Case Study. FDR Partners is a large regional partnership. This year, Rusty acquired an interest in the

Question:

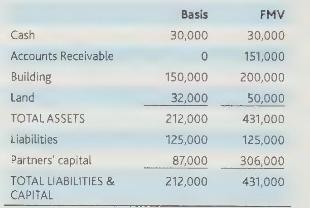

Case Study. FDR Partners is a large regional partnership. This year, Rusty acquired an interest in the firm by purchasing it from an existing partner. The firm's balance sheet just prior to Rusty's acquisition was as follows:

Rusty paid \(\$ 50,000\) for the newly purchased interest, which represented a ten percent interest in the firm. The partnership does not currently have a Section 754 election in effect. Our firm has advised Rusty that the partnership should make a Section 754 election for his benefit. Review Reg. \(\$ 1.754-1\) and prepare a memorandum explaining how the Section 754 election is made and when it must be made in order to benefit Rusty. Also illustrate to Rusty the different tax consequences for him if the election is made vs. if it is not made.

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback