Suppose a factor model is appropriate to describe the returns on a stock. The current expected return

Question:

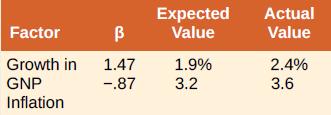

Suppose a factor model is appropriate to describe the returns on a stock. The current expected return on the stock is 10.5 percent. Information about those factors is presented in the following chart:

a. What is the systematic risk of the stock return?

b. The firm announced that its market share had unexpectedly increased from 11 percent to 15 percent. Investors know from past experience that the stock return will increase by .58 percent for every 1 percent increase in its market share. What is the unsystematic risk of the stock?

c. What is the total return on this stock?

Expected ReturnThe expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: