a. Return to Concept Check 5.3. What is the 5% VaR of the portfolio? b. What is

Question:

a. Return to Concept Check 5.3. What is the 5% VaR of the portfolio?

b. What is the VaR of a portfolio with normally distributed returns with the same mean and standard deviation as this portfolio?

Data in Concept Check 5.3.

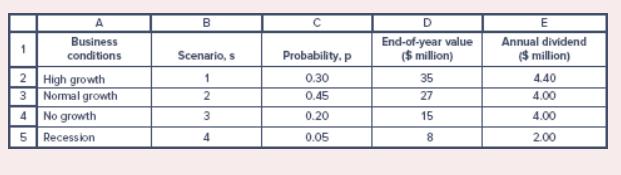

The current value of a stock portfolio is $23 million. A financial analyst summarizes the uncertainty about next year’s holdingperiod return using the scenario analysis in the following spreadsheet. What are the holding-period returns of the portfolio in each scenario? Calculate the expected holding-period return and the standard deviation of returns.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

ISE Essentials Of Investments

ISBN: 9781265450090

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted: