15. The expected returns and standard deviations of stocks A and Bare: Mox McQuery buys $20,000 of...

Question:

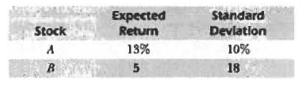

15. The expected returns and standard deviations of stocks A and Bare:

Mox McQuery buys $20,000 of stock A and sells short $10 ,000 of stock B, using all of the proceeds to buy more of stock A. The correlation between the two securities is .25. What are the expected return and standard deviation of Mox's portfolio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey

Question Posted: