiton skill could help any business person to achieve its goals.

-

j. Interest was accrued on the note receivable received on October 17 ($100,000, 90-day, 9% note). Assume 360 days per year. Date Description Dec. 31 Interest Receivable Interest Revenue Debit Credit

-

A Chief Risk Officer (CRO) is interested in understanding how employees can benefit from AI assistants in a way that reduces risk. How do you respond

-

f: x x + 6 for x > 0 g: x x for x >0 Express x x 2 - 6 in terms of f and g.

-

Element compound homogeneous mixture (heterogeneous mixture) 4) A piece of gold has a mass of 49.75 g. What should the volume be if it is pure gold? Gold has a density of 19.3 g/cm (3 points) D=m/v...

-

As discussed in the text, an annuity due is identical to an ordinary annuity except that the periodic payments occur at the beginning of each period and not at the end of the period. Show that the...

-

Take a look back at Figure 5.4 . Notice the wide range of coupon rates. Why are they so different?

-

What are the three factors that determine a companys price-earnings ratio?

-

Regarding research and experimental expenditures, which of the following are not qualified expenditures? 3 a. costs of ordinary testing of materials b. costs to develop a plant process c. costs of...

-

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting...

-

Oct. 31: Paid salaries, $45,000 ( 75% selling, 25% administrtive). Data table Data table them to retail stores. The company has three inventory items: and floor lamps. RLC uses a perpetual inventory...

Study smarter with the SolutionInn App