Alex purchased one thousand shares of Ambrose Corporation stock on March 10, 2018, for $95,000. On August

Question:

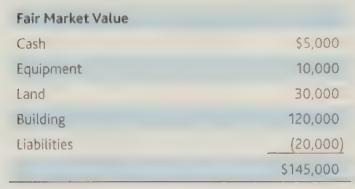

Alex purchased one thousand shares of Ambrose Corporation stock on March 10, 2018, for $95,000. On August 1, 2019, Alex received the following as a distribution in cancellation of his stock in a complete liquidation of Ambrose:

a. What is the amount and character of Alex’s recognized gain?

b. What is Alex’s basis for each oft he items of property received?

c. When does the holding period for each of the items of property begin?

d. How would your answer to

(a) change if Alex had purchased 500 shares of Ambrose stock 15 months ago for $10,000, and the remaining 500 shares six months ago for $80,000?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: