Assume that ACW Corporation has 2023 taxable income of $1,500,000 for purposes of computing the 179 expense.

Question:

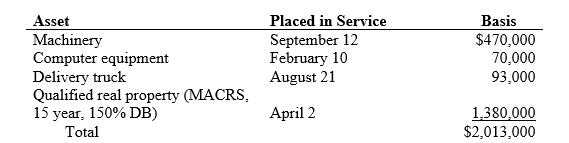

Assume that ACW Corporation has 2023 taxable income of $1,500,000 for purposes of computing the §179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation):

- What is the maximum amount of §179 expense ACW may deduct for 2023?

- What is the maximum total depreciation deduction that ACW may deduct in 2023 on the assets it placed in service in 2023?

Transcribed Image Text:

Asset Machinery Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Placed in Service September 12 February 10 August 21 April 2 Basis $470,000 70,000 93,000 1,380,000 $2,013,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a The maximum 179 expense is 1160000 b The maximum depreciation deducti...View the full answer

Answered By

Hassan Imtiaz

The following are details of my Professional Experience. Responsibilities Eight years of demanding teaching experience in the field of finance and business studies at Master’s Level. Completion of the given tasks within given time with quality and efficiency. Marketing professional with practical experience in and solid understanding of a diverse range of management applications, including market analysis, sales and marketing, team building and quality assurance. I have excellent skills to approach deal and sustain corporate clients / customers by demonstrating not only extraordinary communication and interpersonal skills but also high caliber presentation, negotiation and closing skills. Manage and follow up the day-to-day activities. Manage and co-ordinate the inventories. Fulfillment of all the tasks assigned.

The following are details of my Areas of Effectiveness. Finance 1. Corporate Finance 2. Advanced Corporate Finance 3. Management of Financial Institutions 4. International Financial Management 5. Investments 6. Fixed Income 7. Real Estate Investment 8. Entrepreneurial Finance 9. Derivatives 10. Alternative Investments 11. Portfolio Management 12. Financial Statement Analysis And Reporting (US GAAP & IFRS) 13. International Financial Markets 14. Public Finance 15. Personal finance 16. Real estate 17. Financial Planning Quantitative Analysis 1. Time Value Of Money 2. Statistics 3. Probability Distribution 4. Business Statistics 5. Statistical Theory and Methods Economics 1. Principles of Economics 2. Economic Theory 3. Microeconomic Principles 4. Macroeconomic Principles 5. International Monetary Economics 6. Money and Banking 7. Financial Economics 8. Population Economics 9. Behavioral Economics International Business 1. Ethics 2. Business Ethics 3. An introduction to business studies 4. Organization & Management 5. Legal Environment of Business 6. Information Systems in Organizations 7. Operations Management 8. Global Business Policies 9. Industrial Organization 10. Business Strategy 11. Information Management and Technology 12. Company Structure and Organizational Management Accounting & Auditing 1. Financial Accounting 2. Managerial Accounting 3. Accounting for strategy implementation 4. Financial accounting 5. Introduction to bookkeeping and accounting Marketing 1. Marketing Management 2. Professional Development Strategies 3. Business Communications 4. Business planning 5. Commerce & Technology Human resource management 1. General Management 2. Conflict management 3. Leadership 4. Organizational Leadership 5. Supply Chain Management 6. Law 7. Corporate Strategy Creative Writing 1. Analytical Reading & Writing Other Expertise 1. Risk Management 2. Entrepreneurship 3. Management science 4. Organizational behavior 5. Project management 6. Financial Analysis, Research & Companies Valuation 7. And any kind of Excel Queries

4.80+

150+ Reviews

230+ Question Solved

Related Book For

McGraw Hills Essentials Of Federal Taxation 2024

ISBN: 9781265364656

15th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted:

Students also viewed these Business questions

-

Moment of inertia of a uniform disc of mass m about an axis a = ais mk?, where k is radius of gyration. What is its moment of inertia about an axis r = a +b (A) mk? + m(a +b) ma? (a+b) (B) mk? + m...

-

Assume that ACW Corporation has 2015 taxable income of $1,000,000 before the §179 expense and acquired the following assets during 2015 (assume no bonus depreciation but assume that the 2014...

-

Assume that ACW Corporation has 2018 taxable income of $1,000,000 for purposes of computing the §179 expense. The company acquired the following assets during 2018 (assume no bonus...

-

Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on buildings and equipment, $17,500...

-

a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the internal control weaknesses in the system. Model your response according to...

-

Please list the main components of CoCo a. b. c. d. e.

-

When are face-to-face meetings more appropriate than phone calls or email? AppendixLO1

-

Interest versus dividend income During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $490,000. In addition, during the year it received $20,000 in income...

-

When Wisconsin Corporation was formed on January 1 , the corporate charter provided for 92,900 shares of $9 par common stock. During its first month of operation, the corporation issued 6,940 shares...

-

Assume TDW Corporations (calendar-year-end) has 2023 taxable income of $650,000 for purposes of computing the 179 expense. The company acquired the following assets during 2023: What is the maximum...

-

Assume that Timberline Corporation has 2023 taxable income of $240,000 for purposes of computing the 179 expense. It acquired the following assets in 2023: What is the maximum amount of 179 expense...

-

Compute the present value of $10,000 received at the beginning of each year over the following time periods at the following discount rates. Complete the following table: Time Periods (Years)...

-

1. A concise introduction of the brand, including but not limited to a brief history, location information, size of the business, product/service offering, and so on.Give brief explanation. 2. Which...

-

A wood frame structure as shown to the right. The framingconsists of 2x6 studs, a single 2x6 bottom plate, two 2x6 topplates and a 2x10 joist. The studs are spaced at 16 in. on centerand sheathed...

-

In your reflection journal please list your order - 'most efficient' mediums at the top, 'least efficient' at the bottom. (for eg. social media, display ads, etc)Then, in five hundred words or more,...

-

Energy prices and global warming are discussed daily in the news as environmental impact of e-waste is just beginning to be recognized. Sustainability and corporate social responsibility need to be...

-

3. A Channel section is connected to a 10mm gusset plate with 20mm- diameter bolts as shown in the figure. The connecting member is subjected to dead load and live load only. The pitch distance,...

-

The following is the monthly payroll of White Company, owned by Dana White. Employees are paid on the last day of each month. White Company is located at 2 Square Street, Marblehead, Massachusetts...

-

Ex. (17): the vector field F = x i-zj + yz k is defined over the volume of the cuboid given by 0x a,0 y b, 0zc, enclosing the surface S. Evaluate the surface integral ff, F. ds?

-

Jim purchased 100 shares of stock this year and elected to participate in a dividend reinvestment program. This program automatically uses dividends to purchase additional shares of stock. This year...

-

Jim purchased 100 shares of stock this year and elected to participate in a dividend reinvestment program. This program automatically uses dividends to purchase additional shares of stock. This year...

-

Jerry has a certificate of deposit at the local bank. The interest on this certificate was credited to his account on December 31 of last year but he didn't withdraw the interest until January of...

-

September 23 for $1,050 each. On December 24 , it sold one of the diamonds that was purchased on July 9 . Using the specific identification method, its ending inventory (after the December 24 sale)...

-

Madsen Motors's bonds have 13 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8%, and the yield to maturity is 10%. What is the...

-

Builder Products, Incorporated, uses the weighted - average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion....

Study smarter with the SolutionInn App