Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income

Question:

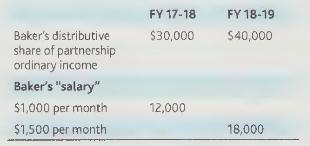

Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income on an October 31 fiscal year. Baker has been provided the following information:

The partnership was short of cash and paid none of the above to Baker until January 3, 2020. Compute Baker's income from the partnership for 2018.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: