Cannon Auto Parts, a calendar-year auto supplies business, had borrowed ($500,000) from Old International Bank three years

Question:

Cannon Auto Parts, a calendar-year auto supplies business, had borrowed \($500,000\) from Old International Bank three years ago and had been making monthly payments on the eight-year loan until recently, when it experi- enced cash flow difficulties due to a year-long construction project on roads near its main store (one of three stores owned and operated by Cannon, but by far, the largest and historically most profitable). This construction had made customer access to the store difficult and, as a result, potential customers turned to Cannon's competi- tors for their auto parts needs. The financial statements did not reflect the worsening condition of Cannon (how- ever, its statement of cash flows had indicated that a greater than usual amount had been expended for purchases of inventory). The bank from which Cannon had borrowed the loan became concerned when Cannon began to be habitually late with its payments after having been so prompt in the first couple of years. Cannon requested a negotiation of the terms of the loan, but the bank would consider modifying the terms only if Cannon agreed to a forensic examination of its operations and financial statements. The forensic examination revealed several areas of concern associated with inventory. First, inventory of \($50,000\) that Cannon had purchased from a wholesaler was shipped on December 29, 20X1 (the terms were FO.B Destination) and recorded as inventory and accounts payable by Cannon on December 30, 20X1. It was received by Cannon on January 3, 20X2. Another shipment from the same supplier for \($8,000\) of merchandise was shipped F.O.B. Shipping Point on December 30, 20X1, was received by Cannon on January 4, 20X2, and re- corded as inventory and accounts payable on December 31, 20X1. Second, Cannon shipped merchandise to one of its largest customers, Ace Custom Trucks, on December 27, 20X1, and billed Ace \($25,000,\) which it recorded as sales. Ace contacted Cannon on January 3, 20X2, to tell Cannon that it had not ordered the merchandise and was sending it back at Cannon's expense. Cannon offered a 25 percent discount on the selling price of the merchan- dise to induce Ace to keep the merchandise. Ace accepted the offer. Next, the forensic examination revealed that Cannon had over-priced the cost of its ending inventory by \($6,000.\) Lastly, a \($100,000\) increase to sales, made on December 31, 20X1, was discovered. When the entry was investigated, the sales invoices indicated sales to two customers who, when contacted, stated that they had not bought merchandise from Cannon during the months of December 20X1 and January 20X2.

Required

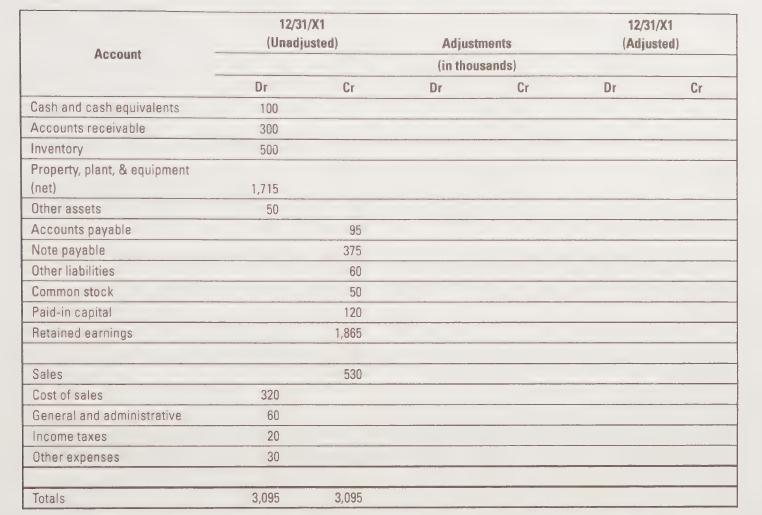

a. Use the following worksheet to correct the balance sheet and income statement of Cannon for the cal- endar year 20X1. (Ignore income taxes.)

b. What is the net income before the corrections were made? What is the net income after the corrections were made?

c. Briefly discuss the ramifications of the forensic examination on Cannon's chances of renegotiating the terms of the loan, specifically with respect to what Old International Bank might do or not do.

Step by Step Answer: