You are analyzing two investment opportunities for your employer. You must determine which of the investment opportunities

Question:

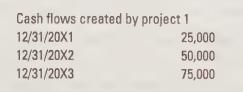

You are analyzing two investment opportunities for your employer. You must determine which of the investment opportunities is the best choice. Project I requires you to invest \($100,000\) on December 31, 20X0. You believe the investment will produce the cash flows on the dates shown in the following table. You have analyzed the investment's risk and other factors. You will use a discount rate of 10 percent.

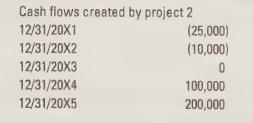

Project 2 requires you to invest \($100,000\) on December 31, 20X0. You believe the investment will produce the cash flows on the dates shown in the following table. You have analyzed the investment’s risk and other factors.

You will use a discount rate of 15 percent.

Required

Which investment is the best choice? Explain and show your calculations. What is the implication of your best choice result on your employer's net worth? If your employer has the capital to make both investments, should it? (You will use present value calculations for this case. You will derive two present values and then compare them.)

Step by Step Answer: