Do a ratio decomposition analysis for the Mordett corporation of Concept Check 1, 14.2 preparing a table

Question:

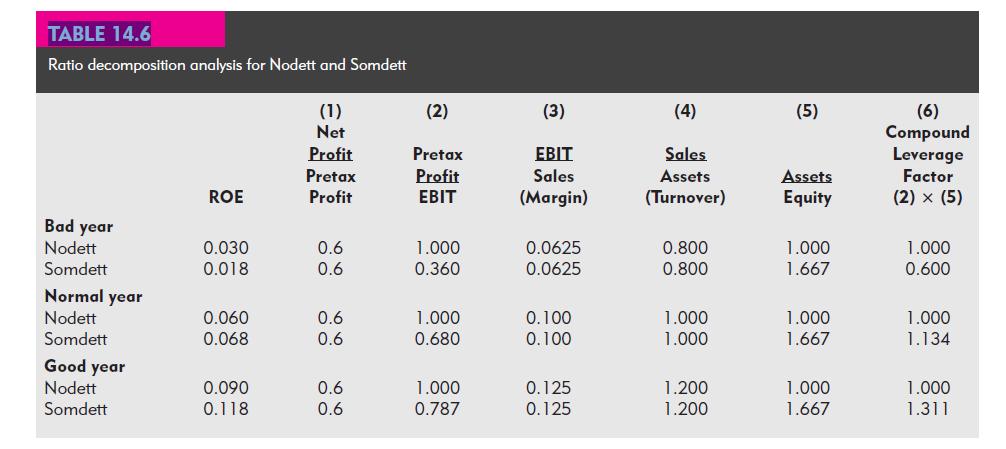

Do a ratio decomposition analysis for the Mordett corporation of Concept Check 1, 14.2 preparing a table similar to Table 14.6.

Concept Check 1

Mordett is a company with the same assets as Nodett and Somdett but a debt/equity ratio of 1.0 and an interest rate of 9%. What would its net profit and ROE be in a bad year, a normal year, and a good year?

Transcribed Image Text:

TABLE 14.6 Ratio decomposition analysis for Nodett and Somdett Bad year Nodett Somdett Normal year Nodett Somdett Good year Nodett Somdett ROE 0.030 0.018 0.060 0.068 0.090 0.118 (1) Net Profit Pretax Profit 0.6 0.6 0.6 0.6 0.6 0.6 (2) Pretax Profit EBIT 1.000 0.360 1.000 0.680 1.000 0.787 (3) EBIT Sales (Margin) 0.0625 0.0625 0.100 0.100 0.125 0.125 (4) Sales Assets (Turnover) 0.800 0.800 1.000 1.000 1.200 1.200 (5) Assets Equity 1.000 1.667 1.000 1.667 1.000 1.667 (6) Compound Leverage Factor (2) × (5) 1.000 0.600 1.000 1.134 1.000 1.311

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (7 reviews)

Ratio Decomposition Analysis for Mordett Corporation Based on Table 146 from Concept Check 1 142 Yea...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Mordett is a company with the same assets as Nodett and Somdett but a debt/equity ratio of 1.0 and an interest rate of 9%. What would its net profit and ROE be in a bad year, a normal year, and a...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Solve the following initial value problem. y" + 2y + 17y=0; y(0) = 1, y'(0) = -1

-

What problems do research directors face in their roles as managers?

-

The 50-kg uniform pole is on the verge of slipping at A when ? = 45 o . Determine the coefficient of static friction at A. 5m

-

What are some factors that make cash management especially complicated in a multinational corporation? AppendixLO1

-

Essex Biochemical Co. has a $1,000 par value bond outstanding that pays 15 percent annual interest. The current yield to maturity on such bonds in the market is 17 percent. Compute the price of the...

-

Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below:...

-

What were GIs ROE, P/E, and P/B ratios in the year 2008? How do they compare to the industry average ratios, which were: How does GIs earnings yield in 2008 compare to the industry average? ROE =...

-

ABC stock has an expected ROE of 12% per year, expected earnings per share of $2, and expected dividends of $1.50 per share. Its market capitalization rate is 10% per year. a. What are its expected...

-

Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the projects NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data from Short Exercise...

-

The revenue recognition principle and the expense recognition principle require that the company recognize related revenue and expense transactions in the same accounting period. Discuss why this...

-

Revisits scope, time, and cost baselines in the context of agile methodologies. Because agile includes several methodologies (like Scrum, Kanban, Extreme Programming, Feature-Driven Development) we...

-

Background information and task: Fed officials divided in July over need for more rate hikes, minutes show WASHINGTON, Aug 16 (Reuters) - Federal Reserve officials were divided over the need for more...

-

Questions: 1. What are the long-term prospects for the Chinese market? 2. Does it make sense for GM to produce automobiles for the Chinese market in China? Why? 3. What do you think would happen if...

-

The purpose of this assignment is to apply your knowledge of conflict management to a real-world situation so that you can enhance your skills in handling conflicts. It is crucial to carefully read...

-

Explain why the same surface roughness values do not necessarily represent the same type of surface.

-

Explain the regulation of the secretions of the small intestine.

-

Three mutually exclusive projects are being considered: When each project reaches the end of its useful life, it would be sold for its salvage value and there would be no replacement. If 8% is the...

-

Consider three mutually exclusive alternatives: Which alternative should be selected? (a) If the minimum attractive rate of return equals 6%? (b) If MARR =9%? (c) If MARR = 10%? (d) If MARR = 14%?...

-

Consider the three alternatives: Which alternative should be selected? (a) If MARR =6%? (b) If MARR =8%? (c) If MARR = 10%? Do Nothing Year A -$100 -$150 +30 +43 +43 2 +30 +30 +43 +43 4 +30 +30 +43

-

MULTIPLE CHOICE ASAP PLS WILL UPVOTE 1 Multiple Choice $106,200. $13,200. $199,200. $267,000. $246,000.

-

I am struggling to find the answers to all of the questions! please help! :) E3-8 Determining Accounting Equation Effects and Net Income [LO 3-2, LO 3-3) The following transactions occurred during a...

-

What is the expected pay-off in a Colonel Blotto game where Blotto has troops in the formation of 3100 and the enemy has troops in the formation of 2100?

Study smarter with the SolutionInn App