Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income

Question:

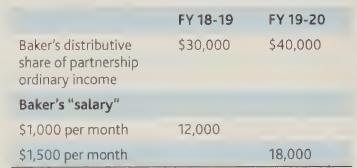

Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income on an October 31 fiscal year. Baker has been provided the following information:

The partnership was short of cash and paid none of the above to Baker until January 3, 2021. Compute Baker's income from the partnership for 2019.

Transcribed Image Text:

Baker's distributive share of partnership ordinary income Baker's "salary" $1,000 per month $1,500 per month FY 18-19 $30,000 12,000 FY 19-20 $40,000 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To compute Bakers income from the partnership for 2019 we need to c...View the full answer

Answered By

Nicholas Maina

Throughout my tutoring journey, I've amassed a wealth of hands-on experience and honed a diverse set of skills that enable me to guide students towards mastering complex subjects. My proficiency as a tutor rests on several key pillars:

1. Subject Mastery:

With a comprehensive understanding of a wide range of subjects spanning mathematics, science, humanities, and more, I can adeptly explain intricate concepts and break them down into digestible chunks. My proficiency extends to offering real-world applications, ensuring students grasp the practical relevance of their studies.

2. Individualized Guidance:

Recognizing that every student learns differently, I tailor my approach to accommodate various learning styles and paces. Through personalized interactions, I identify a student's strengths and areas for improvement, allowing me to craft targeted lessons that foster a deeper understanding of the material.

3. Problem-Solving Facilitation:

I excel in guiding students through problem-solving processes and encouraging critical thinking and analytical skills. By walking learners through step-by-step solutions and addressing their questions in a coherent manner, I empower them to approach challenges with confidence.

4. Effective Communication:

My tutoring proficiency is founded on clear and concise communication. I have the ability to convey complex ideas in an accessible manner, fostering a strong student-tutor rapport that encourages open dialogue and fruitful discussions.

5. Adaptability and Patience:

Tutoring is a dynamic process, and I have cultivated adaptability and patience to cater to evolving learning needs. I remain patient through difficulties, adjusting my teaching methods as necessary to ensure that students overcome obstacles and achieve their goals.

6. Interactive Learning:

Interactive learning lies at the heart of my approach. By engaging students in discussions, brainstorming sessions, and interactive exercises, I foster a stimulating learning environment that encourages active participation and long-term retention.

7. Continuous Improvement:

My dedication to being an effective tutor is a journey of continuous improvement. I regularly seek feedback and stay updated on educational methodologies, integrating new insights to refine my tutoring techniques and provide an even more enriching learning experience.

In essence, my hands-on experience as a tutor equips me with the tools to facilitate comprehensive understanding, critical thinking, and academic success. I am committed to helping students realize their full potential and fostering a passion for lifelong learning.

4.90+

5+ Reviews

16+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income on an October 31 fiscal year. Baker has been provided the following...

-

Case Jeffrey Narley works for Layland & Co. (LNC), a Canadian Controlled Private Corporation (CCPC). Jeffrey, age 68, is married to Judy, who is 55. Jeffrey has a daughter from his first marriage,...

-

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course to study property, plant,...

-

Find f. f(x) = f'(x) = 12x + X x > 0, f(1) = -4

-

Two hundred kg/min of steam enters a steam turbine at 350C and 40 bar through a 7.5-cm diameter line and exits at 75C and 6.5 bar through a 5-cm line. The exiting stream may be vapor, liquid, or "wet...

-

In Figure a 5.0 kg block is sent sliding up a plane inclined at ? = 37o while a horizontal force F of magnitude 50 N acts on it. The coefficient of kinetic friction between block and plane is 0.30....

-

Calculating Future Value. Krista Lee can purchase a service contract for all of her major appliances for $180 a year. If the appliances are expected to last for 10 years and she earns 5 percent on...

-

Mayfield, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Mayfield completed the...

-

Hos llege Demo 14 Selber oders of Chovedano shares of the 720 180 Q15 Stormyrohet i det Share on your mon in the com Althove 16 Gondolewa aby py

-

Because it was anticipated that Bob Short would devote more time to the partnership than would his equal partner Jack Long, it was agreed that Bob would receive a "salary" of $12,000 per year. Bob...

-

Elaine is a 30% partner in the DEF Partnership. She sells some land to the partnership for $50,000, incurring a $30,000 loss on the sale. How much of the loss can she deduct? What happens if DEF...

-

Find the velocity, acceleration, and speed of a particle with the given position function. r(t) = (t 2 + t, t 2 t, t 3 )

-

Let $N$ be a positive integer. Consider the relation $\circledast$ among pairs of integers $r, s \in \mathbb{Z}$ defined as $r \circledast s$ when $r-s$ is an integer multiple of $N$. Prove that...

-

Draw a circuit diagram for a typical home hair dryer. To which form (or forms) of energy is electric potential energy converted when you use the dryer?

-

Draw a vector field diagram for particles carrying charges \(+2 q\) and \(-q\) separated by a distance \(r\). Comment on the significance of the vector diagram.

-

(a) Show that the Jones matrix of a polarization analyzer set at angle \(\alpha\) to the \(X\)-axis is given by \[ \underline{\mathbf{L}}(\alpha)=\left[\begin{array}{cc} \cos ^{2} \alpha & \sin...

-

Let \(\mathbf{V}(t)\) be a linearly filtered complex-valued, wide-sense stationary random process with sample functions given by \[ \mathbf{v}(t)=\int_{-\infty}^{\infty} \mathbf{h}(t-\tau)...

-

Fred and Ethel are married with two children and plan to file jointly. a. Their taxable income sources were as follows. Wages and Salaries $42,381 Interest and Dividend Income ..$ 1,215 Capital Gains...

-

ABC company leased new advanced computer equipment to STU Ltd on 1 January 2019.STULtd has to pay annual rental of $290,000 starting at 1 January 2019. It is a four years lease with ultimate rental...

-

Several years ago, Tampa Corporation acquired 100% of Union Corporation stock for $1,000,000. In the current year, Tampa liquidates Union and receives all of its assets and liabilities. Tampa...

-

Frank, Paul, and Sam are considering merging their respective unincorporated businesses into a new C corporation called FPS. Frank would transfer land and a building with a $50,000 adjusted basis and...

-

Beth, who is married, is the sole shareholder of Pet Store Inc., a C corporation. She also manages the store. She wishes to expand the business, but the corporation needs additional capital for her...

-

Your company produces a health magazine. Its sales data for 1 - year subscriptions are as follows: Year of Operation Subscriptions Sold % Expired at Year End 2 0 2 0 $ 3 0 0 , 0 0 0 5 2 0 2 1 $ 6 4 7...

-

Problem 3 - 2 0 ( Static ) Calculate profitability and liquidity measures LO 3 - 3 , 3 - 4 , 3 - 6 Presented here are the comparative balance sheets of Hames Incorporated at December 3 1 , 2 0 2 3...

-

3 Required information [The following information applies to the questions displayed below) John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter. Samantha. In 2020,...

Study smarter with the SolutionInn App