Locate the Treasury bond in Figure 8.4 maturing in November 2039. Is this a premium or a

Question:

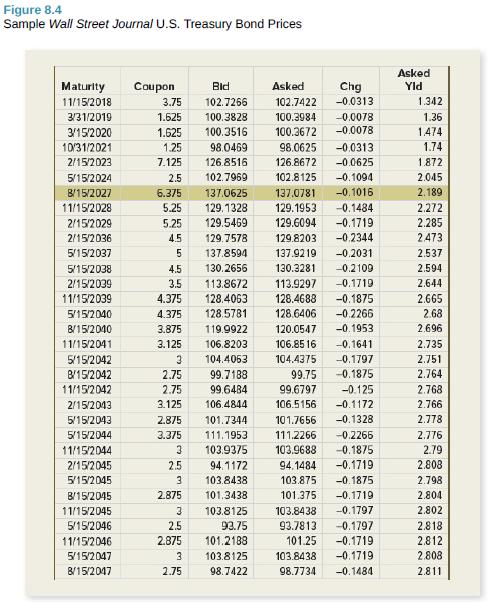

Locate the Treasury bond in Figure 8.4 maturing in November 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000.

Figure 8.4

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Transcribed Image Text:

Figure 8.4 Sample Wall Street Journal U.S. Treasury Bond Prices Asked Maturity Coupon Bid Asked Chg Yld 11/15/2018 3.75 102.7266 102.7422 -0.0313 1.342 3/31/2019 1.625 100.3828 100.3984 -0.0078 1.36 3/15/2020 1.625 100.3516 100.3672 -0.0078 1.474 10/31/2021 1.25 98.0469 98.0625 -0.0313 1.74 2/15/2023 7.125 126.8516 126.8672 -0.0625 1.872 5/15/2024 2.5 102.7969 102.8125 -0.1094 2.045 B/15/2027 6.375 137.0625 137.0781 -0.1016 2.189 11/15/2028 5.25 129,1328 129.1953 -0.1484 2.272 2/15/2029 5.25 129.5469 129.6094 -0.1719 2.285 2/15/2036 4.5 129.7578 129.8203 -0.2344 2.473 5/15/2037 5 137.8594 137.9219 --0.2031 2.537 5/15/2038 4.5 130.2656 130.3281 -0.2109 2.594 2/15/2039 3.5 113.8672 113.9297 -0.1719 2.644 11/15/2039 4.375 128.4063 128.4688 -0.1875 2.665 5/15/2040 4.375 128.5781 128.6406 -0.2266 2.68 B/15/2040 3.875 119.9922 120.0547 -0.1953 2.696 11/15/2041 3.125 106.8203 106.85 16 -0.1641 2.735 5/15/2042 104.4063 104.4375 -0.1797 2.751 B/15/2042 2.75 99.7188 99.75 -0.1875 2.764 11/15/2042 2.75 99.6484 99.6797 -0.125 2.768 2/15/2043 3.125 106.4844 106.5156 -0.1172 2.766 5/15/2043 2.875 101.7344 101.7656 -0.1328 2.778 5/15/2044 3.375 111.1953 111.2266 -0.2266 2.776 11/15/2044 103.9375 103.9688 -0.1875 2.79 2/15/2045 2.5 94.1172 94.1484 -0.1719 2.808 5/15/2045 3 103.8438 103.875 -0.1875 2.798 B/15/2045 2.875 101.3438 101.375 -0.1719 2.804 11/15/2045 3 103.8125 103.8438 -0.1797 2.802 5/15/2046 2.5 93.75 93.7813 -0.1797 2.818 11/15/2046 2.875 101.2188 101.25 -0.1719 2.812 5/15/2047 3 103.8125 103.8438 -0.1719 2.808 8/15/2047 2.75 98.7422 98.7734 -0.1484 2.811

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

This is a premium bond because it sells for more than 1...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Related Video

The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. This video will give a complete tutorial on how to calculate Yield to Maturity on Microsoft Excel

Students also viewed these Business questions

-

Locate the Treasury bond in Figure 8.4 maturing in November 2028. What is its coupon rate? What is its bid price? What was the previous days asked price? Assume a par value of $10,000. Figure 8.4...

-

Locate the Treasury bond in Figure 5.4 maturing in February 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread? d 2. 2 3...

-

Locate the Treasury bond in Figure 7.4 maturing in November 2024. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread? Figure...

-

Given that, VDD = 5V, VTN = 0.4 V, kn = 100 A/V, An = 0.02 V-, () = 80, R = 4 kN, R = 0.5 MN, R3 = 4.5 M, and assume that the current through R and R3 is negligible compared to IDs. 1) Find Vo. For...

-

Most organic acids can be represented as RCOOH, where COOH is the carboxyl group and R is the rest of the molecule. (For example, R is CH3 in acetic acid, CH3COOH). (a) Draw a Lewis structure for the...

-

Discuss the sampling strategy and technique to be used. Develop a hypothetical research scenario that would necessitate the use of the Qualitative Method and the Grounded Theory Perspective. The...

-

Discuss the role of statistical inference with respect to the huge sample sizes prevalent in data mining.

-

The following data are for Ernst Company. Note: All inventory is purchased on account, and Accounts Payable relates only to the purchase of inventory. Instructions: Compute the following: 1. The...

-

Find the value of the annuity at the end of the indicated number of years. Assume that the interest is compounded with the same frequency as the deposits. (Round your answer to the nearest cent.) $...

-

Write a function to add two floating point numbers. Determine the integer floor of the sum. The floor is the truncated float value, i.e. anything after the decimal point is dropped. For instance,...

-

You buy a zero coupon bond at the beginning of the year that has a face value of $1,000, a YTM of 5.7 percent, and 20 years to maturity. If you hold the bond for the entire year, how much in interest...

-

Suppose the real rate is 2.25 percent and the inflation rate is 3.2 percent. What rate would you expect to see on a Treasury bill?

-

In the Willy Loman problem, suppose you must visit New York immediately after Denver. What is the solution to the problem?

-

The following accounts appear in the ledger of Sheridan Ltd. after the books are closed at December 31 ( in thousands). Share Capital-Ordinary, no par, 1 stated value, 400,000 shares authorized;...

-

1. Let f(x) 223-9x2. (a) Find all critical points for f(x).

-

Sadie's ski shop sells ski and boots. Skis are sold for $300 per pair and have associated Variable Costs of $150 per pair. Boots are sold for $200 per pair with an associated Variable Expense of $65...

-

How do you apply what is learned in the Science of Branding 1 5 - 1 , Key Insights Regarding Global Brand Strategies Based on Research Findings to improve on the brand?

-

CASH MANAGEMENT Dr. Umburgh noticed that the $100.00 check made to Trenton Medical Supplies has not cleared for four months. What type of check is the outstanding check referred to as? a. Stale-dated...

-

The function f is defined by f: x x 3 for x R. The function g is defined by g: x x - 1 for x R. Express each of the following as a composite function, using only f and/or g: a. x (x - 1) 3 b. x ...

-

The Ranch 888 Noodle Company sells two types of dried noodles:ramen, at $6.50 per box, and chow fun, at $7.70 per box. So farthis year, the company has sold a total of 110,096 boxes ofnoodles,...

-

Suppose an investment offers to quintuple your money in 12 months (dont believe it). What rate of return per quarter are you being offered?

-

Suppose an investment offers to quintuple your money in 12 months (dont believe it). What rate of return per quarter are you being offered?

-

As discussed in the text, an annuity due is identical to an ordinary annuity except that the periodic payments occur at the beginning of each period and not at the end of the period. Show that the...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

Study smarter with the SolutionInn App