You want to find the expected return for Honeywell using the CAPM. First, you need the market

Question:

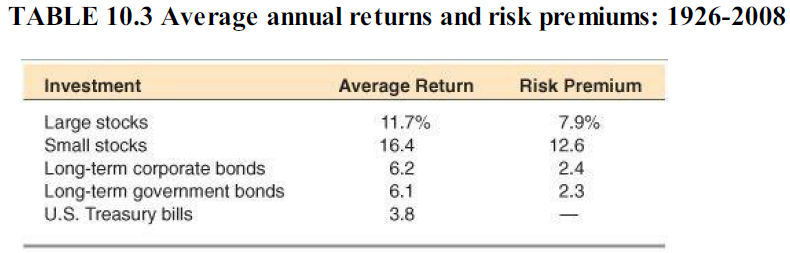

You want to find the expected return for Honeywell using the CAPM. First, you need the market risk premium. Use the average large-company stock return in Table 10.3 to estimate the market risk premium. Next, go to money.cnn.com and find the current interest rate for three-month Treasury bills. Finally, go to finance.yahoo.com, enter the ticker symbol HON for Honeywell, and find the beta for Honeywell. What is the expected return for Honeywell using CAPM? What assumptions have you made to arrive at this number?

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted: