9. The SML relationship states that the expected risk premium on a security in a one-factor model...

Question:

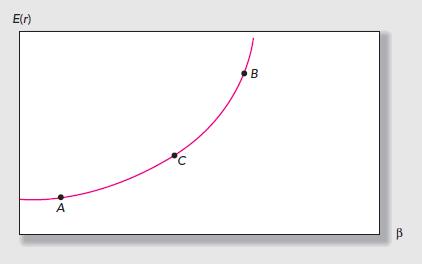

9. The SML relationship states that the expected risk premium on a security in a one-factor model must be directly proportional to the security’s beta. Suppose that this were not the case. For example, suppose that expected return rises more than proportionately with beta as in the figure below.

a. How could you construct an arbitrage portfolio? (Hint: Consider combinations of portfolios A and B, and compare the resultant portfolio to C.)

b. Some researchers have examined the relationship between average returns on diversified portfolios and the and 2 of those portfolios. What should they have discovered about the effect of 2 on portfolio return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: