An estate with distributable net income of $100,000 distributes the following assets to a beneficiary in December

Question:

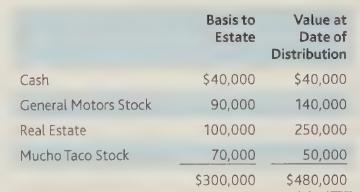

An estate with distributable net income of $100,000 distributes the following assets to a beneficiary in December of 2019:

a. What is the beneficiary's basis in the distributed assets?

b. What would be the beneficiary's basis in the distributed assets if the election is made by the fiduciary under Code Sec.

643(e)(3)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: