Peanut Holdings Ltd. owns an 80 percent interest in Snoop Inc. Prepare a consolidation worksheet using the

Question:

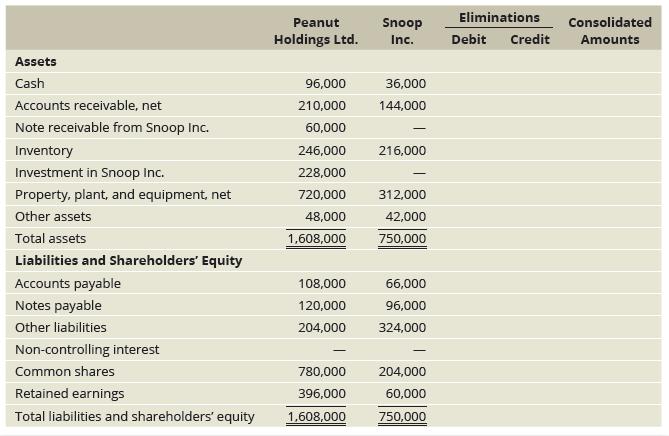

Peanut Holdings Ltd. owns an 80 percent interest in Snoop Inc. Prepare a consolidation worksheet using the information below. Assume that the fair values of Snoop Inc.’s assets and liabilities are equal to their book values.

Peanut Snoop Eliminations Consolidated Holdings Ltd. Inc. Debit Credit Amounts Assets Cash 96,000 36,000 Accounts receivable, net 210,000 144,000 Note receivable from Snoop Inc. 60,000 Inventory 246,000 216,000 Investment in Snoop Inc. 228,000 Property, plant, and equipment, net 720,000 312,000 Other assets 48,000 42,000 Total assets 1,608,000 750,000 Liabilities and Shareholders' Equity Accounts payable 108,000 66,000 Notes payable 120,000 96,000 Other liabilities 204,000 324,000 Non-controlling interest Common shares 780,000 204,000 Retained earnings 396,000 60,000 Total liabilities and shareholders' equity 1,608,000 750,000

Step by Step Answer:

ANSWER Peanut Holdings Ltd Snoop Inc Consolidated Amounts Assets Cash 96000 36000 1...View the full answer

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood

Related Video

It is the equity interest of outside investors other than of parent. In other words it is the equity in a subsidiary not attributable, directly or indirectly, to a parent. Non-controlling interest should be presented in the consolidated statement of financial position within equity, separately from the parent shareholders\' equity.

Students also viewed these Business questions

-

Son Corporation's recorded assets and liabilities are equal to their fair values on July 1, 2017, when Pop Corporation purchases 36,000 shares of Son common stock for $900,000. Identifiable net...

-

Sal Corporation's recorded assets and liabilities are equal to their fair values on July 1, 2012, when Pub Corporation purchases 36,000 shares of Sal common stock for $900,000. Identifiable net...

-

Pid Corporation owns an 80 percent interest in Sed Corporation and at December 31, 2011, Pid's investment in Sed on an equity basis was equal to 80 percent of Sed's stockholders' equity. During 2012,...

-

Using atomic weight, crystal structure, and atomic radius data tabulated inside the front cover of the book, compute the theoretical densities of aluminum (Al), nickel (Ni), magnesium (Mg), and...

-

Conduct the following analyses for the Nike data given in Internet and Computer: a. Calculate the simple correlations between awareness, attitude, preference, intention, and loyalty toward Nike and...

-

The following are the major balance sheet classifications: Current assets (CA).......... Current liabilities (CL) Long-term investments (LTI)....... Long-term liabilities (LTL) Property, plant, and...

-

Using the data provided, calculate the potential lost downstream hospital revenue from ED admissions who walked out over the past year.

-

Late one Thursday afternoon, Joy Martin, a veteran audit manager with a regional CPA firm, was reviewing documents for a long-time client of the firm, AMT Transport. The year-end audit was scheduled...

-

Write a 1 1/2 - 2 page member to a team member in your company that is not an auditor. This person does not understand what SOX is and does not know what role the SEC plays in the audit profession....

-

Suppose you manage Campbell Appliance. The stores summarized financial statements for 2025, the most recent year, follow: Assume that you need to double net income. To accomplish your goal, it will...

-

Answer these questions about consolidation accounting: 1. Define parent company. Define subsidiary. 2. Which companys name appears on the consolidated financial statements? How much of the...

-

On March 1, 2019, Brrr Inc. paid $1,000,000 to acquire a 35 percent investment in Mint Ltd. After one year, Mint Ltd. reported net income of $250,000 for the first year and declared and paid cash...

-

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can...

-

Exercise 11-5 Profit allocation in a partnership LO3Dallas and Weiss formed a partnership to manage rental properties, by investing $161,000 and $189,000, respectively. During its first year, the...

-

operation research an introduction by Taha, Hamdy A . 2 0 2 2 . Operations Research - An Introduction. 1 1 th ed . Prentice Hall..kindly explain this

-

which 2 statements are correct regarding budgets in quickbooks online? a . budgets can be created to track capital expenditures. b . budgets can be set up bsed on the last fiscal year's financial...

-

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500....

-

This program will not require any IF statements, loops, or custom classes. Instead, it will check inputted data for two kinds of mistakes: Wrong data type (entering text instead of numbers), and math...

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and Stock As beta is greater than Stock Bs beta by .25,...

-

Find the inverse, if it exists, for the matrix. -1

-

Josh's Overhead Doors reports the following financial information Assets .........................$42600 Liabilities ......................17220 Josh, Capital ..................26240 Josh,...

-

This and similar cases in later chapters focus on the financial statements of a real company-Starbucks Corporation, a premier roaster and retailer of specialty coffee. As you work each case, you will...

-

Visit www.pearsonhighered.com/Horngren to view a link to the Starbucks Corporation Fiscal 2013 Annual Report. Requirements 1. Calculate the debt ratio for Starbucks Corporation as of September 29,...

-

THIS IS ONE QUESTION WITH TWO PARTS. PLEASE ANSWER COMPLETELY AND SHOW ALL WORK. (NO EXCEL) Information for Question 1: State Probability Retum on A Return on B Return on C Retum on Portfolio X Boom...

-

Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (2.0 hrs. @ $13.00 per hr.) Overhead (2.0 hrs. @ $18.50 per hr.) Total standard cost $25.00 26.00 37.00 $88.00 The predetermined overhead rate...

-

Problem 1-28 (Algo) (LO 1-4, 1-5, 1-6b 1-7) Harper, Inc., acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's...

Study smarter with the SolutionInn App