Robert Campbell and Carol Morris are senior vice presidents of the Mutual of Chicago Insurance Company. They

Question:

a. What is the difference between common stock and preferred stock? What are some of the characteristics of each type of stock?

b. What is the difference between a publicly held company and a privately held company? How can the two types of companies be identified?

c. What is classified stock? When €˜€˜going public,€™€™ why might a small company designate some stock currently outstanding as €˜€˜founders€™ shares€™€™?

d. (1) Write a formula that can be used to value any stock, regardless of its dividend pattern.

(2) What is a constant growth stock? How do you value a constant growth stock?

(3) What happens if the growth is constant, and g > rs? Will many stocks have g > rs?

e. Bon Temps has an issue of preferred stock outstanding that pays stockholders a dividend equal to $10 each year. If the appropriate required rate of return for this stock is 8 percent, what is its market value?

f. Assume that Bon Temps is a constant growth company whose last dividend (D0, which was paid yesterday) was $2.00 and whose dividend is expected to grow indefinitely at a 6 percent rate. The appropriate rate of return for Bon Temps€™ stock is 16 percent.

(1) What is the firm€™s expected dividend stream over the next three years?

(2) What is the firm€™s current stock price?

(3) What is the stock€™s expected value one year from now?

(4) What are the expected dividend yield, the capital gains yield, and the total return during the first year?

g. Assume that Bon Temps€™ stock is currently selling at $21.20. What is the expected rate of return on the stock?

h. What would the stock price be if its dividends were expected to have zero growth?

i. Assume that Bon Temps is expected to experience supernormal growth of 30 percent for the next three years, then to return to its long-run constant growth rate of 6 percent. What is the stock€™s value under these conditions? What are its expected dividend yield and its capital gains yield in Year 1? In Year 4?

j. Suppose Bon Temps is expected to experience zero growth during the first three years and then to resume its steady-state growth of 6 percent in the fourth year. What is the stock€™s value now? What are its expected dividend yield and its capital gains yield in Year 1? In Year 4?

k. Assume that Bon Temps€™ earnings and dividends are expected to decline by a constant 6 percent per year€”that is, g = -6%. Why might someone be willing to buy such a stock, and at what price should it sell? What would be the dividend yield and capital gains yield in each year?

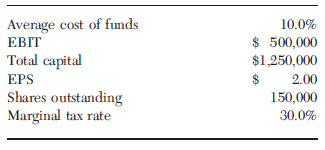

l. Bon Temps€™ financial statements show the following information:

(1) Compute the company€™s economic value added (EVA).

(2) Interpret the EVA figure that you just computed. m. Suppose that normally Bon Temps€™ P/E ratio is 20×. Using the information given in part l, estimate the market price per share for Bon Temps€™ common stock.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Stocks

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham