30. The following are the average yields on U.S. Treasury bonds at two points in time. a....

Question:

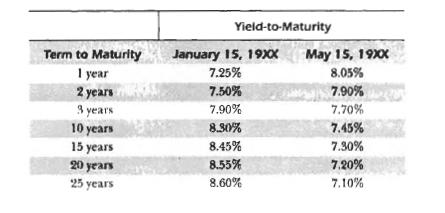

30. The following are the average yields on U.S. Treasury bonds at two points in time.

a. Assuming a pure expectations hypothesis, define a forward rate. Describe how you would calculate the forward rate for a three-year U.S. Treasury bond two years from May 15, 19XX, using the actual term structure above.

b. Discuss how each of the three major term structure hypotheses could explain the January 15, 19XX term structure shown above. (Note: the CFA exam question does not take into account the preferred habitat theory.)

c. Discuss what happened to the term structure over the time period and the effect of this change Oil the U.S. Treasury bonds of two and ten years.

d. Assume that you invest solely on the basis of yield spreads, and in January 19XX acted upon the expectation that the yield spread between one-year and 25-year U.S. Treasuries would return to a more typical spread of 170 basis points. Explain what you would have done onJanuary 15, 19XX, and describe what happened between January 15, 19XX and May 15, 19XX.

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey