a. Construct the balance sheet if Dot Bomb goes up to $110. b. If the short position

Question:

a. Construct the balance sheet if Dot Bomb goes up to $110.

b. If the short position maintenance margin in Example 3.4 is 40%, how far can the stock price rise before the investor gets a margin call?

Transcribed Image Text:

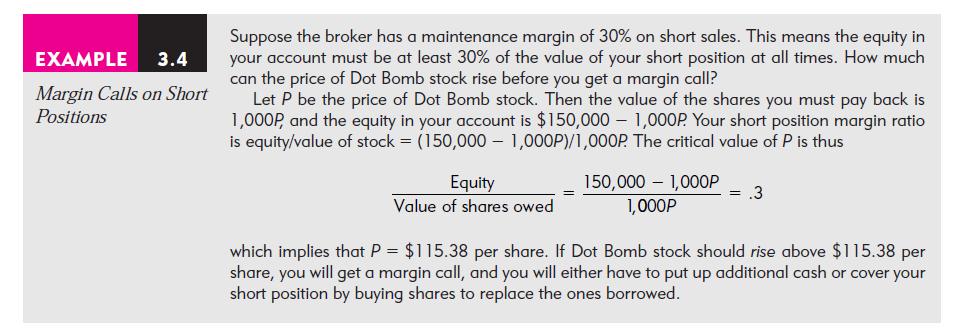

EXAMPLE 3.4 Margin Calls on Short Positions Suppose the broker has a maintenance margin of 30% on short sales. This means the equity in your account must be at least 30% of the value of your short position at all times. How much can the price of Dot Bomb stock rise before you get a margin call? Let P be the price of Dot Bomb stock. Then the value of the shares you must pay back is 1,000P, and the equity in your account is $150,000 1,000P. Your short position margin ratio is equity/value of stock = (150,000 1,000P)/1,000P. The critical value of P is thus 150,000 1,000P Equity Value of shares owed = 1,000P = .3 which implies that P = $115.38 per share. If Dot Bomb stock should rise above $115.38 per share, you will get a margin call, and you will either have to put up additional cash or cover your short position by buying shares to replace the ones borrowed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a Once Dot Bomb stock goes up to 110 your ...View the full answer

Answered By

Brown Arianne

Detail-oriented professional tutor with a solid 10 years of experience instilling confidence in high school and college students. Dedicated to empowering all students with constructive feedback and practical test-taking strategies. Effective educator and team player whether working in a school, university, or private provider setting. Active listener committed to helping students overcome academic challenges to reach personal goals.

4.60+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

An investor initially pays K6 000 towards the purchase of K10 000 worth of shares at K100 each borrowing the rest from a broker; (a) . Draw up the investors simple balance sheet to reflect this...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Suppose the maintenance margin in Example 3.2 is 40%. How far can the stock price fall before the investor gets a margin call? Suppose the maintenance margin is 30%. How far could the stock price...

-

Carl contributes equipment with a $50,000 adjusted basis and an $80,000 FMV to Cook Corporation for 50 of its 100 shares of stock. His son, Carl Jr., contributes $20,000 cash for the remaining 50...

-

Based on the case scenario described throughout this chapter, prepare a research proposal that addresses this situation.

-

Determine the force in each member of the space truss and state if the members are in tension or compression. The truss is supported by ball-and-socket joints at A, B, and E. Set F = {800j} N. 2 m 5m...

-

Briefly explain why executive compensation in Japan is generally lower than that in the United States.

-

Ralph's Mini-Mart store in Alpine experienced the following events during the current year: 1. Incurred $270,000 in selling costs. 2. Incurred $180,000 of administrative costs. 3. Purchased $870,000...

-

Question 3 Cole & Company has old inventory on hand that cost $15,000. Its scrap value is $20,000. The inventory could be sold for $50,000 if manufactured further at an additional cost of $12,000. To...

-

Consider these data from the September 2006 balance sheet of the Growth and Income mutual fund sponsored by the Vanguard Group. (All values are in millions.) What was the net asset value of the...

-

Canadian National Railway Company Obtain the financial statements of the Canadian National Railway Company for its year ended December 31, 2014 from SEDAR (sedar.com) or the company's website....

-

What words and phrases in an unqualified audit report imply that there is a risk that the financial statements may contain a material misstatement?

-

Identify each fringe benefit provided to Maggie and determine whether an exemption applies. (6 marks) Question 2: Explain the impact the fringe benefits will have on Maggie's taxable income and/or...

-

Rosita Flores owns Rosita's Mexican Restaurant in Tempe, Arizona. Rosita's is an affordable restaurant near campus and several hotels. Rosita accepts cash and checks. Checks are deposited...

-

Your second task will require you to recover a payload from the conversation. Just need 2.3. Need you to explain step by step, and concept by concept if possible. Use wireshark. Tell me your answer...

-

2. Supply for art sketchbooks at a price of $p per book can be modelled by P <10 S(p) = = textbooks. p3+p+3 p 10 (a) What is the producer revenue at the shutdown point? (b) What is the producer...

-

Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided: Expected Consumption Ratios Activity Driver Wafer A Wafer B Inserting and sorting process...

-

Explain the difference between short and long freezing ranges. How are they determined? Why are they important?

-

Consider the circuit of Fig. 7.97. Find v0 (t) if i(0) = 2 A and v(t) = 0. 1 3 ett)

-

A firm pays a current dividend of $1.00 which is expected to grow at a rate of 5% indefinitely. If current value of the firms shares is $35.00, what is the required return applicable to the...

-

a. Computer stocks currently provide an expected rate of return of 16%. MBI, a large computer company, will pay a year-end dividend of $2 per share. If the stock is selling at $50 per share, what...

-

a. MF Corp. has an ROE of 16% and a plowback ratio of 50%. If the coming years earnings are expected to be $2 per share, at what price will the stock sell? The market capitalization rate is 12%. b....

-

ZOA Ltd had the following information available: Sales Profit or loss Cash and bank 13% Loan stock Ordinary shares a $0.20 10% Preference shares @ $0.80 $ 1,250,000 (70,000) 55,000 200,000 440,000...

-

B&T Company's production costs for May are: direct labor, $19,000; indirect labor, $5,700; direct materials, $14,100; property taxes on production facility, $870; factory heat, lights and power,...

-

Allowance for Doubtful Accounts The Company makes ongoing estimates relating to the collectability of accounts receivable and maintains an allowance for estimated losses resulting from the inability...

Study smarter with the SolutionInn App