The SGS Co. had $275,000 in taxable income. Using the rates from Table 2.3 in the chapter,

Question:

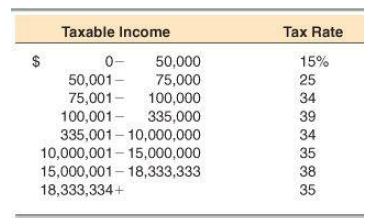

The SGS Co. had $275,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company’s income taxes.

Table 2.3

Transcribed Image Text:

Taxable Income Tax Rate 0- 50,001– 75,001- 100,001- 335,000 335,001 – 10,000,000 10,000,001- 15,000,000 15,000,001- 18,333,333 18,333,334+ 50,000 15% 75,000 25 100,000 34 39 34 35 38 35 %24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

Using Table 23 we can see the marginal tax schedule The first 5000...View the full answer

Answered By

Jehal Shah

I believe everyone should try to be strong at logic and have good reading habit. Because If you possess these two skills, no matter what difficult situation is, you will definitely find a perfect solution out of it. While logical ability gives you to understand complex problems and concepts quite easily, reading habit gives you an open mind and holistic approach to see much bigger picture.

So guys, I always try to explain any concept keeping these two points in my mind. So that you will never forget any more importantly get bored.

Last but not the least, I am finance enthusiast. Big fan of Warren buffet for long term focus investing approach. On the same side derivatives is the segment I possess expertise.

If you have any finacne related doubt, do reach me out.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

The Fly Leaf Co. had $315,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company's income taxes.

-

The SGS Co. had $243,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company's income taxes. Table 2.3 Taxable Income Tax Rate 0 50,000 50,00175,000 75,001-...

-

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.? Taxable Income Tax Rate 9,525 10% 9,525 38,700 12 38,700- 82,500...

-

The following are selected transactions of Sarasota Department Store Ltd. for the current year ended December 31. Sarasota is a private company operating in the province of Manitoba where PST is 8%...

-

If T: V U is a linear transformation where dim V - n, show that TST = T for some isomorphism S: V V. [Let {e1,..., er, er+1,...,en] be as in Theorem 5 7.2. Extend {T(e1),..., T(er)} to a basis of...

-

Determine whether the vector field is conservative. If it is, find a potential function for the vector field. F(x, y, z) = 4xyi + 2xj + 2zk

-

1. Under the equity method, Pam reports investment income from Sun for 2016 of: a $120 b $96 c $80 d $104 loss

-

The Brandt Company presents the following December 31, 2007 balance sheet: The following information is also available: 1. Current assets include cash $3,800, accounts receivable $18,500, notes...

-

Cambridge Company manufactures three main products, L, M, and N, from a joint process. Additional information for June production activity follows: used. Multiple Choice $37,000 $20,300 $76,720...

-

J. Tilkenhurst Limited (JTL) is a Canadian-controlled private corporation which was started in 1988 by Mr. Santosh Prasad with an initial investment in common shares of $18,000. Mr. Prasad has...

-

Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $4 million. The machinery can be sold to the Romulans today for $6.2 million. Klingons current balance sheet shows net...

-

Rotweiler Obedience Schools December 31, 2009, balance sheet showed net fixed assets of $1.725 million, and the December 31, 2010, balance sheet showed net fixed assets of $2.04 million. The companys...

-

From a total compensation perspective, what can companies do to ward minimizing the negative impact of the compensation-productivity gap?

-

From your reading this unit on motivation and change from the TIP series, what is the connection and interplay between these concepts/statements below in your opinion in working with clients facing...

-

Please help with the following The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,200 cases of Oktoberfest-style beer from a German supplier for 276,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Define meaning of partnership deed.

-

List down the information contains in the partnership deed.

-

For the following exercises, use the Rational Zero Theorem to find all real zeros. x 3 + 2x 2 9x 18 = 0

-

Hotel Majestic is interested in estimating fixed and variable costs so that the company can make more accurate projections of costs and profit. The hotel is in a resort area that is particularly busy...

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

Required information Skip to question [ The following information applies to the questions displayed below. ] Forten Company's current year income statement, comparative balance sheets, and...

-

Give a breakdown of all the intangible assets with the values shown in the statement of financial position of Unilever in 2022.

-

1-The yield to maturity will be greater than the coupon rate when a bond is selling at a premium. Select one: a. False b. True 2-Which one of the following would have the greatest present value,...

Study smarter with the SolutionInn App