21. [In 1990,] Barney Gray, CFA, is Director of'Fixed-Incorne Securities at Piedmont Security Advisors. In a recen

Question:

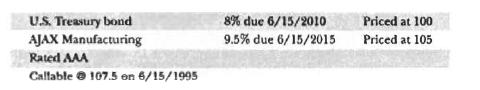

21. [In 1990,] Barney Gray, CFA, is Director of'Fixed-Incorne Securities at Piedmont Security Advisors. In a recen t meeting, one of his major endowment clients suggested investing in corporate bonds yielding 9%, rather than U.S. government bonds yielding 8%. Two bond issues-one U.S. Treasury and one corporatewere compared La illustrate the point.

Gray wants to prepare a response based upon his expectation that long-term U.s. Treasury interest rates will fall sharply (at least 100 basis points) over the next three months.

Evaluate the return expectations for each bond under this scenario, and support an evaluation of which bond would be the superior performer. Discuss the price-yield measures that affect your conclusion.

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey