The Ombudsman Foundation is a private not-for-profit organization providing training in dispute resolution and conflict management. The

Question:

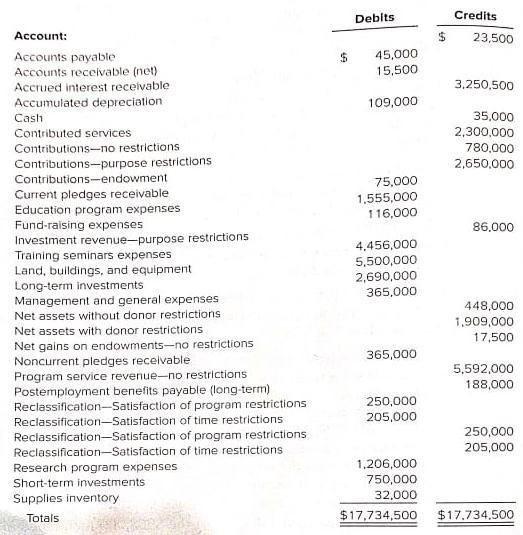

The Ombudsman Foundation is a private not-for-profit organization providing training in dispute resolution and conflict management. The Foundation had the following preclosing trial balance at December 31, 2020, the end of its fiscal year:

a. Prepare closing entries for the year-end, using separate entries for each net asset classification.

b. Prepare a Statement of Activities for the year ended December 31, 2020.

c. Prepare a Statement of Financial Position as of December 31, 2020. (Use a classified approach, providing separate totals for current and noncurrent items.)

Debits Credits Account: 24 23,500 45,000 Accounts payable Accounts receivable (net) Accrued interest receivable Accumulated depreciation 15,500 3,250,500 109,000 Cash 35,000 Contributed services Contributions-no restrictions 2,300,000 780,000 Contributions-purpose restrictions Contributions-endowment 2,650,000 75,000 Current pledges receivable Education program expenses 1,555,000 116,000 Fund-raising expenses Investment revenue-purpose restrictions Training seminars expenses Land, buildings, and equipment Long-term investments Management and general expenses 86.000 4.456,000 5,500,000 2,690,000 365,000 448,000 Net assets without donor restrictions 1,909,000 Net assets with donor restrictions 17,500 Net gains on endowments-no restrictions Noncurrent pledges recelvable Program service revenue-no restrictions Postemployment benefits payable (long-term) Reclassification-Satisfaction of program restrictions Reclassification-Satisfaction of time restrictions 365,000 5,592,000 188,000 250,000 205,000 Reclassification-Satisfaction of program restrictions Reclassification-Satisfaction of time restrictions 250,000 205,000 Research program expenses 1,206,000 Short-term investments 750,000 Supplies inventory 32,000 $17,734,500 $17.734,500 Totals

Step by Step Answer:

a Account Debit Credit Fundraising expenses 250000 Program service revenueno restrictions 250000 Education program expenses 1555000 Contributionsno re...View the full answer

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Using the Montgomery County, Maryland, preclosing trial balance at June 30, 20X9, presented here, prepare the countys Capital Projects Fund (a) statement of revenues, expenditures, and changes in...

-

A debt service fund's condensed trial balance at December 31, 2014 shows the following: Dr (Cr) Cash $1,000,000 Due from water utility (an enterprise fund) 200,000 Short-term investments 9,000,000...

-

At the end of its fiscal year, Berwyn Cleaners, Inc.'s trial balance is as follows. The following information is also available: a. A study of the company's insurance policies shows that $680 is...

-

The City of Amarillo is authorized to issue $8,000,000, 3 percent regular serial bonds in 2017 for the construction of a new exit off the interstate highway within city limits. The bonds mature in...

-

Why is it important to use two independent dimensions of performance to build a product portfolio for Kellogg's? Why would these performance dimensions be different for Netflix?

-

Prepare journal entries for the City of Pudding's governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements. a. A...

-

What approach should Hoi take to getting bills paid from delinquent customers? LO.1

-

Cybernetics Inc. issued $60 million of 5% three-year bonds, with coupon paid at the end of every year. The effective interest rate at the beginning of Years 1, 2, and 3 was 8%, 5%, and 2%. Required:...

-

ASA315 makes reference to the five components of internal control. Which of the following is not a component? Select one: A. Control Environment B. Control Activities C. Risk Assessment process D....

-

Earnings for several employees for the week ended March 12, 20--, are as follows: Calculate the employer's payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA...

-

The Evangelical Private School follows FASB standards of accounting and reporting. Record journal entries for the following transactions during the year ended June 30, 2020. 1. Cash contributions...

-

The Blair Museum Association, a nonprofit organization, had the following transactions for the year ended December 31, 2020. 1. Cash contributions to the Association for the year included (a)...

-

Using the parallel-axis theorem, determine the product of inertia of the area shown with respect to the centroidal x and y axes. 3 in. in. 1 in. 0.5 in. 3 in. 5 in. 0.5 in. -0.5 in.

-

Problem 2-26 (Static) Complete the balance sheet using cash flow data LO 2-2, 2-3, 2-5, 2-6 Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together...

-

Consider the following potential events that might have occurred to Global Conglomerate on December30, 2018. For eachone, indicate which line items inGlobal's balance sheet would be affected and by...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 95% confident that the estimated percentage is in error...

-

Jamonit Ltd is a non-group employer which paid wages of $136,000 in the Northern Territory during March 2021. The company does not pay wages in any other state. Calculate the payroll tax payable in...

-

Following is a partially completed balance sheet for Epsico Inc. at December 31, 2019, together with comparative data for the year ended December 31, 2018. From the statement of cash flows for the...

-

Presented below is information related to Berge Real Estate Agency: Oct. 1 Lia Berge begins business as a real estate agent with a cash investment of $30,000. 2 Pays rent, $700, on office space. 3...

-

A 20-cm-square vertical plate is heated to a temperature of 30oC and submerged in glycerin at 10oC. Calculate the heat lost from both sides of the plate.

-

Consider FASB standards for mergers and acquisitions by not-for-profit organizations. Answer the following questions: a. What is the difference between a merger and an acquisition? b. What is the...

-

For the following transactions and events, indicate what effect each will have on the three classes of net assets using this format. Put an X in the appropriate column. If the net assets are...

-

Presented below is a partially completed Statement of Activities for a homeless shelter. Complete the Statement of Activities by filling in the amounts that would appear in each of the shaded areas....

-

What is the present value of $500 invested each year for 10 years at a rate of 5%?

-

GL1203 - Based on Problem 12-6A Golden Company LO P2, P3 Golden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are...

-

A project with an initial cost of $27,950 is expected to generate cash flows of $6,800, $8,900, $9,200, $8,100, and $7,600 over each of the next five years, respectively. What is the project's...

Study smarter with the SolutionInn App